South Africans are a resilient bunch compared to their global counterparts and have adjusted to the complex economic environment that saw a series of interest rate increases in 2023.

Image supplied. The SpendTrend 2024 report, a collaboration between Discovery Bank and Visa analyses credit card spending behaviour to understand consumer spending habits

A key finding of the SpendTrend 2024 report, a collaboration between Discovery Bank and Visa that analyses credit card spending behaviour to understand consumer spending habits.

The results of the research were presented recently at Discovery Place in Sandton by Discovery Bank and Discovery South Africa CEO, Hylton Kallner, and Lineshnee Moodley, country manager, Visa SA.

“South Africans are well known for their resilience across the world, and it is the same in their spending. As a result the country’s spending has not been characterised by wild swings, as in other countries, but by a consistency,” says Kallner.

The report highlights trends across three areas:

- How much people spend

- What people spend on

- How people spend.

How much people spend

Personal consumer spending in South Africa steadied in 2023.

While South African consumers have shown resilience in an increasingly complex economic environment with interest hikes, 86%* of South Africans have expressed concerns about the increasing prices of everyday goods.

Spending in the High Net Worth (HNW), Everyday Affluent (EA) and Mass affluent (MA) segments is rising while spending in the Mass (M) segment has decreased slightly.

What people spend on

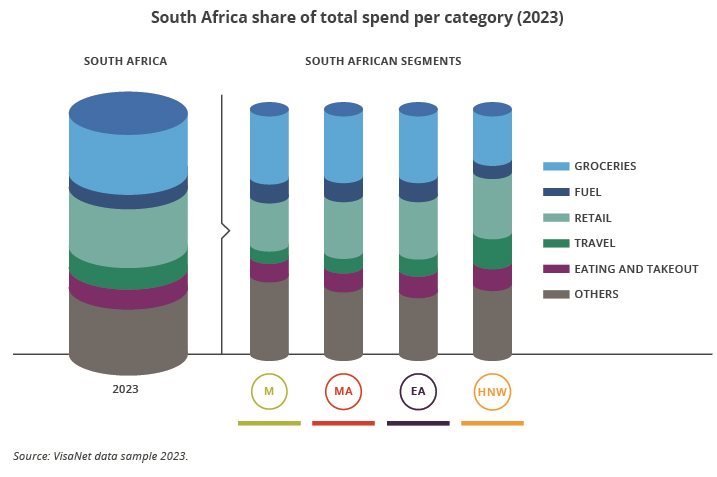

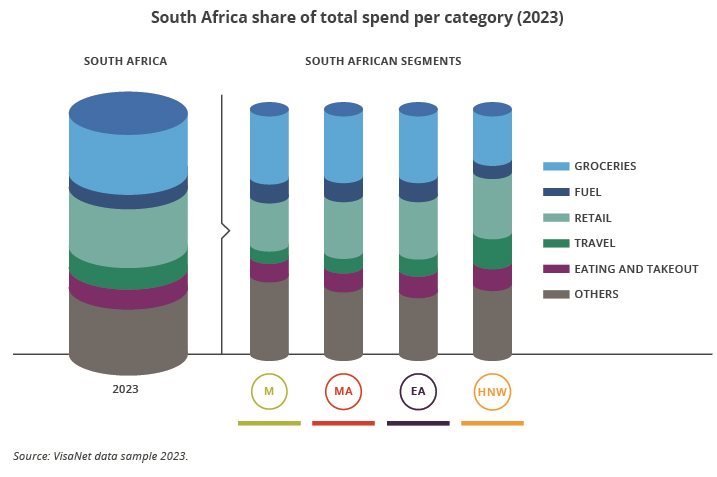

Groceries, retail, travel and fuel are the biggest spend categories for South Africans. While these four segments make up nearly two-thirds of the total spend, the breakdown by market segment varies. For M, MS and EA, groceries are the top category for spend, while for the HNW category retail is the main spend category.

Image supplied.

- Groceries

The average grocery spend in South Africa rose by eight percent (compared to 2022). Grocery spend growth has ranged from zero percent in the M segment to eight percent in the HNW segment. This shows that the M segment has adjusted its purchasing to cope with rising costs.

Overall in 2023 consumers visited grocery stores and made online grocery purchases more frequently, however, the average amount spent per transaction remained about the same as in 2022.

Despite eating out and takeout increasing last year by eight percent (28% in 2022) almost three-quarters of South Africans* say they cook/bake at least once a week.

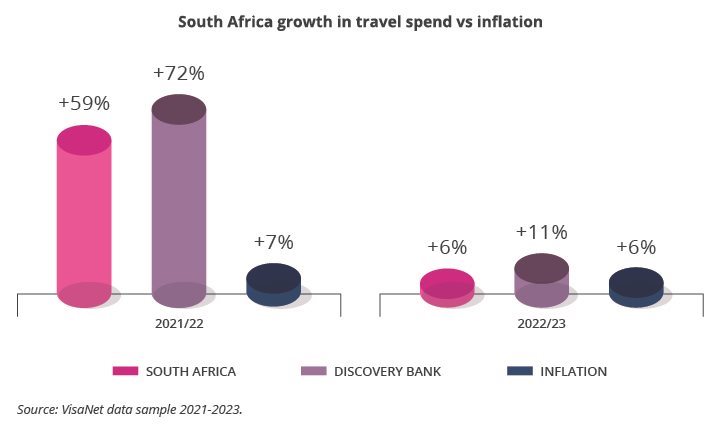

Image supplied.

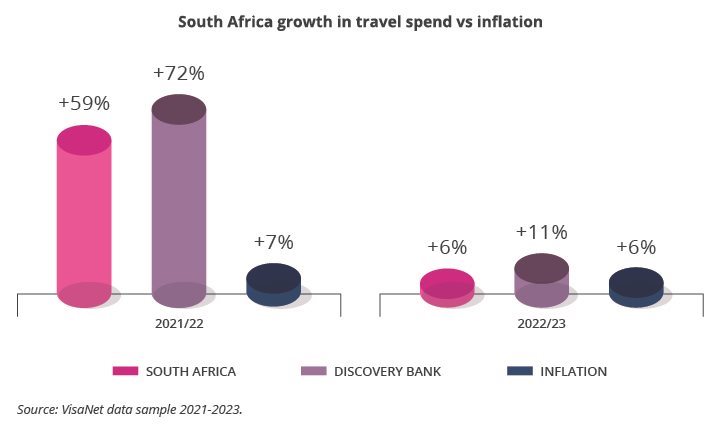

- Travel

Travel is returning to normal but is costing more for everyone. The surge in revenge travel is over and South Africans' travel habits have settled. Overall travel spend has increased but only because of rising costs.

- Fuel

Fuel is the other big purchase for South Africans with a fuel price 1.5% higher in 2023 compared to 2022.

How people spend

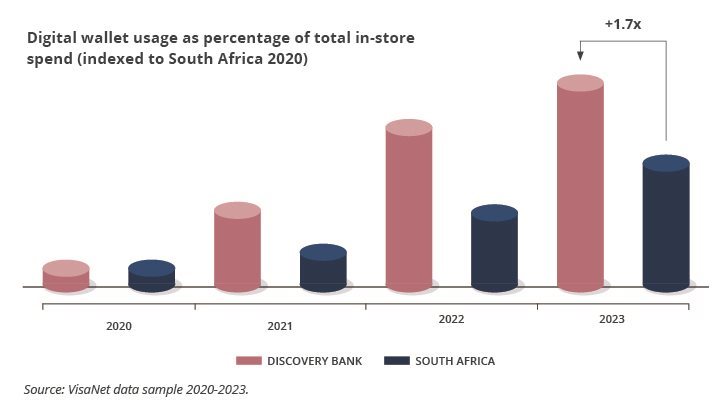

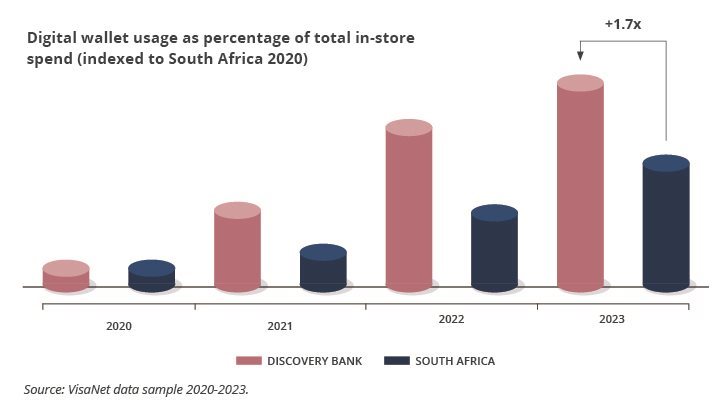

Image supplied.

- Digital wallets

Digital wallet use has increased in South Africa by nine percent, with more than 60% of South Africans preferring digital wallets. South Africa’s growth in spending and frequency of using digital wallets for payments has outpaced all other global cities where digital wallet data is available.

“This shows that South Africans have a high level of confidence in using mobile wallets as a payment method. This growth is phenomenal and the financial services sector needs to understand the behaviour driving this if it is to grow,” says Moodley.

- Online shopping

South Africans are embracing “phygital” shopping experiences. South African spend growth for online outpaces in-store by five times in 2023. This is surpassing other emerging markets and keeping pace with developed markets, with 84% of South Africans making an online purchase in the past year.

However, South Africans still value physical shopping experiences. South Africans still prefer shopping in-store, although they will compare prices online.

Online spend is also international with the rise in global online e-commerce platforms delivering to South Africa. Online entertainment is the fastest-growing online spend category for South Africans.

Online streaming services for music, series and movies are a key source of entertainment.

Predictions

- As the impact of high-interest rates persists, people will keep shifting towards value-based spending. Consumers will continue to prioritise getting the most value for their money and this is increasing rewards and loyalty programmes. “Consumers seek rewards where they spend most but these need to be seamless and special to them. 76% of the participants surveyed had loyalty cards, and 30% had one for more than a year,” explains Moodley.

- Digital payments will become more dominant. People are increasingly using contactless payments through smart devices and online transactions. This is driven by convenience, security and the growing availability of digital payment options.

- Both in-store and online purchasing will see balanced growth as retailers integrate omnichannel sales strategies. Consumers increasingly expect a seamless shopping experience that combines shopping with the tactile experience of in-store. In-store is developing an online strategy.

- The entertainment industry will continue to thrive with more people engaging in mobile gaming and online betting. Global players will offer high-quality content to attract a wider audience while regulators adapt to keep up with innovation.

*of South Africans surveyed in 2023