Top stories

More news

The report analyses BrandsEye’s social media data and Bonsella’s consumer survey data to assess shifts in buying habits and consumer priorities during the pandemic. Bonsella is a consumer rewards programme located in 150 tier 2 independent retailers across South Africa. The programme rewards customers with instant airtime to their mobile phones.

Commenting on the report findings, BrandsEye chief executive, Nic Ray said: “Since the lockdown, complaints about retailers have focused on Covid-19 issues such as price changes, stockouts and store hygiene. And while pricing is unsurprisingly consumers’ chief concern in deciding where to shop, across all LSMs, people are acutely aware of the safety and health measures retailers are taking around Covid-19. These measures are influencing where people are deciding to do their shopping."

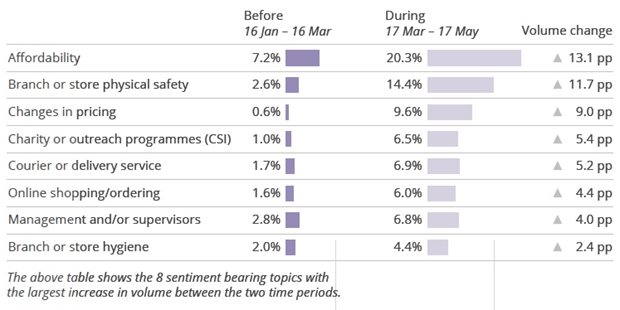

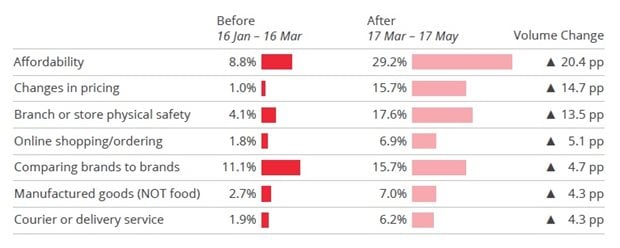

The majority of shoppers surveyed wanted Covid-19 safety protocols implemented by retailers. Social media conversations about branch or store physical safety had the second-largest increase during lockdown increasing by 11.7 points, and complaints about it increased by 13.5 points.

Shoppers expected retailers to adhere to social distancing measures and took to social media to praise those that met their expectations and criticise those that did not.

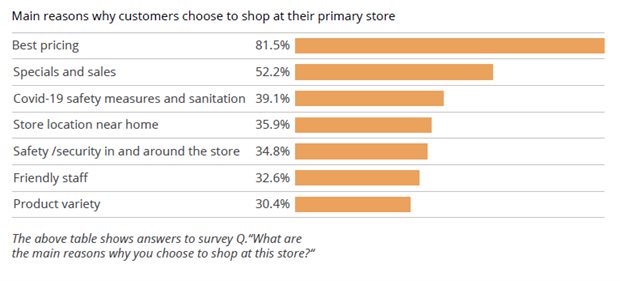

The report reveals that 39.1% of customers said the main reasons why they shopped at their primary store was due to Covid-19 safety measures and store sanitation.

Social distancing at checkout-tills was the most desired in-store Covid-19 safety measure mentioned by 70.7% of those surveyed. This was followed by shoppers wearing masks (68.5%) and staff wearing masks (57.6%).

According to Andrew Weinberg, CEO of Retail Engage, which owns the Bonsella brand, there has been significant shift in consumer adoption to health precautions in stores, over the last three months. Most stores implemented the appropriate health and safety measures quite quickly resulting in consumer confidence and continued support of the stores.

The most valuable resources and indicator on “what is happening on the ground” is the analysis of consumer buying behaviour, combined with intercept consumer research and review of historical trendlines. Retail Engage has staff located in stores throughout South Africa, and the feedback and research surveys from these staff have been extremely valuable, the company says.

According to the report, 81.5% of surveyed shoppers chose their primary store based on price, followed by specials and sales (52.2%). On social media, affordability and changes in pricing were conversation topics that had the largest increases during the lockdown.

Consumers took to digital channels to complain about price-hikes in particular, leading to a 14.7 point increase in complaints about changes in pricing and an 11.6 point increase in complaints about competition and price-fixing.

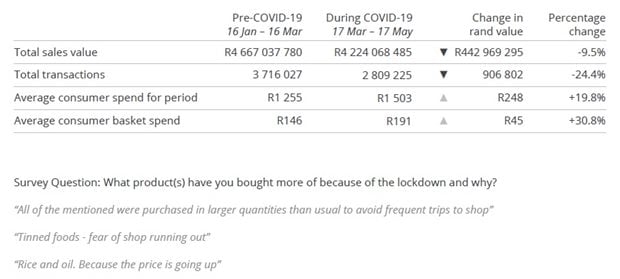

Since lockdown began, consumers have made less frequent visits to shops but are spending more per visit, with basket value increasing by 30%.

Some survey respondents said they had been purchasing groceries in larger quantities to decrease the number of visits made to the shops, while others did so because of concern over stock-outs and forthcoming price hikes.