Following the declines experienced in 2020 that resulted in a 4.4% drop in premium volumes, the global Long-Term (Life) Insurance industry demonstrated resilience, by achieving significantly higher growth of 9.9% in 2021, with a marginal 0.2% contraction expected in 2022. Much of this recovery can be attributd to the InsurTech-driven simplification of Life Insurance products, part of the focus on customer centricity following Covid-19-driven changes in consumer expectations. Crucially, this trend is driving greater accessibility in terms of policy requirements and understandability, as well as the development of simplified offerings provided via non-traditional channels, and boosting penetration in underserved markets.

Insight Survey’s latest South African Long-Term Insurance Industry Landscape Report 2023 carefully uncovers the global and local Long-Term Insurance market, based on the latest information and research. It describes the key global and local market trends, innovation and technology, drivers, and challenges, to present an objective insight into the South African Long-Term Insurance industry and its future.

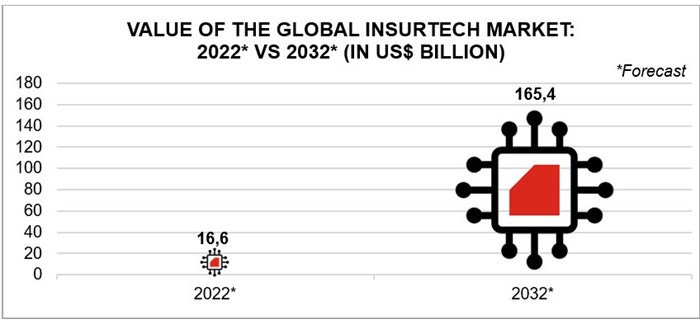

In 2022, the InsurTech market was expected to continue to expand rapidly, with a predicted compound annual growth rate of 25.9%, to reach a total value of $165.4bn in 2032. This expansion can be largely attributed to the collaboration between InsurTechs and major industry players, to digitalise, automate, and simplify Insurance processes. This is also aimed at enabling the embedding of Life Insurance products with everyday consumer products, and the distribution of these products via popular consumer channels, such as online retailers.

Globally, there has been a rapid emergence of new and innovative trends and products focusing on consumer simplicity and accessibility. This includes the utilisation of accelerated underwriting, to offer products that do not require a medical examination, as well as the emergence of pay-as-you-go Life Insurance models that help to penetrate previously underserved markets.

In terms of the South African market, paradoxically, as consumer needs evolve and become more complex, demand for simple, quick, and easily understandable Life Insurance products is increasing. As consumer expectations grow for personalised products, clear pricing, and simple digital platforms, Insurance players are responding with the launch of ‘demystified’ accessible products, accompanied by understandable policy wording and marketing.

For example, major local player, Hollard, launched its Hollard Life Select Policy, as part of its strategy of expanding Long-Term Insurance to the broader South African market. Touted as a ‘no-frills’ Life Insurance policy, this product has less than 100 permutations, down from 3600 in previous versions. It has also been designed to accelerate the application process and assist advisors in explaining the product to consumers via simple policy wording and marketing material.

Interestingly, the launch of this product was also accompanied by an education drive, aimed at informing consumers about the importance of Life Insurance. The policy itself is also designed to address specific consumer pain points and barriers, including extended application processes, complex policy wordings, gaps between premiums and perceived value, and general financial illiteracy, thereby contributing to its expanded appeal.

Similarly, Sanlam and MTN’s recent partnership with the aYo Insurtech platform is also aimed at extending the accessibility of Life Insurance to underserved populations, not only in South Africa, but across the African continent. This partnership is designed to provide easier access to Sanlam’s products, especially amongst consumers with previously limited access via traditional distribution channels, thereby enabling the company to significantly expand its market on the continent.

Additionally, further demonstrating the role of InsurTech in product simplification, Mr Price Money, in partnership with local InsurTech company, Root, launched its new ‘Life Matters’ product, specifically marketed as a simplified Life Insurance option. This simplification includes the removal of the requirement for a medical examination when signing up, an application process that only requires consumers to answer a limited number of questions, and immediate activation.

The simplification and enhanced availability of traditionally complex, inaccessible Long-Term Insurance products are revolutionising the market, by enabling local players to expand into previously underserved markets. This is increasingly being achieved through partnerships with InsurTech companies that provide the technological expertise necessary to design, develop, and launch simplified products catering to broader South African consumer segments.

The South African Long-Term Insurance Industry Landscape Report 2023 (123 pages) provides a dynamic synthesis of industry research, examining the local and global Long-Term Insurance industry (including the impact of Covid-19) from a uniquely holistic perspective, with detailed insights into the entire value chain – from market size, industry trends, latest innovation and technology, key drivers and challenges, to a detailed competitor and product analysis.

Some key questions the report will help you to answer:

- What are the current market dynamics (overview, market environment, and key regional markets) in the Global Long-Term Insurance industry?

- What are the latest news and developments in the South African Long-Term Insurance industry, as well as the current market dynamics (overview, market environment, and key industry statistics)?

- What are the latest Global and South African Long-Term Insurance industry trends (including Insurtech), innovation and technology, drivers and challenges?

- How did South African Long-Term Insurance companies perform in 2022?

- What is the latest company news for each South African Long-Term Insurance player, in terms of products, services, new launches, and marketing initiatives?

- What is the latest marketing and advertising news for each of the key Long-Term Insurance players?

Please note that the 123-page report is available for purchase for R45,000 (excluding VAT). Alternatively, individual sections can be purchased from R17,500 (excluding VAT). For more information, please email info@insightsurvey.co.za or call our Cape Town office on (021) 045-0202 or Johannesburg office on (010) 140- 5756.

For more details and a full brochure: South African Long-Term Insurance Industry Landscape Report 2023

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 15 years of heritage, focusing on business-to-business (B2B) and industry research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer market research solutions to help you successfully improve or expand your business, enter new markets, launch new products, or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za