In 2021, the global and local short-term insurance industries have endured the impact of the Covid-19 pandemic relatively well, despite declines in both growth and premium volumes. The industry appears to on the road to recovery, driven not only by strongly rebounding economies and consumer spending, but a paradigm shift towards the incorporation of InsurTech and Fourth Industrial Revolution (4IR) technologies. These include the use of artificial intelligence (AI), machine learning, Internet of Things (IoT), blockchain, and even drones, to develop innovative short-term insurance products that cater to capricious consumer demands, whilst increasing efficiency and lowering costs.

Insight Survey’s latest SA Short-Term Insurance Industry Landscape Report 2021, carefully examines the global and local short-term insurance landscape, based on the latest research and information. It describes the latest global and local market trends, innovation and technology, drivers and challenges, and detailed competitor analysis, to present an objective insight into the South African short-term insurance industry environment and its future.

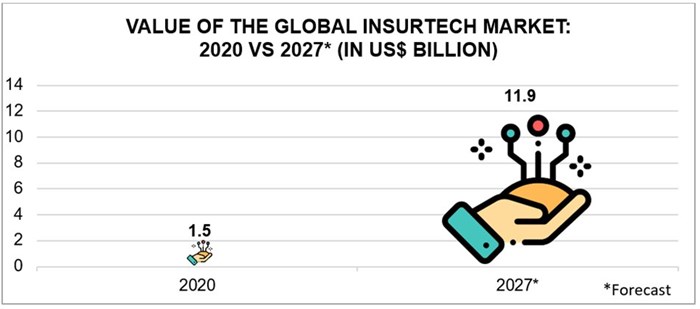

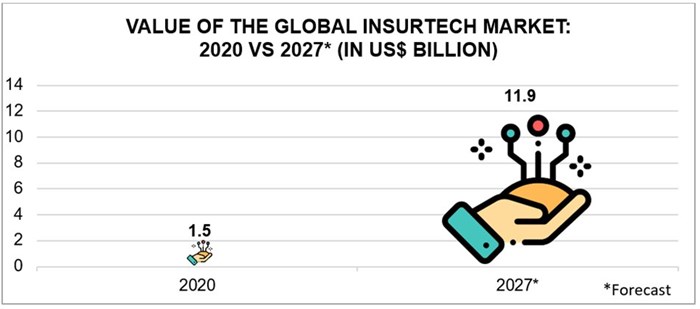

In terms of the Global Insurtech market specifically, significant growth is expected, with the market expected to grow at a compound annual growth (CAGR) of 34.4%, to reach a total value of US$11.9 billion in 2027, as per the graph below. The expected growth of the InsurTech market globally is largely due to its ability to simplify the claims process, meet demand for digitalisation, enhance cost-effectiveness, and expand into new routes and markets, such as social insurance, and ultra-customised coverage.

In terms of the local InsurTech market, the impact of the Covid-19 pandemic on local insurers has accelerated the digital transition of insurance tasks, to meet consumer demands in terms of service and digital offerings, resulting in many local insurers proactively partnering with InsurTech companies. This has included strategic alliances, such as the one between Sanlam Group and MTN Group, as well as the early-stage investment of R1.4 billion into the local tech ecosystem by Naspers Foundry, which included a R120 million investment in local AI-driven InsurTech company, Naked Insurance.

South African consumers are increasingly demanding the digital, self-service, and on-demand experiences from insurers that they have become accustomed to from other industries, during the Covid-19 pandemic. This is resulting in the adoption of digital strategies to improve communication and improve satisfaction, with the ‘phygital’ trend becoming particularly prominent in terms of blending automation and human expertise, which is becoming the market norm.

In particular, local insurers, such as King Price, are increasingly leveraging artificial intelligence (AI) technology to transform their operations and the market. As AI becomes more accessible, it is being used to transform claims and underwriting processes, as well as streamline processes and enhance operational efficiencies. This is enabling insurers to offer rapid quotes and cover for specific items and events, as well as traditional cover, both online and through mobile apps.

As an example, Vaai.co launched one-day car insurance cover in March 2021, designed to be a stop-gap measure for periods during which consumers are exposed to increased risk, which works similar to buying prepaid airtime. Consumers can purchase instant cover through the mobile app, or pay premiums in cash at FNB ATMs, with cover ranging from as little as R40 for R13,000 of cover.

MiWay has also launched its new MiWay Blink fully digital car insurance app, which includes monthly cashback benefits that incentivise safer driving, as well as allowing for the tracking of mileage. Moreover, these apps make it possible to buy and manage car insurance through the app, using just a smartphone, and also includes crash detection.

Non-traditional insurers are also getting in on the InsurTech act, with both Standard Bank and Absa announcing the launch of dedicated car insurance apps, that offer consumers the ability to purchase car insurance in as little as five minutes. Both these offerings also include telematics-based features, that track driving behaviour and incentivise good driving behaviour, through usage-based rewards.

The SA Short-Term Insurance Industry Landscape Report 2021 (150 pages) provides a dynamic synthesis of industry research, examining the local and global short-term insurance industry from a uniquely holistic perspective, with detailed insights into the current market dynamics and stakeholder positioning – from market size, industry trends, industry innovation and technology, industry drivers & challenges, to competitor and product analysis.

Some key questions the report will help you to answer:

- What are the current market dynamics (overview, market environment, COVID-19 impact and key regional markets) of the Global Short-Term Insurance industry?

- What are the latest South African Short-Term Insurance trends (including tech & Insurtech), innovation, drivers and challenges?

- How did Short-Term Insurance companies perform in 2020/21, what is the strategic focus and expansion plans?

- What are the latest product and service developments for Short-Term Insurance companies and what products do they offer?

- What is the latest marketing and advertising news for each of the Short-Term Insurance players?

Please note that the 150-page report is available for purchase for R45,000.00 (excluding VAT). Alternatively, individual sections can be purchased for R15,000.00 (excluding VAT). For more information, please email az.oc.yevrusthgisni@ofni or call our Cape Town office on (021) 045-0202 or Johannesburg office on (010) 140- 5756.

For more details and a full brochure: SA Short-Term Insurance Industry Landscape Report 2021

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 15 years of heritage, focusing on business-to-business (B2B) and industry research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.