Extending e-commerce to m-commerce and q-commerce: The ABCs of CX in 2022

For the responsible consumer of today, ‘wanting it all’ means the trend for collaborative consumption is more pronounced. 70% of of under-45s claim that a company’s ethics and morals play an active role in their purchasing decisions, with the sharing economy shaped by this mindset that’s attuned to environmental issues and maximising existing resources.

Smart retailers therefore need to learn how to exploit the sharing economy to their benefit. For example, the Marks and Spencer-Oxfam Shwopping partnership began in 2008 as an easy way to give unwanted clothes a second life. With over 28m garments donated thus far, this is now worth an estimated £19m and a clear example of collaborative consumption in action as channel takes to the seat and seamless experience takes a stand.

The blurred line between online and offline further disappears as new market entrants typically start online, moving into the physical space with pop-ups and networks of collection or showcase stores as awareness and demand increases.

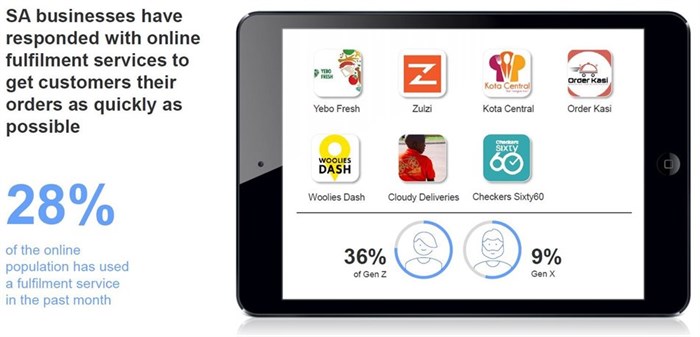

This means pure-play online retailers will continue to develop physical presences to enhance fulfilment and customer service for multi-brand sellers. This is especially important in a time where customers are pivoting to online fulfilment services, with 28% of the SA online population having used a fulfilment service in the past month, with 49% using it at least weekly and 62% intending to use it more often.

But emphasis will shift from take-home transactions to building brand awareness through smaller store formats and event-driven pop-ups, which will occupy more desirable locations to satisfy manufacturers’ demands for reach and impact.

Q-commerce: The partnership opportunity of the fragmented physical footprint

That demand for large-footprint physical retail space will fall further as the need to keep complete inventories in stock at every store diminishes, due to improved logistics built around online delivery and quick commerce (q-commerce).

Time-scarce millennials’ demand for instant gratification is driving the $25bn q-commerce industry. Amplified by learned consumer behaviours during the pandemic, it is forecast to almost triple in the next few months, to $72bn by 2025.

It is essentially the latest iteration of e-commerce, as quick commerce has a strong online component but often requires physical fulfilment. This sees retail space turned into mini depots, resulting in new partnerships between third-party delivery platforms that want to offer customers more choice and physical retailers that can’t afford the costs of last-mile delivery.

M-commerce: Mobile is the glue between the digital and physical universe

This trend towards speed is the driving force behind retailers optimising their sites for mobile shopping, turning the smartphone into a platform that supports the whole shopping journey. With 73% of the dollars spent on online purchases today through mobile devices, mobile-enabled loyalty programmes are also set to become the norm.

Done right, m-commerce delivers instant gratification and exceptional user experience to anyone, anywhere, anytime. It provides levels of interactivity and engagement that traditional programmes cannot match, with 63% of smartphone users claiming they are more likely to purchase from companies whose mobile sites or apps offer them relevant recommendations on products they may be interested in.

The popularity of q-commerce and m-commerce also points to the rise of the curated, contextually relevant shopping experiences. As the range and depth of data continues to proliferate and enable an increasingly rich view of the consumer-shopper journey, 66% of customers now expect companies to understand their unique needs and expectations.

The evolution of predictive analytics will further assist retailers in determining consumers’ likely future actions and needs, supported by next-generation digital assistants to ensure a next-level, personalised and curated shopping experience.

The space between online and offline: What does your metaverse look like?

Brands also need to consider the interplay of the virtual world and real world in the metaverse. An extension of the ‘channel-less’ space between online and offline, experts suggest it could be worth as much as $800bn by 2024, which is why 70% of major brands will have a presence in the metaverse in the next five years. Some companies are already looking at the possibility of creating shopping centres, boutiques and virtual shops where avatars buy NFT products and pay in cryptocurrencies.

Bringing the focus back to 2022, Covid-19 certainly accelerated the adoption of digital behaviours and online channels in South Africa, with 19% of consumers doing more online shopping now. Our 38m active internet users and 25m social media users reflect a 27% increase in social media use and 23% increase in online media use respectively.

This shift towards all things digital extends beyond increased quantity, as here have also been rises in frequency of visits and time spent on these channels, with stronger focus on customer experience and pressure on brands to not only deliver on but also exceed shoppers’ increased expectations in 2022.

Are you interested in how brands can exceed the increased expectations of shoppers? Get in touch for the impact of your brand’s digital experience on the overall relationship that your customer has with your brand, and how you can measure customer experience across digital channels at different points in the journey, and act in real time. Catch our webinar on demand that unpacks the story: ‘Seamless CX in a channel-less world: Delivering winning customer experience to today’s consumer’: https://bit.ly/CXSA2022

Andrew Wiseman

Associate Director, Strategic Consulting, South Africa, Kantar

moc.ratnak@namesiw.werdna

Sources: Kantar e-commerce survey 2022, Kantar Global Monitor, Ovum, The Future of e-Commerce: The Road to 2026, Salesforce, State of the Connect Shopper 2020, Statista smartphone users in South Africa, Statista worldwide consumer spending on mobile apps.

About Andrew Wiseman

Associate Director at Kantar Consulting- Kantar appoints Ndeye Diagne as chief strategy and transformation officer, MEA & Türkiye26 Feb 11:09

- Consumers face climate burnout as fears over global conflicts increase17 Feb 10:35

- Kantar announces senior appointments in South Africa and Africa20 Jan 08:53

- 10 marketing trends for 202618 Nov 08:51

- Rethinking AI-Generated advertising: How real people really react12 Nov 12:31