Top stories

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

Both growing countries show some similarities and huge differences when we analyse marketers’ investment in communications and clients’ relationships with agencies and other partners.

Let us start with three major differences reflected in three key factors. They reflect the importance and prestige of the advertising industry in Brazil and marketers’ respect for agencies compared with the frequent changes and lower levels of investment and perceived contribution to growth in China.

First, in Brazil for every £100 pounds sold, a big company invests an average £3.6 in communications. In China investment is £1.8 (even much lower compared with the global benchmark at 3.5 or 4.0 in the UK when the study was last produced in 2019).

Marketers in Brazil work with their agencies an average of 5 years before deciding to change; 2 years more than in China, where the average duration of relationships is only 3 years.

Thirdly, when CMOs in Brazil are asked how much they perceive their agency is contributing to their business growth, they believe agencies contribute by 61.7%, and in China this figure goes down to 39.1% (adding 17.4% which is the contribution from creative agencies and 21.7% contribution from media agencies).

If we now analyse how marketers in both countries define the ‘ideal’ or perfect,agency, we find more similarities. Marketers want to work with agencies that have a deep knowledge (of the consumer, brands, media, trends, …), agencies that have strong capabilities in strategic planning (very much linked with their data capabilities and the expertise to use it for planning), agencies that provide strong creative and innovative ideas, and that can offer integrated services. Those four factors define the perfect agency for marketers in both countries. With a lower number of mentions, but also very similar levels of importance in both markets, clients want an excellent account service, good internal processes and working methods, and branded content expertise.

It is interesting to note that marketers in Brazil are much more demanding, and on top of mentioning all those factors, they go beyond and demand research, agencies meeting deadlines, good execution, proving effectiveness, proactivity, and value for money.

Digital capabilities demand further analysis. While in Brazil clients want to solve digital needs with their agencies (as fully integrated partners that solve all needs – even media as media agencies do not operate in Brazil), in China clients work with many different digital specialists in different territories and therefore very few marketers think of digital within a single agency.

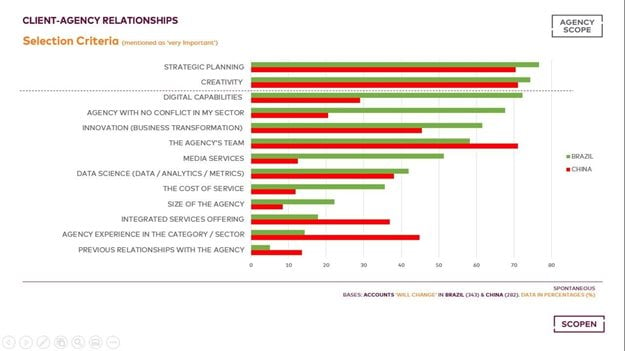

When selecting agencies and identifying relevant criteria, we also notice similarities in between Brazilian and Chinese marketers. Strategic planning is the most important factor in both countries, followed by creativity. Innovation capabilities, that would lead to brands and businesses transformation, and the agency’s team have also similar importance in both cases. The biggest differences appear in digital (for the same reason as mentioned above). Media services are key in Brazil (because of the non-existence of media agencies). Interesting also that Brazilian marketers are more reluctant than Chinese marketers to work with agencies that have a conflict in the same sector.

We also find similarities between both markets when focusing on reasons for changing agencies. Clients in Brazil and China decide to change an agency mainly because of bad service or execution and because they need to revise their accounts periodically (because of procurement influence). Value for money is much more mentioned in Brazil than in China.

Finally, it is interesting to mention that in both countries, the top 3 most mentioned marketers for their campaigns are: Burger King, Ambev and Itaú (in Brazil), and Mondelez, Tmall and Taobao (in China); and the top 3 most mentioned marketers for their marketing are Natura, Itaú and Magazine Luiza (in Brazil), and Alibaba, Coca-Cola and Huawei (in China).

The top 3 most creative agencies in Brazil are Africa (Omnicom), Almap BBDO and DPZ&T (Publicis Groupe), while Ogilvy, BBDO and Amber (independent) lead the creative ranking in China.

When marketers mention three agencies for their shortlist for a pitch Africa, F.biz (WPP) and Wieden+Kennedy lead the list in Brazil and Ogilvy, Socialab (independent) and BBDO are the three most mentioned in China.

The most ‘ideal’ agencies in Brazil are DPZ&T, F.biz and David while Ogilvy, Socialab and Publicis are the most ‘ideal’ agencies in China.

Scopen is currently conducting Agency Scope in the UK, also interviewing the largest companies by ad spend. Key decision makers will be interviewed through end of April to analyse trends in the UK, perception and image of agencies, consultancies and digital platforms. The study is supported by ISBA.