Get ready for a wealth of acronyms! The newly refreshed Publisher Research Council (PRC) showcased the power of the Publisher Audience Measure Survey (PAMS) Brands and People, Products and Platforms (PPP) fused data at breakfast events in Johannesburg and Cape Town mid-November, where they provided a teaser of insights on consumer media habits and preferences, media usage throughout the day on different devices and usage of different media at the same time. Here's what you missed...

Josephine Buys and Peter Langschmidt of the PRC at Cape Town's Inner City Ideas Cartel on 19 November 2019. Image: Leigh Andrews

If you’re in the marketing research, media or publishing industry in South Africa, you can’t say no to an event that offers planning insights based on the real consumer’s authentic brand consumption behaviour and longitudinal digital behaviour. This helps you maximise both media and device synergy to increase your ROI.

That’s where the PRC’s new fused datasets and findings prove their worth.

The new data obtained in the survey is the largest, most robust sample of FMCG brand penetration, profile and volumes in the SA marketplace and speaks to the PRC’s new business vision.

While the PRC pioneered media survey fusion in SA last year, they’ve since further fused a digital study to this, to provide a more extensive understanding of consumer digital behaviour.

Three fused studies give triple the insights

PRC CEO Josephine Buys explains:

This ‘day in the life’ data at a brand level will provide unsurpassed planning insights to planners and advertisers, enabling them to maximise both media and device synergy to increase advertising ROI.

At the event, she adds that the future is fusion, with three fused studies giving triple the insights, before handing over to Peter Langschmidt, lead consultant to the PRC.Langschmidt told attendees of his recent experience at the Rugby World Cup in Japan, dressed in full Zulu attire and teaching the attentive Japanese fans to sing ‘Shosholoza’ in just 20 minutes. Fittingly, we echoed this activity in the Inner City Ideas Cartel at the Old Foundry before learning more about the SA dataset fusion journey…

The SA dataset fusion journey

Back in 2013, the Saarf board looked to futureproof Amps with the Establishment Survey’s ‘hub and spokes’ model. In the six years since then, they have found that you don’t need that central hub as the model works well as a snake or chain that can have additional surveys added on.

As a result, last year’s Pams was fused with Nielsen's consumer panel survey (CPS) data.

Jos Kuper said in a telephonic call supporting last year’s fusion project:

The world is not the same as it was 50 years ago when Amps was the ‘gold standard’, there’s a new global ‘gold-standard’ relevant to a far more complex and diverse media landscape. Even since the future-proofing audience research exercise, fusion has become a more successful technique and I wholeheartedly stand by the Nielsen and PRC approach to implementing the model we presented to the Saarf board five years ago.

That’s why a new level has been added, with digital data added to the mix. Langschmidt mentioned that next year’s release will also stack new audience data.

The reason? Fusion data offers a richer, more granular result than what you get from single-source studies.

You can also layer in your own customer databases, which Langschmidt calls an exciting development, but he cautions to be careful when comparing data to note whether the results are based on just the online or the total universe.

How media viewing has changed

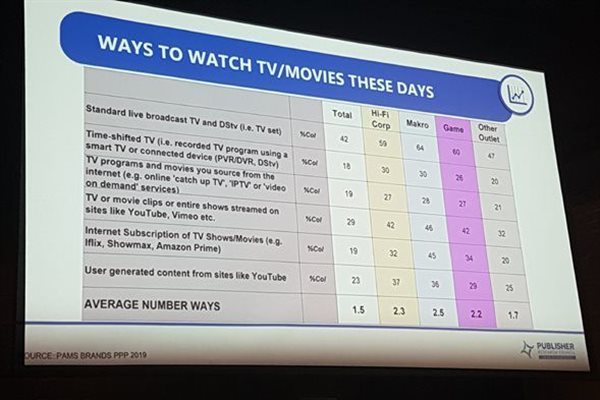

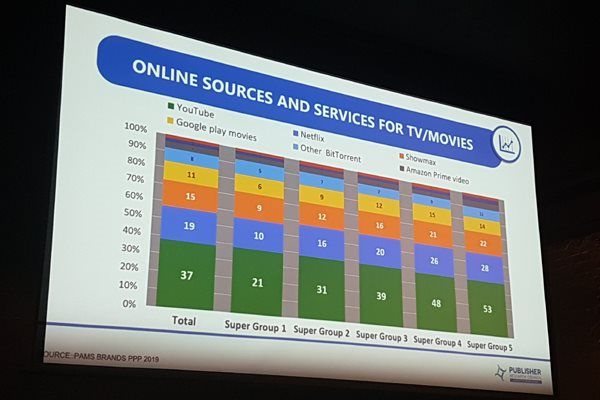

Langschmidt whet attendees’ appetites by sharing slides on how consumers’ ways of viewing media have changed.

For example, 42% reported favouring standard live TV broadcasts, while for online services for TV and movies, YouTube comes in at 37%.

When it comes to time spent on the media, Langschmidt said it’s important not to look at the national average, as 80% of South Africans are still not doing the bulk of their media viewing online.

As a result, when it comes to devices, you’ll note less is watched via computer and more on smartphones, especially at the bottom of the market.

Note distracted consumers’ second screening

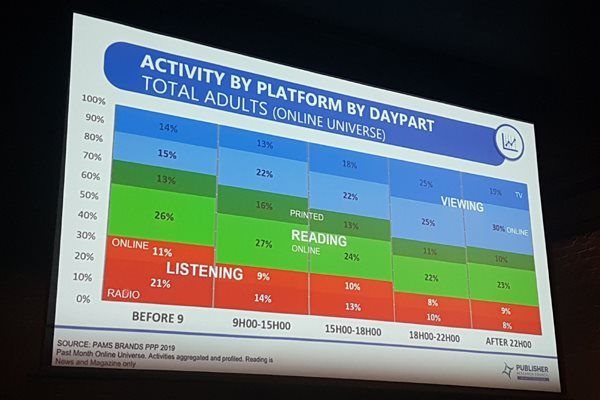

When analysing activity by platform by daypart, Langschmidt shared that TV really comes into its own in the evening, with reading more dominant in the morning.

Looking at the types of programming watched via the internet, it becomes clear that the days of sitting around the TV set and watching it exclusively are gone.

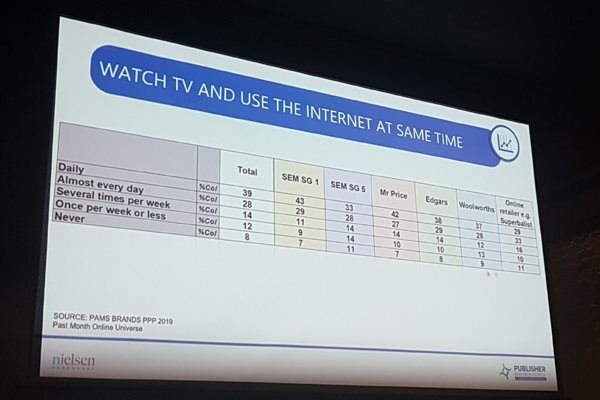

Today, most of us engage in distracted or ‘dual viewing’, where we split our attention between the TV set and using the internet on our handheld devices at the same time.

Again, this is based on only on the internet universe findings and not the total, with as many as 60% reporting “doing something else” while watching TV.

Langschmidt promised they will return in April 2020 with more fusion data findings.

The Fusion 2019 report was gifted to attendees in printed format, making it easy to see all 3,000 brands and questionnaires, but you can also click here to download it in full. Buys concluded the session with a reminder to visit the PRC website and Facebook, Twitter and LinkedIn channels regularly, as their publisher members are steadily moving to the platform economy and the PRC is following suit by releasing information in the digital space on a regular basis.