Amplified by the pressures of a global pandemic, 2020 saw the continuation of a challenging economic climate for both consumers and rental agencies.

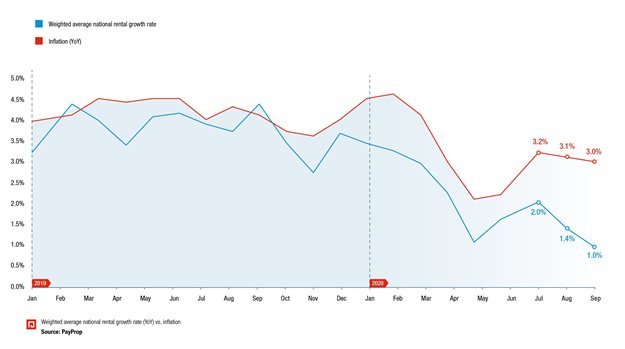

It is therefore unsurprising that recent rental growth is the lowest it has been since PayProp started measuring it in 2012, with the weighted average national rental growth rate reaching just 1% year on year. To place this in context, inflation growth of around 3% was recorded over the same period – during a time that inflation numbers were lower than usual.

The other big trend has been for rental agencies to adopt virtual technologies and processes to enable staff that remained on their payrolls to work from home, while also accommodating virtual client-facing processes during times when property sales and leasing continued.

From this backdrop, we identify three megatrends in the market. Let’s examine them in more detail.

1. Continuing oversupply

Oversupply has become a growing issue nationally, as many short-term lets were put back on the market due to the national travel ban, leaving many holiday properties standing empty.

While oversupply was prevalent in 2019 as well, its cause – and effects in the form of downward pressure on rental prices – is no longer just the rate at which cheaper units are being developed. For this reason we expect a degree of oversupply to continue as global travel remains restricted.

2. Growing strain on affordability

As well as the oversupply of housing, last year’s predictions around affordability manifested beyond expectation in 2020 too.

Sub-inflation income growth has significantly increased financial pressure on consumers – particularly for those who lost part or all their income – and those in provinces where rental growth outpaces inflation.

3. New ways of working

In addition to market trends, perhaps the most notable shift has been the way rental agents are operating and managing their businesses.

Despite many rental agencies in South Africa relying either on outdated processes or supplementing them with digital platforms in managing their portfolio payments, Covid-19 has propelled an urgency to adopt new technology and, more significantly, welcome it with open arms.

In a very big way, the pandemic has hastened the long-awaited digitisation of business processes all over the world, with tremendous spin-off benefit for efficiencies, scalability (growth) and new products and revenue streams.

Johette Smuts, head of data and analytics at PayProp

The importance of getting it right

We have seen tech-empowered agencies more equipped to make a smooth transition to remote working, with the extra reassurance of being able to access all the necessary data securely.

When failing to adopt high-quality proptech solutions, rental agencies can be left behind and become vulnerable to this new virtual world, which offers reengineered processes for tasks as diverse and encompassing as payments, document signing and property viewings.

But with the brave new world of tech enablement comes a fair bit of homework.

Payments, for example. Many software providers claim to offer a full digital payment service, but it is an area steeped in industry knowledge and regulation, and there are some key questions business owners must ask of their providers: Can the system in question account for where the landlord or tenant’s money is, where it came from and that account it was paid into? Does it offer undeletable audit trails and daily reconciliation? How clearly are consumers’ trust funds separated from business funds, and how clearly are one consumer’s trust funds separated from that of another consumer? What data security is in place – in storage, use and transit?

We’ve seen an increasing number of agencies realising the importance of asking these questions and investing in reliable proptech, even during a time of tightening budgets.

This is partly due to businesses understanding the vast untapped opportunity cost of keeping their processes up to date with the aid of smart technologies. Such benefits include resource savings, work and business process flexibility, portfolio growth, and the assurance of bank-grade security protocols in the best platforms.

On the one hand, it’s a protective strategy. Having peace of mind around data being stored safely, and encrypted when being transferred, will be especially important for rental agencies going forward, as cybercrime continues to rise – and according to the latest research, South Africa is one of the most vulnerable countries.

On the other, it’s a proactive business growth strategy. Having powerful proptech on your side means resource savings and rapid scalability of automated processes.

A slow but steady recovery

Our predictions for 2021 as a result of all this? With the country already in recession prior to Covid-19, current rising fuel and medical costs and an uncertain landscape ahead, the continued trend of subdued rental growth is inevitable for 2021.

Agents continuing to embrace the regenerative powers of smart technologies will lead the way in reducing time-wasting process complexity, making lives easier for themselves and their clients and potentially creating growth and revenue opportunities.

Or, like some are doing in a shell-shocked market, they could retreat into ‘pandemic thinking’, hope to survive by cutting costs, and suffer the opportunity cost of doing nothing.

The choice is theirs!