Related

Top stories

Energy & MiningGlencore's Astron Energy gears up with new tanker amidst Sars dispute

Wendell Roelf 10 hours

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

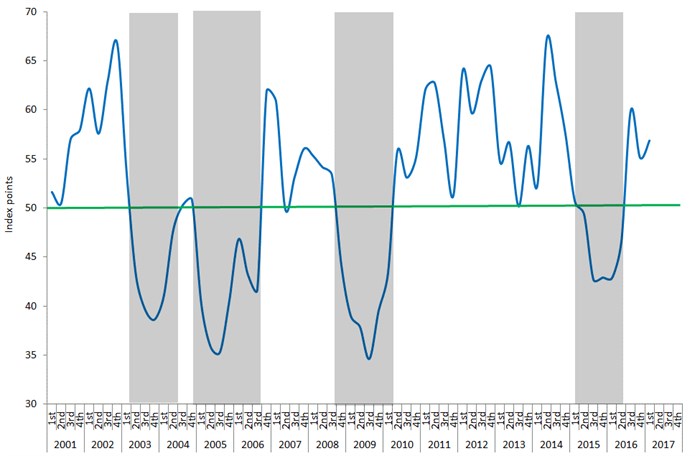

Amongst the ten sub-indices making up the Agbiz/IDC Agribusiness Confidence Index, the turnover, net operating income, employment, economic growth and agricultural conditions sub-indices were the key drivers of the improvement in confidence in the first quarter of 2017. The general improvement in these particular sub-indices is in line with positive prospects for the 2016/17 production season. Meanwhile, the decline in other sub-indices mirrors the aftermath of the 2015/16 El Niño induced drought, as well as uncertainty regarding land reform processes in the country.

Turnover: Confidence regarding the turnover sub-index improved by six index points in the first quarter to 72. This suggests that some agribusinesses foresee improvement in their profitability status relative to the previous quarter, particularly the ones operating in winter grain producing regions, livestock, financial sector, as well as the wine industry. Meanwhile, the summer grain producing regions, as well as deciduous fruits might still be under pressure due to a decline in stock levels and handling income.

Net operating income: In a similar trend with the turnover sub-index, confidence in net operating income sub-index improved by 23 index points to 69 in the first quarter.

Market share: The perception in the market share of the business sub-index declined by 13 index points from the previous quarter to 67. These results reflect the effects of the 2015/16 drought. However, with a general improvement in agricultural conditions, the coming quarters could potentially show an uptick in confidence reading.

Employment: The perceptions regarding employment in the agricultural sector improved in the first quarter of this year from the previous one. The sub-index reached 56 points, up from 53. This is in line with results of the recent labour statistics survey by Statistics South Africa. The survey showed a 4% improvement in agricultural jobs in the fourth quarter of 2016 to 991,000.

Capital investment: With the rise of “radical economic transformation”, along with controversial land reform statements, confidence regarding capital investment amongst agribusinesses declined by 13 points from the previous quarter to 56.

Export volumes: Confidence in the export volumes sub-index declined by 9 index points from the previous quarter to 55. This is largely due to lower agricultural commodity volumes, as most crops are still at the early growing stages.

Economic growth: Confidence regarding South Africa’s economic growth improved by 16 index points from the previous quarter to 50. This is in line with improved sentiment in the country, with the South African Reserve Bank forecasting a 1.1% economic growth for 2017 from a 0.4% forecast for 2016.

General agricultural conditions: The general agricultural conditions sub-index improved by 4 index points in the first quarter of this year to 69. This is largely supported by the favourable outlook for the 2016/17 production season. The National Crop Estimate Committee’s first production estimates for summer crops reached 16.21 million tonnes, up by 72% from the previous season. This could be the largest crop since the 2013/14 production season. Also worth noting is that South Africa’s 2015/16 final wheat production estimate reached 1.90 million tonnes, which is 32% higher than the previous season due to an increase in area plantings, as well as higher yields on the back of favourable weather conditions.

Provision for bad debt: The agribusiness survey suggests that the provision for bad debt might decline in the first quarter of this year. This is due to improvement in agricultural conditions and expectations that farmers’ cash flows could improve over the coming months. This is shown by the debtor provision for bad debt sub-index, which declined by 21 index points in the first quarter of this year to 39.

Financing costs: In a similar trend with the debtor provision for bad debt sub-index, the financing costs sub-index declined by 37 index points in the first quarter of this year to 29. To some extent, this is due expectations that the South African Reserve Bank might keep the interest rates unchanged at 7% in their March 2017 meeting.

The Agbiz/IDC Agribusiness Confidence Index results paint an encouraging picture of the South African agricultural sector. Following higher rainfall in the past few months, the sector is expected to show positive improvements in production this year compared to the previous one. This will subsequently have positive effects on employment, economic growth, as well as food inflation this year.

With that said, developments in the land reform subject, particularly the talks of “expropriation without compensation” could potentially discourage investments in the agricultural sector over the foreseeable future.