Top stories

Energy & MiningGlencore's Astron Energy gears up with new tanker amidst Sars dispute

Wendell Roelf 14 hours

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

Positively, affordability has improved on the back of the significantly reduced interest rates, with serious sellers responding to the current economic environment with realistic, market-related pricing. While house prices have continued to show positive growth this year, on a real or inflation-adjusted basis they remain in negative territory, reflecting an ongoing price correction in line with the persistently subdued national economic growth rate. In addition, the rent vs purchase equation has shifted to favour buyers, which is having a significant impact on activity in the local housing market. Homeowners around the world have unquestionably re-evaluated their lifestyles and, in particular, their living spaces. According to Lightstone, many countries from the USA to Australia, are seeing a reverse migration as remote working becomes a permanent option across many job sectors and industries, resulting in a steady increase in movement to smaller cities and towns where quality of life, family and affordability are highly valued. Lightstone also points out that in South Africa, the trend is more about the more balanced lifestyle, with home buyers in their late 20s and 30s and early retirees leading the coastal buyers.

Not surprisingly, the significant reduction in the interest rate has made home ownership an appealing proposition for many tenants. In high-demand Boland towns, such as Stellenbosch and Somerset West, developments are selling at a steady pace with developers eager to break ground so that they can also benefit from the low interest rates.

As expected, given South Africa’s hard lockdown and Covid-19 restrictions, Lightstone data (to June 2020) shows a sharp drop-off in unit sales in South Africa in 2020. After averaging around 22,000 units per month each year between 2013 and 2015, this slowed to 21,148 (2016), 20,644 (2017), 19,003 (2018) and 17,328 (2019) as the sluggish economy took its toll on the market. During the first half of 2020, just 5,178 units were sold (although repeated closures of Deeds Offices across the country resulted in a longer delay than usual in transfer of properties sold during this period). Nonetheless, activity, particularly since June (2020), has surprised analysts in terms of its resilience.

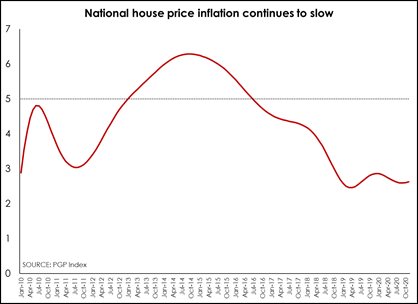

Similarly, house price inflation has surprised on the upside. In the initial months of lockdown, there were numerous forecasts suggesting that prices would decline by between 5% and 15% this year. And yet house price inflation, as measured by the Pam Golding Properties Residential Property Index, remains positive (at least in nominal terms) – averaging +2.7% in the year to November (latest available data).

By comparison, house price inflation averaged -2.4% in 2009 during the recession following the global financial crisis (PGP Index registered a decline of -1.8% in 2008).

One of the initial reasons offered for the unexpected resilience in both price and activity as the lockdown regulations were eased was pent-up demand following the severe lockdown and the closure of the Deeds Office. However, it is apparent that something beyond pent-up demand is contributing to the unexpectedly buoyant conditions in the market.

This unexpected buoyancy in the market is a global trend, and a recent article in The Economist suggested that it was attributable to a combination of factors:

Combined, these three factors have created an unexpected ‘sweet spot’ for the market. However, unlike global markets, the local market is not experiencing rising house price inflation (except for the lower price bands).

An additional factor in South Africa is the large pool of potential first-time buyers who have been encouraged by the current low interest rates to forego renting and are opting to purchase a property instead. This is providing a solid underpinning for the local housing market, although perhaps not in regard to house prices as the bulk of activity is taking place at the lower to middle end of the market (mainly up to R2m).

With a second wave of infections upon us, the need to work remotely where possible is likely to continue to enable the ability to move away from traditional urban and suburban areas to small towns and villages offering more affordable housing and a more relaxed lifestyle.

South Africa’s house prices have surprised analysts, confounding expectations of a slump as the pandemic hit the local economy. This trend is seen globally – with property prices surprisingly buoyant. Numerous reasons are offered for ongoing activity, including significantly reduced interest rates and a desire to relocate or upgrade due to the pandemic.

While in South Africa it is largely about activity surprising on the upside not prices, sales are being concluded because sellers are being more realistic about asking prices.

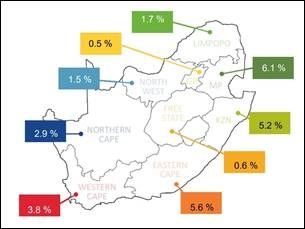

According to Lightstone, the Eastern Cape, KwaZulu-Natal and Mpumalanga have seen strong house price momentum and now lead the provincial growth with rates currently above 5% (see map below). Properties in the coastal provinces continue to outperform, with house prices in Gauteng increasing by just 0.5% in the year to July.

There are concerns as to how sustainable the current recovery is, particularly as the country experiences a second wave of Covid infections. Many of the personal and business relief measures introduced in April have come to an end and unemployment is expected to rise further, placing further financial pressure on consumers.

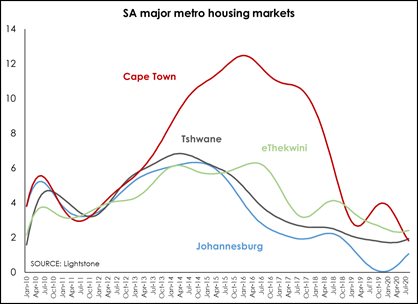

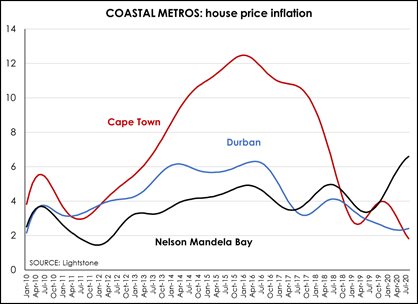

Cape Town’s period of outperformance relative to the other major metro housing markets has also come to an end, with house price inflation slowing rapidly during the course of 2020. The one metro which has outperformed Cape Town since October 2018 is Nelson Mandela Bay, which is reflective of the strong growth in the regional market. This may well be attributable to the semigration of South Africans to coastal towns, with the Eastern Cape (as well as KwaZulu-Natal) benefiting due to affordability and its lifestyle offering.

The Cape Atlantic Seaboard has experienced a far busier selling market in what is traditionally a quieter winter market as buyers find good value – including leisure and investment buyers - and there has been significant interest for well-priced luxury property as well as a partial return of the international buyer segment. Port Elizabeth and East London are seeing properties up to R2m and R3m respectively selling literally in days, while Gauteng is experiencing activity across all price bands with Pam Golding Properties’ unit sales transactions out of its Hyde Park office at its highest level in 12 months and the Cape Western Seaboard experiencing a marked increase in unit sales.

For some time, the coastal metro housing markets have outperformed their inland peers, presumably due to the ongoing semigration of locals to holiday and retirement destinations. This trend has been significantly reinforced by lockdowns, which have freed people (to some extent) from their need to live in close proximity to their places of work. Now many are moving to more affordable areas – often with a more pleasant lifestyle – and just need to be within aone to two-hour commuting distance to their places of work.

This trend has been reinforced by the redevelopment of many of these former retirement and holiday towns, which have seen significant investments in medical, educational and retail facilities in these areas, making them more appealing to a young home buyer.

South Africa’s residential property market has seen signs of an earlier than expected rebound. Coupled with generally more realistic pricing, a ripple effect is filtering through the market, placing upward pressure on demand through the various price bands. One of the benefits of the prevailing low interest rates is the large number of first-time buyers. This is positive for South Africa because home ownership and a growing middle class are the key factors contributing to economic growth and stability.

While it remains to be seen how the country’s economic recovery gains traction, we believe that solid foundations and fundamentals remain in place for ongoing investment in the residential property market. This is especially so since, in addition to the usual reasons for movement in the marketplace, the lockdown has inadvertently created the rationale for a wave of new reasons for relocation and property acquisitions, from upsizing for additional space due to work-from-home scenarios to lifestyle moves to more appealing destinations further afield.

Work from home: Historically, ‘working from home’ segmented people into roughly three categories; the self-employed professional, the young startup, and the cottage industry entrepreneur. For almost everyone else in an established business or the corporate world, it meant a daily, costly, time-consuming commute to an office. Lockdown was a social disrupter but also gave rise to a new approach to how we work and, more importantly, where we are most productive. While manufacturing and hospitality industries have no choice but to centralise, many people are now presented with promising options. Underutilised spare rooms are being redesigned as working hubs. For young professionals and first-time buyers, a sectional title unit with an extra bedroom is likely to be an attractive choice. For families, a freehold home with good Wi-Fi connectivity in a peripheral area, retirement village or a country estate, solves the dilemma of choosing income generation over quality of life.

Ongoing demand from first-time buyers: With the easing of the hard lockdown, and moving forward, the 50-year low interest rates coupled with the zero transfer duty payable on properties up to R1m has fuelled high interest and significantly increased activity among first-time buyers - some of whom were formerly renting but now find affordable and appealing opportunities to gain a foothold on the property ladder. Furthermore, in the current environment, millennial buyers can get into a property or suburb that they might not have been able to afford a year ago. According to FNB, data from the Deeds Office shows that younger buyers (below 35 years) now account for 43% of residential sales – up from 38% in 2019.

With a population of predominantly ‘young’ buyers, the increasing demand for accommodation to buy is helping drive activity in the residential property market, with a ripple effect upwards across all sectors of the market and even creating stock shortages in high-demand areas. If managed correctly, apart from enabling security of tenure going forward, homeownership is one of the best ways to create wealth and, in South Africa, plays a critical role in economic transformation.

According to Lightstone, most first-time buyers enter the residential property market in the R700,000 – R1.5m price band, rather than in less expensive valuation bands; both first-time and repeat buyers mostly want three bedrooms and two bathrooms; and women make up most of the first-time buyers while men make up most of the repeat buyers. Sectional title and estate properties are particularly appealing to female buyers as they tend to offer better security and this steady rise in women’s buying power is reshaping the local property market.

According to ooba, the percentage of first-time homebuyers has been rising steadily since late-2007 (available data) with a clear acceleration in the percentage of first-time buyers in recent months – briefly reaching a record high of 56.2% in May this year – with the underlying trend remaining upward.

Also according to ooba, the approval rate for first-time buyers has averaged 80.1% from January to October 2020 (available data), which compares to an average of 80.0% during 2019 as a whole. In 2016 (first available data), the approval rate for first-time buyers was just 68.5%, reflecting a marked improvement in recent years.

Positively for home buyers, the deposit that financial institutions require from both first-time and repeat buyers is declining. For the year to date, the deposit – as a percentage of purchase price, for first-time buyers has averaged 7.0% while for repeat buyers it has averaged 9.03%, also according to ooba.

Loan applications for 100% bonds have risen steadily in recent years, reaching a peak of 67.5% in June 2020 before easing back to 62.5% in October, with the approval rate for 100% applications being 80.4% during the 10 months January to October 2020 (available data).

The conversion model: Buying a property that required a deposit, mortgage approval, and dual household income to service repayments, meant that owning a home was out of reach for the majority of young South Africans. The market has swung in their favour this year, and with the lowest interest rates in nearly 50 years, buying rather than renting, is a realistic prospect. First-time buyers are discovering that unwanted office and retail space must still earn its keep and a conversion to residential units is a win for both sides. Precincts that were deserted after office hours now show signs of life as young people transform them into smart, urban hubs.

Co-living: This is a global trend as more and more people move to co-living spaces. Essentially communal living, co-living brings together a community of people who live in small personal spaces and share communal areas like work areas and kitchens. The buildings are tech enabled and offer a variety of amenities.

The primarily appeal of co-living is that it allows people to live in areas that they could not afford in the traditional housing market. The sacrifice is that their private space is typically smaller. Co-living also generally offers flexibility (which is important in uncertain times) with daily, weekly and monthly stays generally available. Co-living also goes some way towards addressing a significant social ill – loneliness. A 2020 research report indicates that three out of every five Americans are lonely.

Aimed at the young professional in South Africa’s major metros, HOMii is a local example - an app whereby users can book stays at apartments in buildings in major cities which offer co-working hubs. It offers an accessible alternative to traditional renting as there is no lease agreement while credit checks or deposits are not required. Accommodation options include single and shared rooms with flexible options (daily to several months).

Gated lifestyle estates rise in prominence: With many people now spending the majority of their time at home, working or studying, homes have become more than a sanctuary, they have also evolved into ‘quarantine bubbles’, with homes on secure estates, with an abundance of safe open space and restricted access as well as a variety of amenities, becoming increasingly popular among those taking into account potential future quarantine requirements.

Move to second tier cities and smaller towns: FNB data shows a sub-trend of homeowners reassessing their housing needs and preferences as a result of life in lockdown, with some relocating to less crowded second-tier cities and smaller towns. For example, Port Elizabeth is a second-tier hub with a safe, convenient lifestyle in an affordable coastal location. More and more of these locations offer urban convenience and quality of life with a lower price tag.

The 2020 shift to remote working has given South Africans another reason to consider semigration. If you can live and work anywhere, it makes sense to live somewhere with a better quality of life and less expensive lifestyle and/or housing.

Sustainability becomes increasingly mainstream: An increasing number of environmentally conscious home-owners and buyers across all age groups are looking beyond the aesthetic of a potential new property in pursuit of sustainability of the planet. Energy and water efficiency and sustainable use of materials top the wish list but there’s a long-term strategy in place. Buyers are also looking sharply at rising utility costs and erratic municipal service delivery. As a result, the house of their future is ideally off-grid and independent.

Rise of tech cities: According to a recent Tech Cities report by Savills, tech lifestyle cities are seeing a growing emphasis on health and wellness, as they seek to attract top talent. Cape Town, home to some of South Africa’s largest financial institutions, with fintech startups taking advantage of the mature financial ecosystem in the city to scale up and gain notice, and with relatively inexpensive flex-working or co-working space, is ranked among rising global tech contenders. According to Invest Cape Town, almost 60% of the country’s startups are located in the Mother City, while Venture Capital investment in Cape Town grew by 147% from 2016 to 2019. According to Savills, top tech lifestyle cities meet high standards of air quality, access to green space and have smaller geographic footprints while also providing the services and products that tech talent seeks today, such as fast broadband speeds and an affordable vegan burger, as explored in Savills Digital Nomad Essentials Index.

The fact that interest rates are so low and banks have attempted to help people keep their homes (with payment holidays and the like) rather than repossessing their homes means that the market has not been flooded with surplus stock, even though there has been some uptick in the number of sales due to financial pressure. The full economic impact of the lockdown has yet to be felt as a still sluggish economy is likely to result in more business closures and job losses.

While interest rates are expected to remain at their current low levels until late-2021 at least, this remains a positive for the market. However, it remains to be seen whether government will increase the tax burden in the 2021/22 National Budget as it attempts to contain its debt levels.

The unexpected strength in demand from predominantly young buyers, coupled with the fact that fewer homes have come onto the market due to financial pressure, explains why prices have held up better than expected thus far. Whether this is sustained into 2021 remains to be seen.

While it is far from clear how the work-from-home vs office issue will be resolved in the long term, it appears that overall, people will be freed to some extent from being completely office bound. This in turn means that many towns and suburbs, which previously were too far from work and schools and offering more affordable accommodation, are now feasible for homeowners.

Coupled with the current low interest rates, and the opportunity to spend more time at home, is prompting many new buyers into the market and encouraging repeat buyers to purchase a different type of home, such as larger, to incorporate a dedicated working space and a garden.

The co-working and co-living trend has been emerging for some time now. While there were initial fears that people would be reluctant to share spaces with other people during the pandemic, the need to reduce overheads and equally the opportunity to reduce office space since most employees are not returning full time, is likely to see demand for smaller, often more flexible office options.

In many ways, the pandemic has not introduced new trends but rather has significantly accelerated existing trends, such as the move to online, remote working and the shift to co-working.

Although health risks remain a concern, the fact that people may increasingly work from home – at a time when more and more households consist of single people – the need for community is likely to encourage the trend towards co-working and co-living.

While the extensive damage caused to the economy by the lockdown will take years to repair, on balance it may well have created a more flexible work and home lifestyle while the concerted interest rate cuts appear to have attracted numerous first-time buyers into the market who would not otherwise have purchased a home.

This year, South African buyers have continued to demonstrate a strong appetite for offshore property investments, with the biggest demand unequivocally still for Portugal, with the ultimate goal being EU citizenship, followed by Mauritius and Grenada – which offers a path to US residency. The US will always be a pull for those looking for a bigger and better lifestyle, and therefore the EB-5 Green Card programme will always be interesting for high-net-worth South Africans looking to participate in the biggest economy in the world.

In addition, the EU residency programmes allow for a good hard currency investment coupled with the ability to acquire EU residency opportunities for one's family, enabling dependents to cast their net further afield when considering studying or working in Europe.

During the lockdown, there has been a significant increase in enquiries from South Africans for property offering residency in Mauritius, attributable to a number of factors. These include the increased desire for security and health safety during uncertain times, the drop in the price entry level for residency from $500,000 to $375,000, ease of access, ease of transition due to familiarity, and an existing, large South African expat community. The successful managing of Covid-19 on the island also assisted in providing confidence to invest and spending time in Mauritius in the security of one’s own home. Sales for 2020, despite the global lockdown and travel restrictions, have been strong and are expected to continue in 2021.