Here are the key trends we believe will gather momentum in the property market in 2018.

1. An increasing demand for sectional title properties for both lifestyle and economic reasons within the major growth nodes.

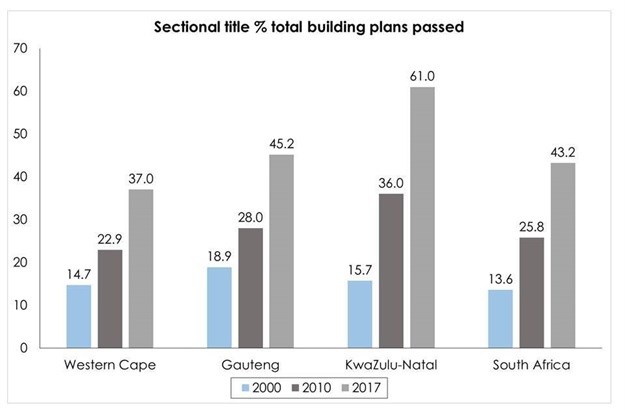

We are seeing that house price inflation in the sectional title housing segment is still outperforming full title, with the gap between the two widening. Nationally, price growth of small sectional title units (two bedrooms and smaller) is increasing faster than that of freestanding homes, with an inflation of just over 10% this year. Developers are responding to the growing demand for sectional title properties, with an increasing portion of all building plans passed being for apartments. According to a recent FNB report, this appears to be a longer term trend which may see this sector ultimately become the larger of the two residential market segments some years from now.

2. Demand for secure and convenient estate living – reflecting the realisation that it is easier to share facilities without the upkeep and as many estates go off-grid, this becomes even more appealing.

Many estates are including more sectional title properties to meet the demand of those no longer wanting freehold homes. While secure estates with golf courses remain popular, there is a shift towards estates offering additional amenities and facilities such as cycling and jogging tracks, play areas, equestrian facilities, outdoor gymnasiums and even crèches and schools, which make them even more popular due to being more inclusive of the entire family’s needs.

3. A steady transition to more energy and water efficient homes as South Africa retains its global lead in sustainable building.

The underlying trends in South Africa’s housing market suggest that the transition to ‘green’ will continue to gather momentum. The growing cost of utilities, coupled with load and water shedding, increases the appeal of alternative, greener sources of energy and water but also greater efficiency in homes.

4. Continued rise in mixed-use developments as well as the emergence of mixed-use suburbs.

Mixed-use developments, such as Melrose Arch in Johannesburg, feature mainly in key urban growth nodes in metropolitan areas where you can live, work and play. These developments may incorporate residential, retail, leisure and hospitality amenities – even schools and healthcare facilities all in a secure and attractive environment.

Another example is Steyn City Lifestyle Resort in Gauteng. The need for a live, work, play lifestyle is growing in part because of major cities’ increased traffic congestion. Instead of spending hours in traffic, people are willing to sacrifice larger plots or gardens to live closer to work opportunities.

5. There is a growing market for retirement accommodation because people reaching retirement age – whatever that may be – no longer wish to move into an ‘old age home’ but would rather more into a retirement estate, possibly within a larger estate where they can enjoy all the usual estate amenities as well as medical care.

People are living considerably longer, so this is a new market, plus this age category is also leading a far more active life, hence the change in demand for a type of lifestyle.

6. Student accommodation within close proximity to the universities and tertiary institutions will prove increasingly popular, including conversions of houses which are then let out per room, giving investors significantly greater returns compared to a single lease over the property.

There is a severe shortage of student housing in South Africa, a trend which is evident in many metros in prime global cities. In mid-2016 there was an estimated 216,000 bed shortage at our universities.