Top stories

ESG & Sustainability#BudgetSpeech2026: SRD grant unchanged, other Sassa social grants see hike

1 hour

More news

ESG & Sustainability

South Africa’s carbon tax should stay: climate scientists explain why

The number of transfers (both bonded and unbonded) recorded at the Deeds Office between January to March amounted to 75,125*. This amount is 22% higher than the number of transfers recorded in Q4 2020 and compared to Q1 2020, the figure grew by 46%.

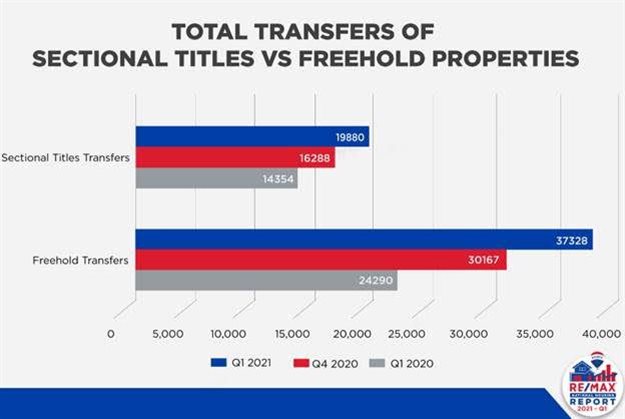

Of the 75,125 transfers, a total of 37,328* freehold properties and 19,880* sectional title units were sold countrywide (these figures exclude estates, farms, and land only transfers). The number of freehold properties registered increased by 54% YoY and 24% QoQ. Sectional titles increased by 38% YoY and 22% QoQ.

“These numbers are staggering, especially when one takes into consideration that Q1 2020 was a normal, pre-pandemic quarter. Owing to the back-log of registrations when the Deeds Office closed, it could be expected that the number of registrations in Q3 and possibly even Q4 would be higher than the figures in Q2 2020, but nobody could have predicted that the numbers would be this high and that the same levels of demand would continue into the new year,” comments regional director and CEO of Re/Max of Southern Africa Adrian Goslett.

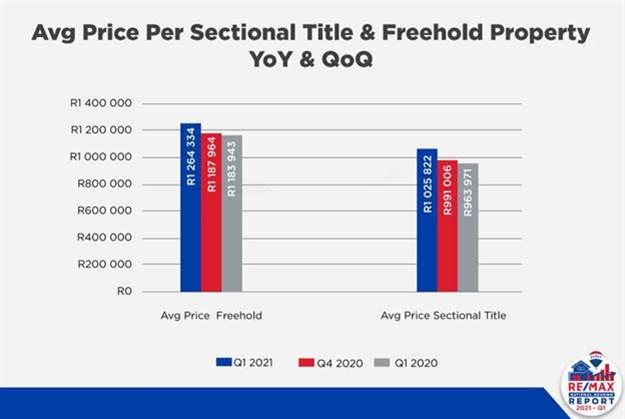

According to Lightstone Property data, the national median price of sectional titles for Q1 2021 is R1,025,822 and the national median price of freehold homes is R1,264,334.

The Re/Max National Housing Reports reveal that, following four consecutive quarters of decline, the price of sectional titles finally recovered this quarter, growing by 6% YoY and 4% QoQ.

Freehold properties continue to grow in value as they have done in previous quarters. Q1 2021’s national median price has grown by 6% when compared to Q4 2020 and by 7% when compared to Q1 2020.

Lightstone Property data reveals that the average bond amount granted during this period amounted to R1,232,000. The Re/Max National Housing Reports reflect that this is an increase of 2% since last quarter and of 12% since Q1 2020.

As of Q4 2020, sales priced between R800,000 and R1.5m continue to account for the largest portion at 27.4%* of all transfers occurring in Q1 2021. Coming in behind this figure were transactions priced between R400,000-R800,000 which make up 23.8%* of the total transfers. This is followed by sales priced below R400,000 which now account for 23.6%* of all transfers in Q1. Sales between R1.5m to R3m accounted for 19.1%* and those priced above R3m account for 6.1%* of the total transfers this quarter.

When reviewing each market segment in isolation, the number of transfers over R3m has grown the most by 59% on the figures from Q1 2020. This is followed by the number of transfers that occurred between R1.5m - R3m price point, growing by 53% YoY; transfers between R800,000 - R1.5m grew by 42% YoY. Sales below R400,000 grew by 20% YoY and those between R400,000-R800,000 grew by 36% YoY.

“There are a host of possible explanations for these shifts. One explanation is that there seems to be a reshuffling of ownership within the mid- to high-end markets. This could be owing to those who are downscaling, those who are selling their investment properties, or those who are relocating because their home no longer suits the shift in lifestyle brought about by the pandemic,” Goslett postulates.

There are also a large number of first-time buyers who are entering the market. According to Lightstone, 10% of all transfers were by first-time buyers.

The top five searched suburbs on remax.co.za were Glenvista in Gauteng with 3,107 searches followed by Parklands in the Western Cape with 3,055 searches. This was followed by Faerie Glen in Gauteng with 2,996 searches, then Morningside in Gauteng with 2,991 searches, and lastly Garsfontein in Gauteng with 2,879 searches.

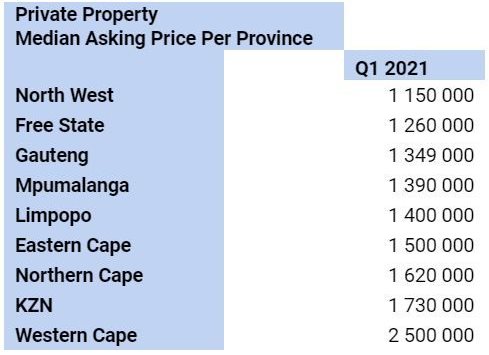

According to stats provided by Private Property, the Western Cape continues to have the highest median asking price at R2.5m. This is followed by KZN at R1,730,000 (which is 1% lower than the R1,750,000 that reflected in Q4 2020). The Northern Cape placed third at R1,620,000, growing by 1% QoQ.

“The level of activity we are experiencing is unexpected and nobody knows how long this boom will last. I do, however, expect that hard times are ahead as many industries continue to be affected by the various lockdown restrictions. Though I cannot predict how things will unfold during these uncertain times, I do believe it to be unlikely that the market will continue to be this active for very much longer.

"Buyers, sellers, landlords and tenants who are hoping to change their living situations over this time should establish a working relationship with a knowledgeable real estate professional who can keep them up-to-date with the local market conditions as things change,” Goslett concludes.