Related

Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

Insight Survey’s latest SA Coffee Industry Landscape Report 2020 uncovers the global and local coffee markets based on the latest information and research. It describes the market drivers and restraints as well as the relevant global and local market trends, innovation and technology to present an objective insight into the South African coffee industry environment and its future.

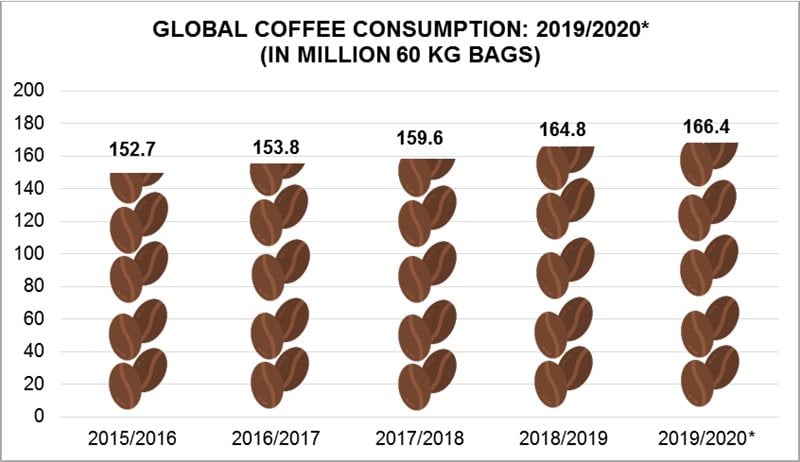

The global coffee market was valued at approximately $87.5bn in terms of retail sales in 2019. According to the US Department of Agriculture, global coffee market consumption has grown steadily over the past five years, achieving a compound annual growth (CAGR) of approximately 2%. Coffee consumption had increased from 152.7 million 60kg bags in the 2015/2016 season, to an estimated 166.4 million 60kg bags in 2019/2020*, as illustrated in the graph below.

By comparison, South Africa’s coffee consumption grew from approximately 589,000 60kg bags in the 2016/2017 period, to approximately 675,000 60kg bags during 2019/2020. Although SA’s coffee consumption accounts for less than 0.5% of global consumption, there has been robust growth over the past few years, achieving a 4.6% CAGR over the same period.

As coffee continues to gain in popularity across the globe, coffee industry players have started incorporating various technologies to further improve the consumer experience. For example, leading industry player, Starbucks, recently introduced reinforcement learning technology, as well as cloud computing and blockchain into its mobile app, in order to offer a more personalised and seamless customer experience.

Intercontinental Exchange Inc, in partnership with Starbucks, recently announced that it will begin testing its bitcoin payment application that will allow users to spend their bitcoins on coffee products in-store. Furthermore, IBM is currently in the process of launching its new ‘Thank My Farmer’ mobile app, which enables customers to trace the origin and supply chain of the coffee they have purchased.

Similarly, as café culture continues to thrive in South Africa, technology has filtered into the South African coffee industry, through the launch of various mobile applications.

Locally, two major mobile coffee apps that are currently trending, include those developed by Vida e Caffé and Coffee Monster. Vida e Caffé recently launched an updated loyalty app, offering consumers additional m-commerce features and greater rewards. Using this app, customers are now able to place their coffee order ahead of time, as well as make online payments, while accumulating loyalty points that can be used for in-store purchases.

The new Coffee Monster application is designed to connect consumers directly with Coffee shops, allowing for quick and convenient ordering and easy payment solutions, prior to collection. This application further enhances the customer experience through providing ‘skip the queue’, ‘drop off at my car’ and ‘deliver to my office’ services, as well as additional loyalty programme features.

The South African Coffee Industry Landscape Report 2020 (167 pages) provides a dynamic synthesis of industry research, examining the local and global coffee industry from a uniquely holistic perspective, with detailed insights into the entire value chain – from manufacturing and importing to retailing, sustainability, pricing analysis, consumption and purchasing trends.

Some key questions the report will help you to answer:

Please note that the 167-page report is available for purchase for R35,000 (excluding VAT). Alternatively, individual sections can be purchased for R12,500 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (021) 045-0202.

For a full brochure please go to: South African Coffee Industry Landscape Report 2020

Insight Survey is a South African B2B market research company with more than 10 years of heritage, focusing on business-to-business (B2B) and industry research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za