Top stories

Energy & Mining#MiningIndaba: How GenAI is reinventing mine maintenance in South Africa

Maroefah Smith 53 minutes

More news

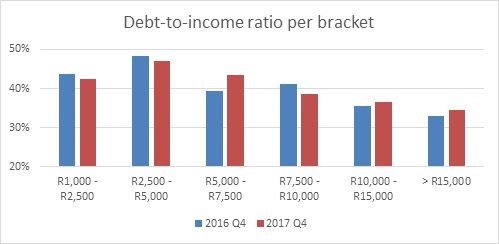

“When we look at the change in debt-to-income ratios from Q4 2016 to Q4 2017, we see that these ratios increased for tenants who pay more than R10,000 rent. This means that tenants in this bracket are essentially living beyond their means while trying to keep up with the proverbial Joneses,” says Smuts.

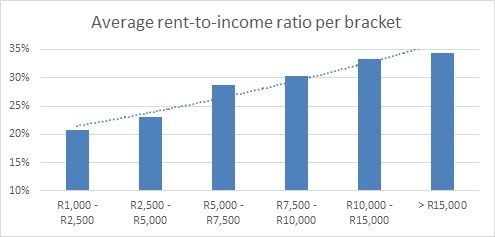

“When we consider average income per rent bracket, indeed we see that tenants who rent more expensive properties have higher incomes. Average credit measures tell a similar story – tenants who rent for more and have higher incomes also have better credit scores and lower debt-to-income ratios.”

“A smaller percentage of these tenants are therefore high-risk clients,” says Smuts, “but this doesn’t mean tenants with higher income spend any less – quite the contrary.” Such tenants tend to have more CPA accounts (retail accounts and cellphone contracts) and higher debt repayments, but their debt as a percentage of income is lower.

“The data highlights once again the importance of affordability checks, even for tenants with high income levels and good credit scores,” says Smuts. “Tough economic times and stagnant income levels are putting tenants in all rental brackets under pressure.”