Related

Top stories

More news

Marketing & Media

Warner Bros. was “nice to have” but not at any price, says Netflix

Logistics & Transport

Maersk reroutes sailings around Africa amid Red Sea constraints

“Property sales suggest, in addition to declining property transfers, those under 35 are switching to the lifestyle benefits offered by sectional title properties, they are buying later - with the average age of first-time buyers being higher than it was ten years ago - and they are increasingly buying solo,” says Hayley Ivins-Downes, head of digital at Lightstone Property.

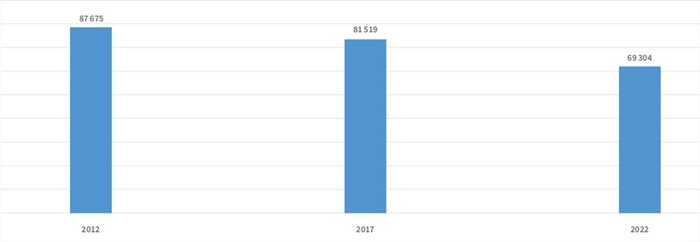

Property transfers (of properties transacting for more than R20,000) to youth over the past ten years have declined from 87,675 (45%) in 2012 to 81,519 (40%) in 2017 and 69,304 (38%) in 2022.

The fall in sales to the youth (sales in 2022 is 79% of the 2012 sales volumes) is more radical than the overall sales (sales in 2022 was 94% of the 2012 sales volumes).

According to Lightstone’s Signio platform, youth accounted for 31% of new car sales in 2022 compared to 39% in 2012.

“Volkswagen’s popularity has grown over the last five years and is the youth’s popular choice at just over 25% market share, while Ford and Suzuki are also growing,” says Jaco van Staden, head of sales at Lightstone Auto.

The big winner in the vehicle segment is the Crossover, which has climbed from around 3% in 2012 to just under 15% in 2022. SUVs and above-one-ton double cabs have also grown in popularity, while small and medium passenger vehicles have been the big losers.

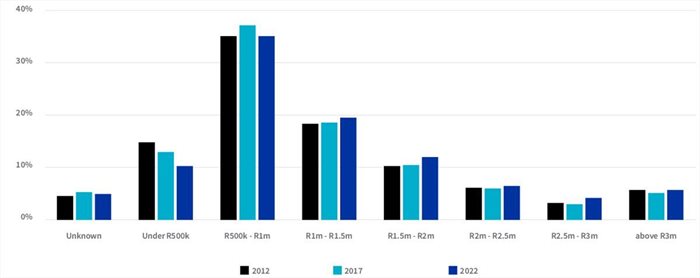

The proportion of sales to the youth is lowest in the under-R20,000 band (10% for transfers at no value, 16% for transfers less than R20,000), rising to 34% in the R20,000-R500,000 band and 44% (the highest) in the R500,000-R1m band and then dropping off to 39% in the R1m-R2m band and 27% in the >R2m band.

Transfers in the under-R20,000 band are often RDP/subsidised housing transactions and are typically skewed toward older people.

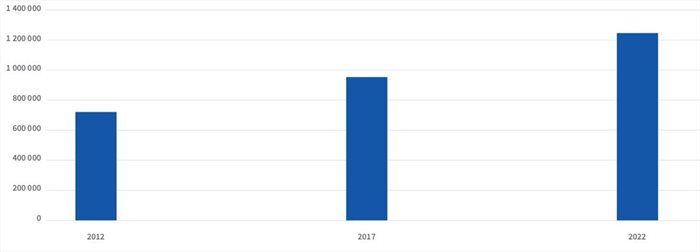

The average price of purchases by youth (graph below) over the ten years has increased from R700,000 in 2012 to R930,000 in 2017 and R1.2m in 2022. The increase, however, is largely attributable to house price inflation and not higher-value assets being purchased (see graph spread of asset values in terms of current values).

Youth are increasingly likely to buy properties as single owners, rising from 69% in 2012 to just under 75% in 2022.

Youth buyers are opting increasingly for sectional title properties and their interest in freehold properties is waning (see graph below), while interest in estates is consistent. The shift is consistent with a preference for urban living which emphasises convenience and lifestyle amenities. This trend is influenced by the younger generation’s desire to live closer to work, reducing commuting time and providing easy access to recreational activities, restaurants, and shopping centres.

Youth are buying properties later in life, as the graph below shows, with 2017 and then 2022 volumes being higher as young people head to 35 years of age.