CSI expenditure remained concentrated, with the top 100 companies (by CSI spend) accounting for 68%, or R6.9bn, of total CSI expenditure. Of the total R6.9bn spent by the top 100 companies, almost two-thirds was spent by the 19 companies whose CSI expenditure was more than R100m in 2019.

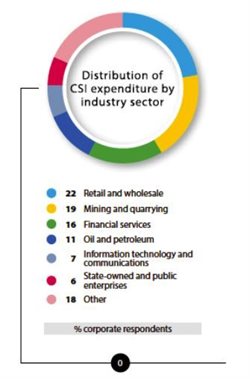

Retail, wholesale sector accounts for greatest CSI spend

For the first time in 2019, the retail and wholesale sector accounted for the largest portion of CSI expenditure (22%). This could be due to the increasing value of product donations. The mining and quarrying (previously the largest sector) and financial services sectors were the second and third-largest contributors, respectively. Together, these three sectors accounted for 57% of CSI expenditure in 2019, down slightly from previous years.

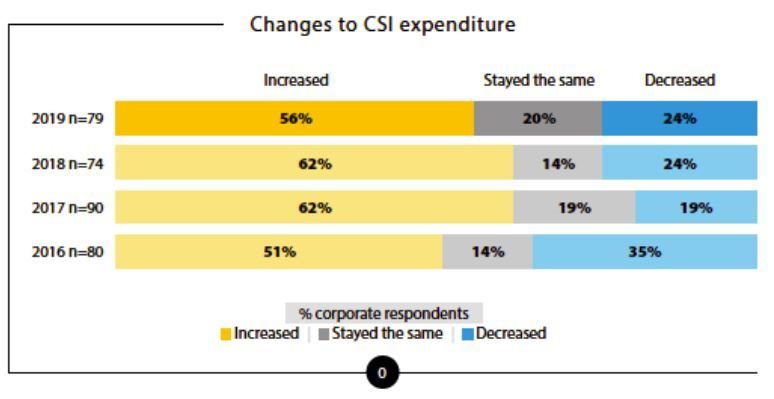

Just over half of all surveyed companies (56%) reported increased CSI expenditure in 2019, down from almost two-thirds in 2017 and 2018. A quarter of companies (24%) reported decreased expenditure, consistent with survey findings in 2018, and down from 2016 when over a third of companies reported decreases.

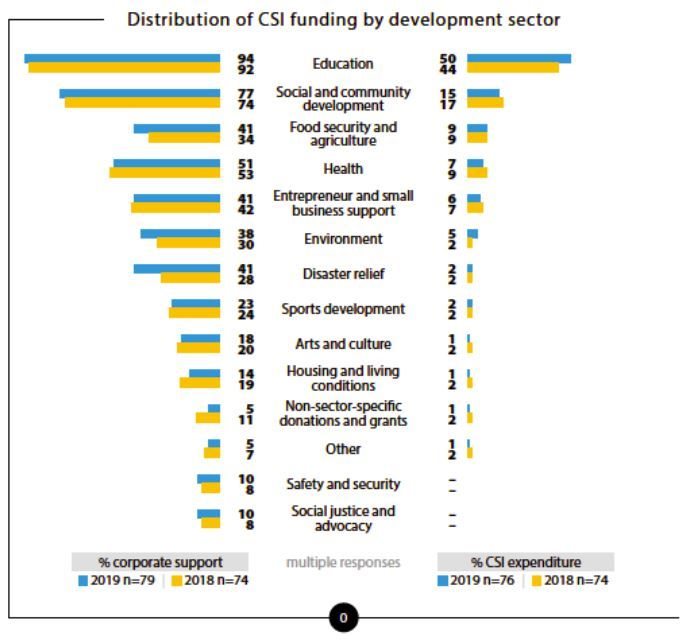

Food security, agriculture trumps health for first time

Education was supported by 94% of surveyed companies and accounted for an average of half of companies’ CSI spend (50%) in 2019, up from 44% in 2018. Social and community development remained the second most supported sector and health the third, with 77% and 51% of companies funding these sectors, respectively. However, food security and agriculture received a greater average percentage of CSI expenditure (9%) than health (7%) for the first time.

The proportion of companies supporting disaster relief increased significantly, from 28% in 2018 to 41% in 2019. However, only 2% of companies’ CSI funds were directed to the sector. Environmental causes also saw increased support, from 30% to 38% of companies, and from a very low 2% of companies’ CSI spend in 2018 to 5% in 2019.

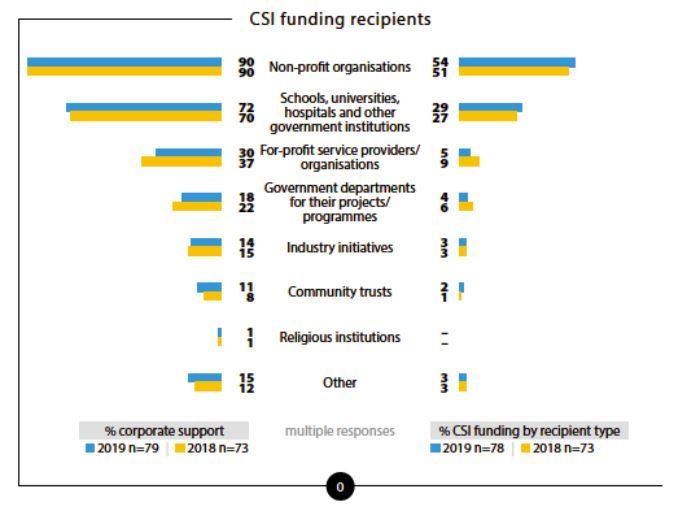

Government funding shows slight decrease

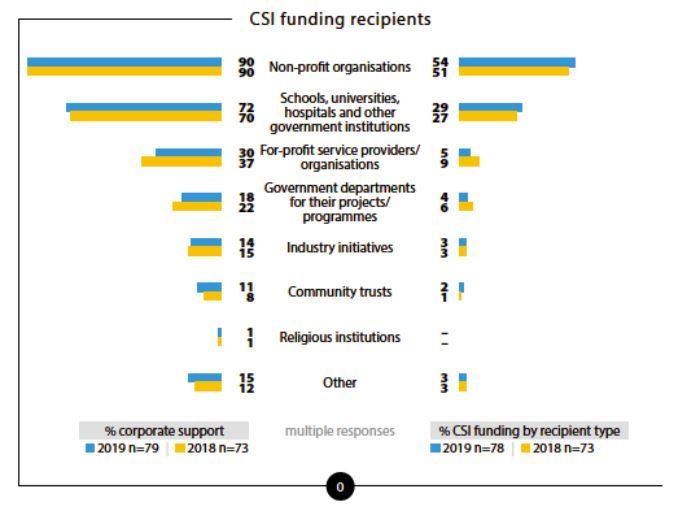

90% of surveyed companies gave to non-profit organisations (NPOs) in 2019. The average proportion of CSI funding directed to NPOs was 54%. The next most common recipient was government institutions (including schools, universities, hospitals and clinics), which were funded by 72% of companies and received an average of 29% of companies’ CSI expenditure in 2019. Funding of, and average expenditure on, government departments decreased slightly to 18% and 4% respectively.

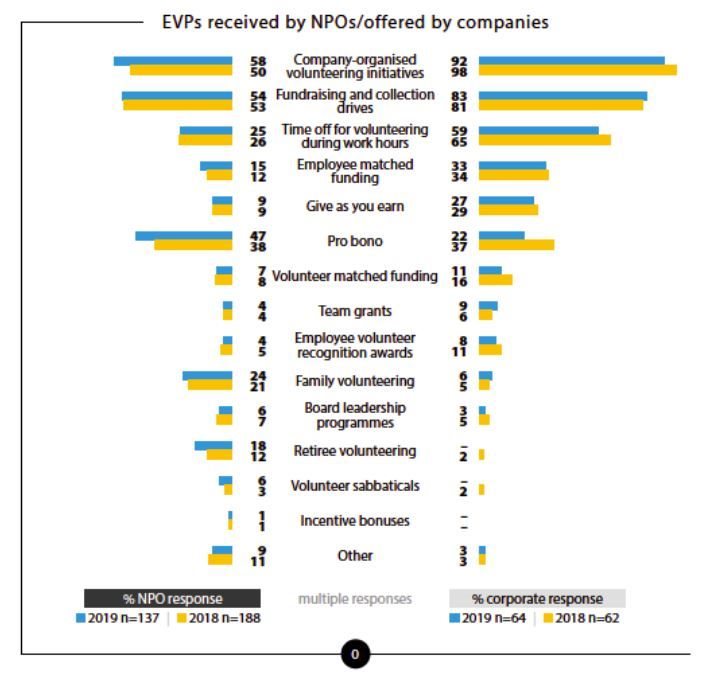

Consistent with previous years, the majority of surveyed companies (81%) had formal employee volunteer programmes (EVPs) in 2019. Companies supported an average of four different types of employee involvement. The most common type was company-organised volunteering initiatives, offered by 92% of respondents, despite this type of initiative being the least popular among NPOs. Companies most commonly (44%) held four or more company-organised volunteering initiatives per year, while 24% limited these initiatives to Mandela Day only. NPOs most liked EVPs that provide funding: fundraising and collection drives, which were offered by 83% of companies, and give as you earn, which was offered by 27% of companies.

The Trialogue Business in Society Handbook 2019 is available for free download here.