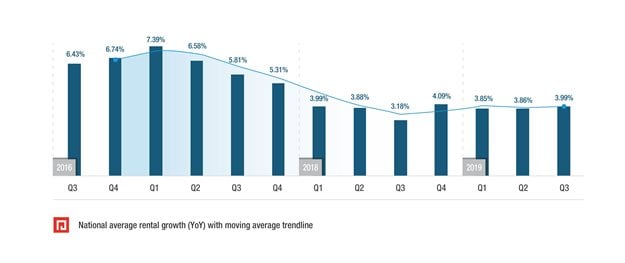

For most of 2017 and 2018, the rental growth rate trended downward - in other words, rents still increased, but at a slower pace. However, in the last quarter of 2018, the country experienced its first uptick in quarterly rental growth (measured year-on-year) after six consecutive quarters of decline.

In 2019, though, we saw rental growth trend sideways at below 4%, trailing even the low inflation rate.

The moving average line on the graph (which effectively smooths the growth rate, making the longer-term trend easier to see) confirms the sideways trend for 2019 so far.

How do the bigger provinces compare?

Let’s consider trends seen across KwaZulu-Natal, Gauteng and the Western Cape – three large provinces that have a relatively big impact on the national average. Because supply and demand are affected by different local factors, rental growth trends differ across provinces.

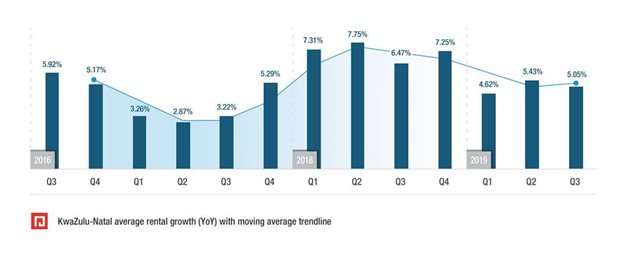

KwaZulu-Natal still experienced growth of around 5% this year – down from the 7% seen in 2018, but still higher than the national average. In contrast to a picture of nationwide declines, rent increases in KwaZulu-Natal rose through 2017 and much of 2018, but the province still did not escape this year’s trend of flat growth.

The high growth of 2018 and above-average growth in 2019 made KwaZulu-Natal the second most expensive province after the Western Cape in which to rent. This could in turn affect affordability in the province if wages do not keep pace in 2020.

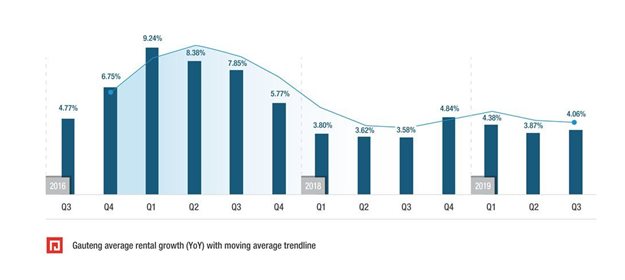

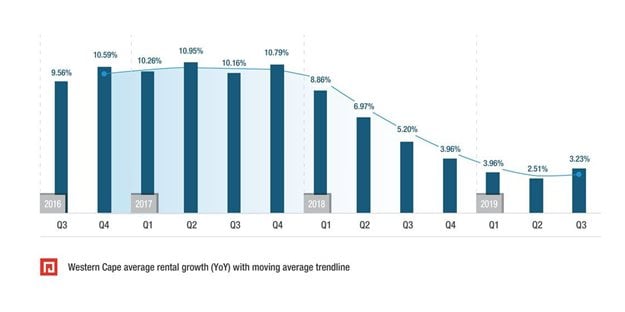

In both Gauteng and the Western Cape, we see rental growth that is closer to the national trend, although the Western Cape’s decline lagged by a few quarters. Recent figures are a long way away from the 9% or 10% seen just two years ago.

Both provinces also experienced a slight uptick in Q3 2019, but it is too soon to tell if that will continue into 2020 – particularly as increasing development of new rental units in both these provinces puts rental price growth under pressure. When tenants can move to more affordable housing, landlords find it difficult to demand high rent increases. Indeed, tenants squeezed by sub-inflation wage growth may opt to move to cheaper housing even without the threat of rent rises.

Johette Smuts, head of data and analytics, PayProp

Looking ahead to 2020

Our prediction is that the oversupply of housing in the two biggest provinces will continue to suppress rental growth – supply is relatively inflexible, and demand is also relatively slow to change in the short term.

Affordability is and will continue to be an important factor. Sub-inflation income growth will increase financial pressure on consumers, particularly in those provinces where rental growth outpaces inflation.

Given these factors and the overall economic outlook for 2020, we expect that the current trend of subdued rental growth will continue over the next 12 months.