Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

For a great majority of independent research houses and research practitioners, the narrative is that “the big entities aren’t as clued-up about the SA mass-market consumer as they would have their clients believe”. The truth of the matter is that global research houses view SA as one territory that needs to be conquered if they’re to realize their objectives of global research dominance and above-average billings. These entities lack the native intelligence that governs the Mzansi mass-market consumer landscape.

These entities make up for this shortcoming by hiring the best in the market research business. The employees tasked with gathering consumer insights are constrained by internal politics, are kept on a “short leash” thus being confined to the clinical methodologies that the big research firms have been undeniably famous for over the past five to six decades, and as a result, have a difficult time breaking from these methodologies.

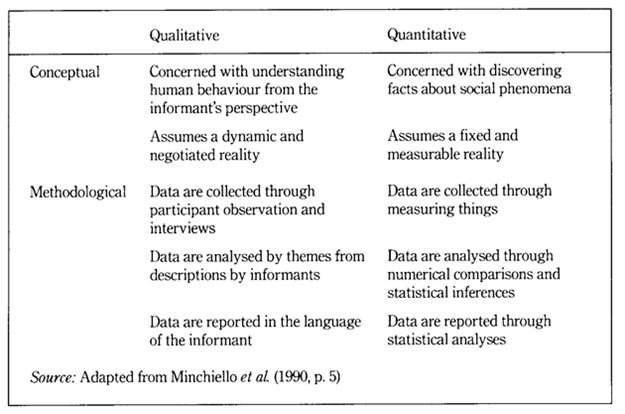

Gone are the days when quantitative research methodologies are treated like royalty.

With the rise in technological advances including a myriad of digital/software tools that enable data analysts/brand professionals and researchers, quantitative research data has become highly commoditized and can now generally be exploited by anyone who has access to a robust consumer panel / data source(s) and solid data collection tools such as Survey Monkey and the likes.

Brands have become empowered to deploy these tools in a bid to afford the industry the opportunity to obtain agility and quicker turnaround times. As much as (I’m inclined to believe) quantitative research generally gives us the “WHAT” in research terms, quantitative affords us the ability to deduce the overarching “WHY”. With this being the reality and a significant change in times, quantitative research has become a tad pricier than qualitative research, thus affecting certain budget allocations from a client’s viewpoint.

As a founding member of a mass-market research entity, comparatively, big firms don’t dig as deep as we do when conducting field interviews with research participants, nor do they dig deeper when making use of online panel communities. As our industry is plagued with tight deadlines, tighter budgets, and higher client expectations, the large firms use their scalability to circumvent this conundrum.

This might be a wise approach to deploy due to the fact that it lessens the overall time spent on attaining nuggets of insights from the various audiences, as well as being generally cost-effective, but it doesn’t give a textured response in answering the overarching, and sometimes contentious WHY.

The WHY is something that is unravelled during a more intimate engagement between moderators and participants. It is not something that is easily comprehended from a quantitative research report.

It is crucial for me to point out that brand professionals and marketers shouldn’t commission a research house purely because they have a consumer panel of thousands of consumers. Yes, larger research entities have larger consumer pools than smaller entities, however, it is not guaranteed that their consumer panels are of a higher quality standard.

Consumer panels need to be maintained at all times and be incentivized in order to retain their status as active participants for any research studies that will arise. Smaller research entities have smaller consumer pools but have a more robust affinity with their consumer panels.

A significant number of established research firms tend to outsource the recruitment of consumer panels to specialist companies that recruit research participants, this is due to the fact that these large entities are lacking in regards to harbouring mass-market consumer panels, thus they task small entities to conduct this aspect of the process for them.

Why you may ask? Apart from the much-needed economic development of the country and support for small business, the truth is I can’t speak on behalf of all emerging entities. But what I can state is that smaller agencies are more agile and more aggressive in their approach to furnishing clients with consumer/market insights.

Not only are these entities agile and aggressive in their approach, but they are more informed about the dynamics of the mass-market consumer than their counterparts. Smaller entities have a point to prove within the entire market research industry, thus they’re far hungrier than the already established entities.

Although established firms have refined their operation models and have streamlined their processes to a larger degree than the small entities have ever done, this doesn’t take away from the fact that smaller agencies can do what their counterparts are doing with precision (sometimes outperforming the bigger firms).

To be politically correct – smaller research houses have more of a greater contextual understanding of the SA mass-market consumer landscape than larger firms. Larger firms are currently playing catch-up whilst emerging research houses are striving to win market share from the big guns.

As general Zhang Yu (one of General Sun Tzu’s military apprentices), states in the timeless literature classic titled The Art of War:

“Once you know the opponent’s conditions, and also know the advantages of the terrain, you can win in battle. If you know neither, you will lose in battle.”The same principle applies in this regard: