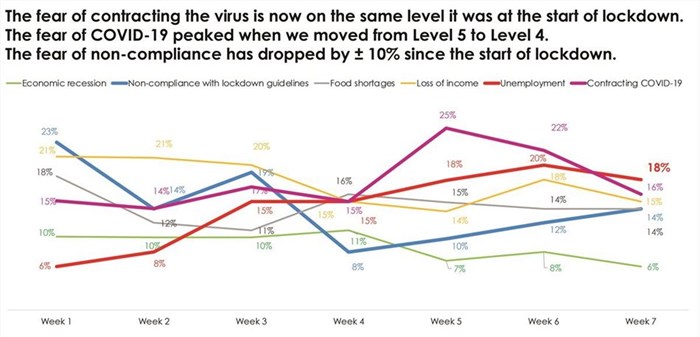

While the fear of contracting the Covid-19 virus remains one of the main fears of South Africans, the fear of being unemployed has tripled during the lockdown period. A total of 76% of respondents are concerned about the livelihoods of their family. One third of individuals do not have the financial means to continue to afford their rent or pay their monthly bond premiums. A further 34% will stop paying rent or their bonds within the next three months should the current financial situation persist.

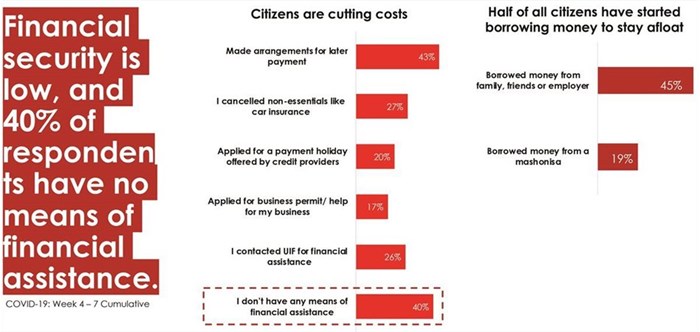

Already 45% of individuals have borrowed money from friends, family or employers while 19% have borrowed money from credit providers in order to meet their monthly financial commitments. Of those surveyed, 58% have started to dip into their savings while 27% have cancelled non-essentials like car insurance. Further to this, four in 10 respondents have made financial arrangements with institutions for later payment and 20% have applied for a payment holiday.

Prior to the pandemic South Africa had R1.7tn in outstanding debt, while 25.7 million South Africans had a credit card, personal, vehicle, home or retail loan. High unemployment and low incomes have forced many people to take on additional debt to maintain their daily living expenses.

One of the consequences of loss of income is a growing concern around food security or, in other words, how they will be able to continue to afford to buy groceries. Quantitative results from Ask Afrika’s research at the onset of the lockdown indicated that adults would start eating less – or only once a day – in order to ration the amount of food they had available for the duration of the lockdown.

Food security at a household level is currently alarmingly low. According to the research, one in three adults surveyed are going to bed hungry as they do not have enough food to eat in their homes.

Concerns around food security are not restricted to vulnerable communities with around half of those in suburbs and metro areas noting that they are concerned about the amount of food in their homes. Nearly 40% of adults in these areas have reduced their portion sizes or meal frequencies due to a limited amount of food in the home.

It is, therefore, perhaps no surprise that a fifth of respondents – four in 10 township consumers and three in 10 metropolitan consumers – have lost weight during the lockdown as they lack sufficient food. A total of 22% of people go an entire day without food while 25% of children are going to bed hungry.

The primary aim of Ask Africa’s research is to better understand the socio-economic impact that the Covid-19 pandemic, South Africa’s lockdown response and the gradual reopening of the economy is having on South Africans. The research firm’s Covid-19 Tracker has been tracing the significant social changes affected since the start of the lockdown. The quantitative research is conducted via computer-aided telephone interviews and online interviews.

The research explores different themes and topics each week in order to better understand relevant issues and provide an immediate statistic. Companies are able to participate in the research to establish how the current situation is impacting their particular brands.

For more information contact Mariëtte Croukamp

Mobile: 082 853 8919

Email: az.oc.akirfaksa@pmakuorc.etteiram