Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

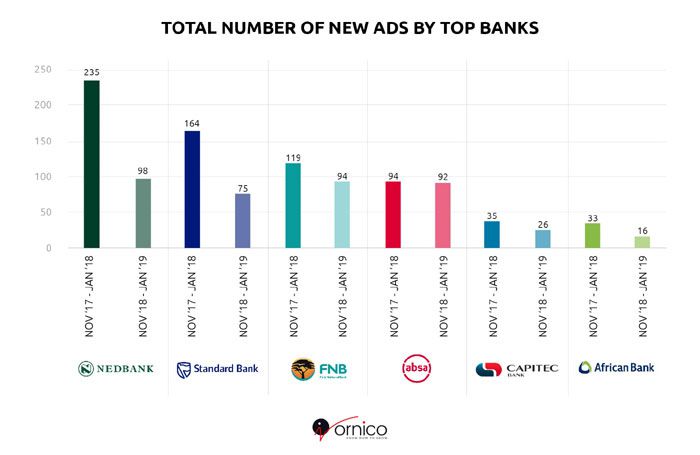

Ornico research for the periods from 1 November 2017 to 31 January in 2018, compared to 1 November 2018 up to 31 January 2019 shows a decrease in advertising spend among top banks. Analysing the two periods, Ornico finds that South Africa’s top financial services institutions had less new adverts flighting for the first time across all mediums. Among the top six banks whose advertising spend was analysed, only Absa remained consistent in the number of new advertisements that the brand released.

The two periods show a decline of 38% in terms of new advertisements – flighting for the first time – that were released by the biggest brands in the sector. Standard Bank, Nedbank and African Bank show the most decline which points to cautious spending over the two periods. Further study reveals that the decrease in spend did not change the top categories with savings & investments, sport, brand adverts and personal loans taking centre-stage across all banking brands.

TymeBank, Discovery Bank and Bank Zero will be ramping their services this year while their larger competitors seem to be slowing down their communication. TymeBank CEO Sandile Shabalala recently announced that the bank had reached over 50,000 customers after their soft-launch in November. This was achieved with little to no advertising in comparison to how the industry operates and it shows the increasing use of digital in banking.

This begs the question, are big banks waiting to see what these entrants have up their sleeve before increasing their advertising initiatives?

Join Ornico, Financial Mail and a panel of leading marketing minds on 29 March 2019, as they analyse advertising and trends in the financial services industry. This event takes place at the Houghton Golf Club.