Top stories

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

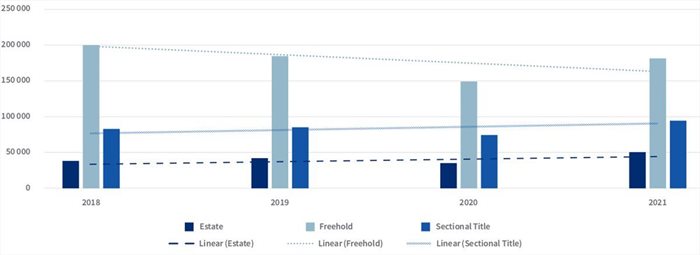

However, the average number of transfers over the last four years is lower than the totals recorded in 2018, 2019 and 2021, suggesting the market continues a gentle decline in volume terms. The decline is driven by falling transfers in freehold property, which in 2021 was nearly 10% down on its 2018 numbers. Both estate and sectional title are trending marginally up since 2018.

“This indicates the same trend that we’ve seen in other data samples: South African homeowners are opting for sectional title properties in greater numbers than ever. One of the prevalent reasons we note for this shift is a desire for more secure living, which is offered by both sectional and estate living,” says Hayley Ivins-Downes, the head of digital at Lightstone Property.

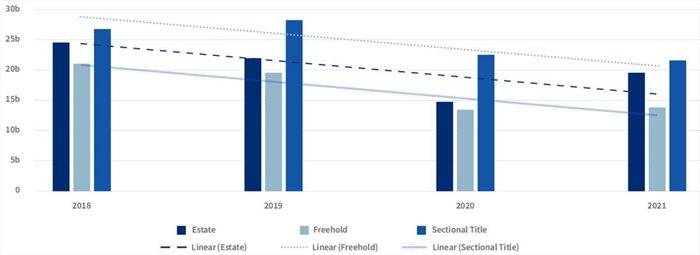

While the volume of properties transferred has fallen, the value of the transactions has risen, confirming previous data which showed that the mid to upper price bands have outperformed the entry-level and lower bands. The value of transfers in 2021 was R334bn, well up on the R245bn recorded in 2018 and a significant recovery from the R225bn in 2020.

The R334bn recorded in 2021 was also well ahead of the average of R261.5bn for the four years, 2018-2021, driven by a spike in the value of freehold sales.

New residential property development has recovered slightly from the crash of 2020, with 55,695 new properties in 2021 compared to 51,106 in 2020. But the 2021 number is still significantly lower than the 73,012 recorded in 2019, which was itself already a drop from the 77,509 new properties recorded in 2018.

As the graph below shows, new freehold residential development fell by almost 40% from the 50,271 units which came onto the market in 2018 to 29,872 in 2021 – although sales in 2022 could edge past last year’s total.

While freehold continues to lose appeal, sectional title remained relatively buoyant during 2021, with new properties falling to 14,907 from 19,705 in 2019, but then recovering strongly to 17,003 in 2021. As a percentage of the total number of new properties on the market, sectional title has risen from 21% in 2018 to 31% in 2021.

Estate volumes have fallen from 10,574 in 2018 to 8,820 in 2021. However, because of the drop in freehold numbers, estate accounted for 16% of all new properties in 2021, up from 14% in 2018.

The value of new developments has also dropped from R73bn in 2018 to R55bn in 2021, which was up on the low of R50bn in 2020. All three property types suffered reversals – estate from nearly R25bn in 2018 to R19.6bn in 2021; sectional title from almost R27bn to R21.4bn in 2021 and freehold fell the most, from R21.3bn in 2018 to R14bn in 2021.

The proportion of volume or value to property type graphs tell an interesting story – and confirm buyers place a premium on estate living, followed by sectional title with freehold offering good value.

Using 2021 as an example, freehold accounted for 25% of the value of new stock but double that – 54% - in terms of volume. Sectional title accounted for 39% of the value against 31% of the stock, but it is in estates that a premium is being charged for properties, as they accounted for 36% of the value for just 16% of the volume.

“Estate offers the best of both worlds – the safety and general function of a sectional title, with the scale and flexibility of a freehold. While the value of a sectional title property is impacted by a number of factors outside of the control of the property owner, such as the condition of the surrounding properties and the efficiency of its body corporate, estate is less impacted by these factors and subsequently offers more value and a safer investment – thus enticing buyers in higher numbers,” says Ivins-Downes.

The data holds over the four years being reviewed. Sectional title has accounted for between 37% and 44% of stock value, and between 21% and 31% of volume, while estates have moved between 29% and 36% of value, and 14-16% of volume. Freehold has, conversely, been drifting downwards in terms of value, from 29% in 2018 to 25% in 2021, and its share of the market in terms of volumes has gone from 65% to 54%.

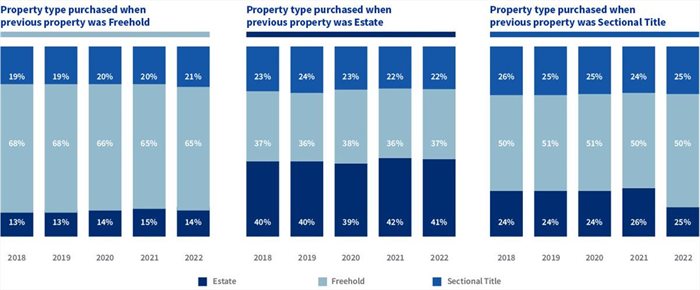

Sellers of freehold have mostly stayed with freehold, but the numbers are dropping, from 68% in 2018 to 65% in 2021. Purchases of sectional title have risen by 1% from 19% to 20% in 2021, while estates have climbed a little more in percentage terms, from 13% to 15% in the same period.

The consistency of purchase choices is evident in both sellers of estate and sectional title properties. Most sellers in an estate buy back into an estate (42% in 2021) or sectional title (36% in 2021), while most sellers of sectional title opt for freehold (50% in 2021), estates (26% in 2021), while just 24% bought sectional title again – suggesting more space was a primary consideration in the repurchase.