Related

Glencore first miner to export cobalt under new DRC quotas

Ange Kasongo, Pratima Desai and Maxwell Akalaare Adombila 15 hours

Sustainable mining is key to a clean, just energy transition

Alastair Bovim 1 Dec 2025

Apple faces new lawsuit over Congo conflict minerals

Maxwell Akalaare Adombila and David Lewis 27 Nov 2025

Top stories

Marketing & MediaEXCLUSIVE: IAB South Africa releases the first Bookmarks Digital Rankings 2025

16 hours

Marketing & MediaAustralia’s social media ban is now in force. Other countries are closely watching what happens

Lisa M. Given 16 hours

Marketing & MediaPrimedia Broadcasting secures multiple wins at the 2025 Radio Awards

Primedia Broadcasting 1 day

More news

Marketing & Media

The G20 and Africa’s creative economy – a new window of opportunity

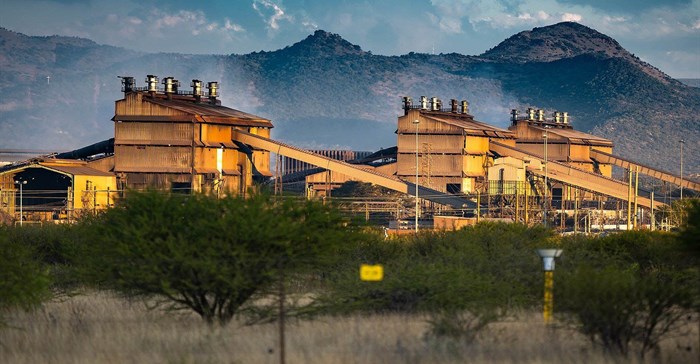

Energy & Mining

5 tips to avoid hefty electricity costs in the Cape Town CBD

Logistics & Transport

Transnet, ICTSI ink 25-year Durban Pier 2 deal, industry calls for transparency

Energy & Mining

Glencore first miner to export cobalt under new DRC quotas