#PulpNonFiction: Fantasy economics; what if money could grow on trees?

"How can you have money," demanded Ford, "if none of you actually produces anything? It doesn't grow on trees you know."

“If you would allow me to continue...”

Ford nodded dejectedly.

“Thank you. Since we decided a few weeks ago to adopt the leaf as legal tender, we have, of course, all become immensely rich.”

Ford stared in disbelief at the crowd who were murmuring appreciatively at this and greedily fingering the wads of leaves with which their track suits were stuffed.

“But we have also,” continued the management consultant, “run into a small inflation problem on account of the high level of leaf availability, which means that, I gather, the current going rate has something like three deciduous forests buying one ship’s peanut.”

Murmurs of alarm came from the crowd. The management consultant waved them down.

“So in order to obviate this problem,” he continued, “and effectively revalue the leaf, we are about to embark on a massive defoliation campaign, and. . .er, burn down all the forests. I think you'll all agree that's a sensible move under the circumstances.”

From the leaf economy to the money printers

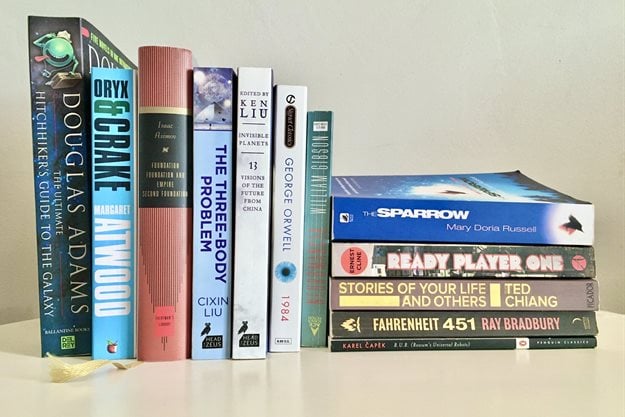

The above dialogue is from Douglas Adams' science fiction classic, The Hitchhiker's Guide to the Galaxy. I was reminded of it this week, due to the increasing noise around MMT, aka Modern Monetary Theory, amongst economic and political circles. Most recently, MMT has been thrown into the spotlight by the US-based celebrity economist Stephanie Kelton’s bestselling book on the subject, titled The Deficit Myth: Modern Monetary Theory and the Birth of the People's Economy.

While I am not going to go into great detail on MMT here, in short, the theory suggests that money can, figuratively speaking, grow on trees; that nations that have control over their own currency don’t have to worry about debt or overspending, because they can simply print more of their own money to pay their bills.

(For readers interested in a more technical breakdown of the theory and it’s pros and cons, you can go here. For an overview on how MMT relates to South Africa’s own particular situation, this article I penned with Ronak Gopaldas gives a high-level view of the local situation.)

For avid readers of Douglas Adams like myself, it all sounds rather familiar.

Of course, it is an attractive idea on paper. Of course being able to keep the (literal and figurative) national lights on without cutting budgets or raising taxes would be a godsend to desperate South Africans, and, of course, nations can print their own money. Printing money will undoubtedly make everyone feel richer in the short term. It might even be necessary to help desperate citizens survive a crisis. Desperate times do call for radical ideas and new ways of distributing pain (and money) more fairly across time and space.

Real vs fantasy economics

As a futurist, I am always wary of adopting short-term solutions for long-term problems without giving full consideration to the long-term consequences of those short-term solutions. Because there always are consequences.There are always trade-offs between prioritising the present over the future. Things that sound too good to be true usually are. In this case, the consequence is that the integrity of any monetary system relies on trust, that is credibility - or belief - that the money is worth what the money printer says it is in real terms. Once that trust is broken, once foreign creditors and domestic traders lose that belief, either the currency collapses or access to credit dries up or, like what happened in the leaf economy, inflation kicks in.

All the money in the world does not make more of the real scarce resources in the real world if no one believes in your money any more.

Money without social value cannot buy you more time or make you more cake. It can just change the price of the cake on sale, and perhaps divide it into more or differently shaped slices.So, like the people in Douglas Adam’s universe, ultimately, while we all may feel richer, we haven’t actually gained anything more of real value.

The moral of the story is to not let greed or fear blind us to the real work that needs to be done to fix our real problems (many though they may be) or to lose sight of the long-term consequences of our short-term actions, however well intentioned they may be.