Throughout the year, I have been privileged to closely interact and track markets across multiple cities such as Nairobi, Lagos, Accra, Johannesburg, Cairo, Casablanca, Lusaka, Abidjan and Maputo.

Tilda Mwai, insights lead at Estate Intel

Interestingly, the markets have been somewhat of a paradox. While they are nothing alike, they are also more similar than you can imagine.

In this round up, I explore some of the emergent themes and topics that have steered the market in 2022 that we anticipate will continue to impact the market in the new year.

Nigeria has seen innovation in the capital markets. Will the East African markets follow suit?

Currency risks and the parallel dollar market, coupled with the acute shortage of dollar liquidity and the imposition of capital controls has continued to weigh on retailers, corporate occupiers, developers, and investors alike in markets such as Lagos, resulting in market exits by key retailers such as Game stores in Nigeria.

Overall, this has also impacted on the ability to dispose of assets in the standard private equity model, inadvertently leading to the rise of the income fund structure and IPO listings in the market as evidenced by recent initiatives by Purple Group IPO, as well as Actis’s first West African income fund.

While these initiatives are a means to an end by themselves, they are notable milestones of innovation for capital raising for any African market.

As such, it will be interesting to see if other key markets such as Kenya will follow suit.

The office is back and global geopolitics will likely play a bigger role in driving demand

At a global level, there is a ‘new scramble for Africa’. This has seen global powers such as the US, UK, South Korea, UAE, Saudi Arabia, Turkey and China all make renewed pronouncements on their engagement with the continent with investments at the core of their focus. So far, the UK, for example, has committed $2bn to Africa for sustainable investments, the US had initially committed $200bn in their Partnerships for Global Infrastructure Initiative, while UAE-Africa non-oil trade nearly doubled in the five years to 2021, all indicating a renewed focus towards Africa.

These initiatives are likely to result in an influx in multinational entries into the hub cities of Lagos, Nairobi, Cairo, Johannesburg and Accra, driving demand, especially for Grade A offices. In 2022, the office sector performance across different markets has remained varied, and outlook on performance on Grade A or Grade B offices differs depending on who you asked.

However, a common consensus has been that the office is back, with Grade A offices across Nairobi, Lagos and Accra seeing relatively lower vacancy levels at 20% on average compared to the 25% average seen with Grade B properties.

This trend is likely to continue in the new year with multinationals driving demand for Grade A offices through their need for quality.

Retail is not dead, but location is key

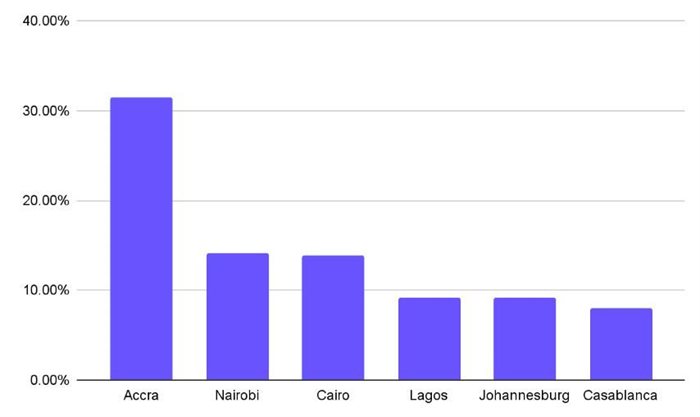

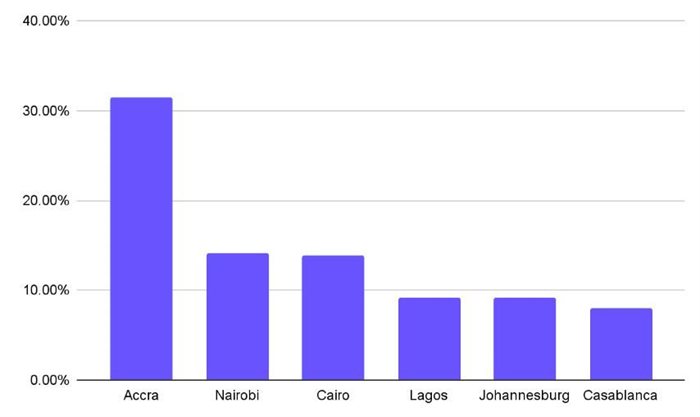

Across the continent, the retail sector has reflected varying performance. On one hand, retail sales in cities such as Accra, Nairobi, Cairo, Casablanca and Johannesburg recorded growth rates ranging from 31%, 14%, 13%, 8% and 9% respectively in 2022 compared to 2021.

YoY Retail Sales Growth (2021-2022). Source: Oxford Economics

On the other hand, anecdotal evidence suggests that retail malls' performance has remained subdued. Interestingly, in key cities, market positioning continues to be the lead determinant of retail performance. For example, Ikeja City Mall in Lagos announced an increase in its operating profit for the first half of the year from $9.5m in 2021 to $10.5m in 2022. This can be directly attributed to its location, among other factors, which has seen it emerge as a stand-out performer.

In Nairobi, retail nodes such as Kilimani, Westlands and Karen emerged as the best performing in the first half of 2022, recording average rental yields of 9.7%, 9.0% and 8.9%, respectively, compared to the overall market average of 7.8% according to Cytonn research. On the other hand, Eastlands recorded an average rental yield of 5.9% compared to the market average of 7.8%, indicating the role of location in retail performance.

A country’s green preparedness will steer sustainable buildings adoption

There are approximately 300 green buildings in Africa outside of South Africa according to the Estate Intel Green Building Fact Sheet. While this number is nowhere near the 120,000 global green buildings, markets such as Nairobi, Accra and Lagos have recorded an over 200% increase on average in the past three years.

Notably, access to financing has been the lead driver for the majority of developers and investors steering the momentum towards green. This has resulted in major transactions across the continent such as the announcement of the largest syndicated sustainability-linked real estate debt facility secured by Grit earlier on in 2022 and organised by Standard Bank.

Interestingly, this momentum towards green adoption has not only been at a private-sector but also at a public-sector level. Cairo’s Capital Garden City development initiative is perhaps the most notable initiative by governments to drive ‘green affordability’. The development features approximately 25,000 units under development in the ‘green housing’ initiative aimed at driving energy and water efficiency.

Overall, we anticipate that a country’s green preparedness will be a key driver towards green adoption as indicated in the 2022 Green Building Matrix. Kenya ranks at the top of the matrix, with the country scoring 72% on average across key indicators such as progress made towards green building legislation, availing local green financing, presence of innovative financing and a strong local green building council.

While Nigeria has had limited green building activity, it ranks second to Kenya at 64% on the matrix in terms of the adoption potential, with significant progress being made towards green building legislation and its commitment to net zero by 2060.

Outside of South Africa, Southern African countries remain significantly low on the matrix, with limited progress towards legislation, financing or even the constitution of green building councils. Overall, countries with a high score on the real estate green matrix are likely to see accelerated growth in green buildings adoption.

Affordable housing and data centres will be the key alternative sectors to watch out for

Although rarely viewed as an asset class across the continent, affordable housing is making a comeback. While this momentum has been steered by governments across Kenya, Zambia, Nigeria and Egypt, the challenge of a gaping housing deficit is set to result in the unlocking of institutional investor interest.

So far Kenya’s new government is looking to put up approximately 200,000 housing units per annum. While this has been viewed as too ambitious, it could very well initiate specialist funding vehicles focused on the sector in the market.

Similarly, the recent trend of expansions in the data centre market has seen data centres rise to the top five sectors for investment in the Africa deal flow tracker. Equinix’s debut into the South African market through a 4MW facility in Johannesburg, as well as Africa Data Centers' recent announcement of plans to expand into Rwanda and expansion of its operations in Nairobi are some of the key developments recorded across the continent. With the sector still in its nascent stages, it is set to see more investments and new builds in order to fully support the whole African continent in 2023.

Ari Birnbaum and Mohamad Hassan Shahrour 23 Dec 2022 Proptech funding grew five-fold in 2022 but homegrown capital might be the key to sustaining the momentum

On a vibrant LinkedIn timeline, you are likely to have come across several proptech funding announcements. This influx can be attributed to the over $16m raised in proptech funding across Africa in 2022. While this is nowhere near the $752m raised in other sectors such as fintech in H1 2022, it is five times what the sector recorded in 2021.

While this momentum is only set to grow, a major concern for proptech companies across the continent has been the dip in global venture capital amidst recession claims. As such, this might prompt an inward look into opportunities for financing within the domestic markets.

Already, key VC platforms such as Ventures Platform have announced their intention to include funding for proptech companies during the West Africa Proptech Forum. While this is a first for the VC ecosystem outside of South Africa, it will be interesting to see if other VC platforms across sub-Saharan Africa follow suit.