Each year, since 2013, BrandMapp has tapped into South Africa's mid-to-top income earners to gauge who they are, how they feel, what they do and what kind of consumer choices they are making. With its annual survey reaching over 30 000 people, BrandMapp is the most independent, consistent and enduring review of the country's taxpaying population.

Brandon de Kock, BrandMapp’s director of storytelling says, “This is a group of about 13 million individuals earning R10k a month or more, that we typically describe as ‘mid-market-and-up’. They fit neatly into what has recently been tagged as the ‘South African consumer class’ and we have always been of the opinion that it’s a vital segment to understand.

We have to be hopeful that at some stage in the near future the political landscape will shift and allow us to fulfil our potential as a country, but we need to have some hope that there will be a large enough pool of talented, educated, invested South Africans to do the work required when and if that happens. In short, without a healthy and growing taxpayer engine to pull the economy along, we’re going to be in real trouble.”

It often feels as if nothing ever changes in our country, at least not for the better, but, the past decade has seen an extraordinary shift in the size, shape, and make-up of this group: the top 30% of households by income.

And as de Kock argues, “amid all the current doom and gloom, it may come as a surprise, but the story of our middle market, as revealed by our data and all sorts of secondary sources over the past 10 years, is as much about resilience, agility and growth as it is about anxiety and stress. So maybe there is reason to hope?”

Four million more middle-market, taxpaying adults

One of the striking changes over the last decade is that there are now 4 million more adults living in households with R10k or more in monthly income, expanding the number of people living in the top 30% of households, the ones who took home R2.5 trillion out of the total R3 trillion earned in the formal sector last year.

De Kock says, “We are assailed with stories of South Africans with money leaving the country in their thousands and dire warnings of a collapsing middle class. What these stories don’t account for is that right now every wealthy adult who immigrates or passes away looks like they’re being replaced by two newcomers to the high-income group. Unless the official statistics are a complete fabrication, you don’t have to be a genius to work out that the demographics of the middle market are shifting, and the meaningful taxpaying base is actually growing.”

SA Treasury data over the past five years reveals that the group of individuals responsible for paying 85% of personal income tax, the largest slice of the tax pie, is growing rapidly. It increased by 300 000 individuals in the past year alone.

According to Treasury, in the two years of post-Covid recovery, it is growing at a rate more than double that of the CPI (Consumer Price Index). “So maybe we’ve been looking at it all wrong,” de Kock suggests, “and maybe the much talked about ‘increasing tax burden on an ever-decreasing number of taxpayers’ is a good headline, but a poor reflection of reality.”

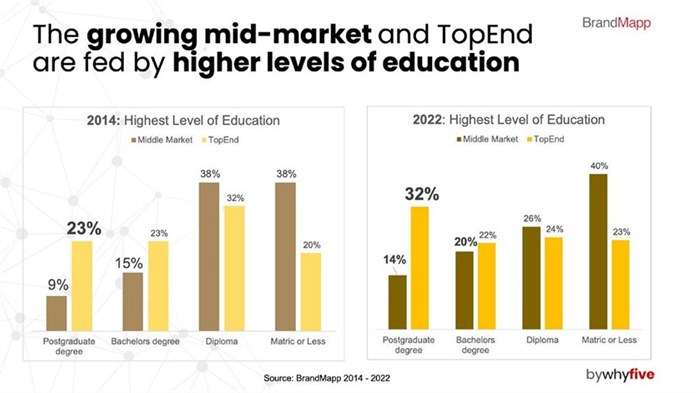

Higher education is the driver of middle-market growth

“One thing you can say definitively about South Africa’s middle market is that this is a segment that highly values education,” says De Kock, “Over the last ten years, the percentage of adults in R10K+ households who have a university degree has grown from 24% to 34%. And when we look at the top-end – that group who paying 85% of the taxes – 78% have some sort of tertiary education. According to Stats SA, between 2010 and 2021, the number of working age adults with a tertiary qualification has increased by 1.2 million individuals, and those educated adults make up just 10% of the unemployed population. It seems clear that opening up greater access to tertiary studies is critical to expanding the middle market.”

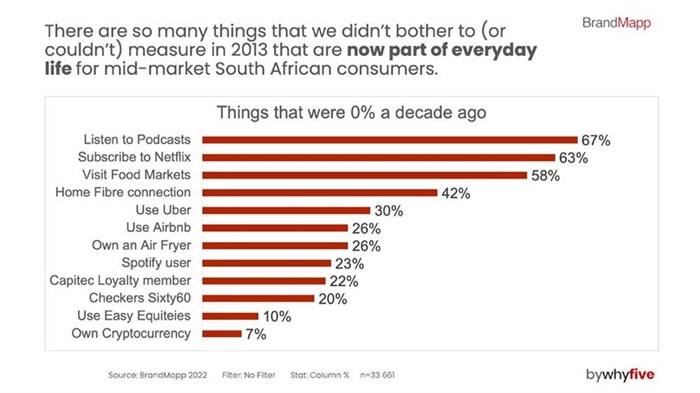

Massive shifts in consumer behaviour

Across the world, tech-driven change has rapidly shaped consumer behaviours and South Africa’s middle-market has wasted no time in keeping pace with global digital innovations. De Kock says, “We forget that ten years ago, Facebook had no competition. Since then, the middle market has jumped onto new platforms and taken up new devices. The slide below give a snapshot of how much has changed in the way we go online, bank, shop and entertain ourselves. This highlights how important it is for the entire population to be able to access the Internet and engage in the digital economy. What’s also striking is the speed of these changes. Ten years ago, we didn’t even measure fibre connection. There was no Netflix or podcasts, no Uber, Airbnb or CheckersSixty60.”

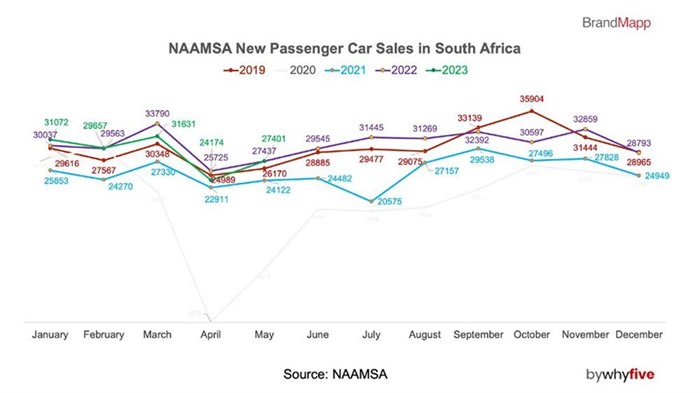

Car ownership hasn’t kept pace

In 2014, 73% of mid-market adults owned cars versus just 65% in 2023 – and the same pattern holds for the top-end. “There’s a ‘dual narrative’ here when it comes to assessing the resilience of the consumer class in South Africa,” says De Kock.

“Although car ownership hasn’t kept pace with the shifting consumer landscape, according to the NaTIS Live Vehicle Population statistics, there were 6 226 478 passenger cars on the roads in 2014. Now there are 7 711 663. That’s about 1,5 million new drivers in a decade. Multiply that by tyres, tins of oil and car washes and it represents a fairly substantial growth for the auto segment as a whole.”

De Kock continues, “If new car sales are a measure of resilience, however, then we must compare the latest NAAMSA new passenger car sales statistics. Against all odds, unit sales for the last two years are at about the same level as they were before the global financial melt-down of 2018.

Despite Eskom’s endless black-outs, periods of overwhelming unrest such as October 2021’s riots, and despite the Covid pandemic, global supply chain failures, high inflation and war, new car sales up until May this year are a testimony to resilience. There are lots of possible reasons for this, but remember that the average new car loan, according to TransUnion, is over R380,000.

You can’t buy a new car without ready cash or an approved loan. So, if everyone and everything is going down the drain, financially speaking, where on earth is all this money coming from?”

Recently, De Kock joined Moneyweb’s Jimmy Moyaha to take a closer look these sorts of hidden middle-market successes and the potential for a brighter future.

Watch the webinar here.