The International Guide to Shale Gas has revealed that South Africa is one of the countries with the most potential for shale gas production. The guide, published by Baker & McKenzie, provides a regional examination of shale gas operations, as well as a unique analysis of local law and key contractual issues in the 10 Hot Countries for shale gas projects.

The other nine countries listed are Algeria, Argentina, Australia, China, Poland, Russia, United Kingdom, Ukraine and the United States.

Morné van der Merwe, a partner in Baker & McKenzie's Johannesburg practice, says natural gas comprises only a small share of South Africa's energy mix, leading to a reliance on coal for most of the country's energy needs. "However, Energy Information Administration (EIA) estimates indicate that South Africa has 390 trillion cubic feet of technically recoverable shale gas resources," Van der Merwe says.

Re-industrialising economy

"This has been good news for South Africa, given our limited amounts of conventional hydrocarbon supplies. Since South Africa imports around 70% of its crude oil needs, shale resource discoveries could help it supply its own energy demand and re-industrialise the South African economy."

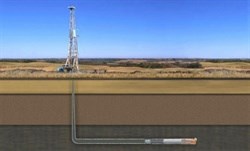

In September 2012, the South African government lifted a moratorium on shale gas exploration in the Karoo. Proposed regulations on hydraulic fracturing were published in October 2013 which require drillers to meet American Petroleum Standards.

The minister expects to issue exploration licences for shale gas in the first quarter of this year. The following companies have applied for shale gas exploration licences for the Karoo from the Department of Mineral Resources: Shell, Challenger Energy subsidiary Bundu Gas & Oil Exploration, Falcon Gas & Oil (in partnership with Chevron), Statoil and Chesapeake.

Shale gas a game changer

"Shale gas has been a game changer in the US and clients are rapidly moving into new markets to capitalise on high-potential shale opportunities," said Hugh Stewart, head of the firm's Global Oil and Gas Practice. "We are excited to offer a single, comprehensive resource that goes beyond a recitation of local law. Companies are looking for global insight in this area, and this guide is intended to help address that need."

Designed for oil and gas industry executives, environmental companies, and the financial services sector, the guide is probably the first single source of information for the shale industry in many areas, including:

- A review of the key contractual issues to consider when negotiating a shale gas permit.

- A first-of-its-kind Aide-Mémoire table comparing conventional vs. unconventional hydrocarbon regimes for the Hot Countries.

- Comparative maps depicting shale gas reserves and policy approaches in Africa/Middle East, Asia Pacific, CIS, Europe, Latin America and North America.

- A structure chart reflecting the administration of oil and gas activities in each of the Hot Countries.

- A table of the companies currently involved in shale gas operations in each of the Hot Countries.