Top stories

More news

Marketing & Media

Warner Bros. was “nice to have” but not at any price, says Netflix

Logistics & Transport

Maersk reroutes sailings around Africa amid Red Sea constraints

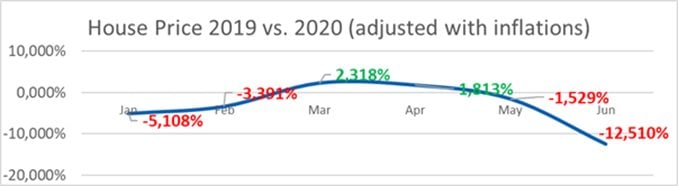

Multinet Home Loans has seen a 36.57% increase in submissions vs 2019 numbers in June, whilst home prices have shown a real decline of 12% in June so far, taking predicted inflation into account. Residential mortgage books for the banks are poised to perform better than expected. Falling house prices combined with low interest rate has created one of the best times for consumers, not impacted by the pandemic, to enter the housing market in over 50 years.

Whilst demand has grown, house prices are declining, indicating that many consumers are either forced to scale down on investment properties or needing to sell their homes due to reduced income as a result of the pandemic.

“Whilst the market looks to be recovering sooner than expected, it is important for home owners looking to sell their properties to get the best advice possible on what they can expect during these times when it comes to property prices,” says Shaun Rademeyer, CEO of Multinet Home Loans.