Top stories

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

The debt-burdened retailer, which reported yesterday a fall in second-quarter sales, wants to boost store space productivity and e-commerce, as well as revive its high-margin private label brands such as Kelso.

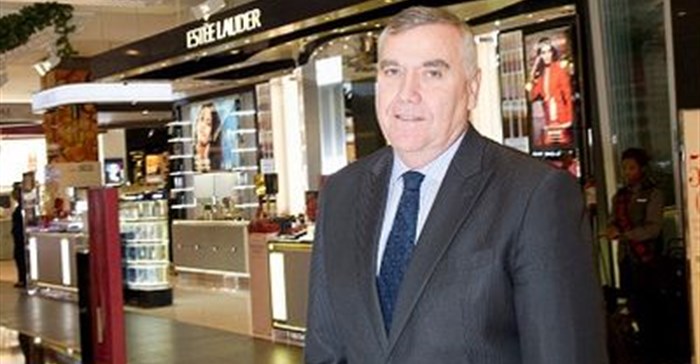

Brookes and his team have been visiting stores as they focus on customer research.

"There does need to be a significant change in strategy ... even though the business has had five consecutive quarters of ebitda (earnings before interest, taxes, depreciation, and amortisation) growth - we're still well behind the pack in terms of sales "¦ we have the poorest space productivity in the country and we're working hard on it."

Brookes joined Edcon at the end of September after nearly a decade leading Myer, Australia's largest department store.

Edcon, once one of the retail sector crown jewels, was bought by Bain Capital for R25bn in 2007 in a deal that burdened the retail group with debt.

Over the three months to September 26, its net loss widened to R2.1bn, compared with a loss of R627m a year earlier. Over the quarter, its debt rose 15% to R27bn.

A decision to clear winter stock early hurt the group's gross profit margin, which declined to 35.4%, from 35.8% in the June quarter, partially offset by increasing first margins before clearance.

In the Edgars division, cash sales growth increased 6%. Credit sales growth declined 6.7%. Same store sales fell 2.6%.

The discount division suffered from a 10.7% drop in credit sales, resulting in retail sales decreasing 0.1%.

Same store sales were 2% lower. At CNA, same store sales slipped 5.6%.

The group's plan to return Edcon to its pre-eminent position in the market also included simplifying its business model and increasing credit sales through an in-house credit book and lay-byes, Brookes said.

"We are not in the midst of selling (noncore assets), but anything, everything and nothing could happen," Brookes said in a conference call. Capital expenditure of R600m-R700m has been pencilled in for the 2016 financial year.

For more than two decades, I-Net Bridge has been one of South Africa’s preferred electronic providers of innovative solutions, data of the highest calibre, reliable platforms and excellent supporting systems. Our products include workstations, web applications and data feeds packaged with in-depth news and powerful analytical tools empowering clients to make meaningful decisions.

We pride ourselves on our wide variety of in-house skills, encompassing multiple platforms and applications. These skills enable us to not only function as a first class facility, but also design, implement and support all our client needs at a level that confirms I-Net Bridge a leader in its field.

Go to: http://www.inet.co.za