Top stories

Energy & MiningGlencore's Astron Energy gears up with new tanker amidst Sars dispute

Wendell Roelf 10 hours

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

The increase in prices of these products is unsurprising and reflects the elevated farm-level prices we observed at the end of 2020 and into 2021. Typically, the passthrough from the farm level to the retail level for products such as grains is three months.

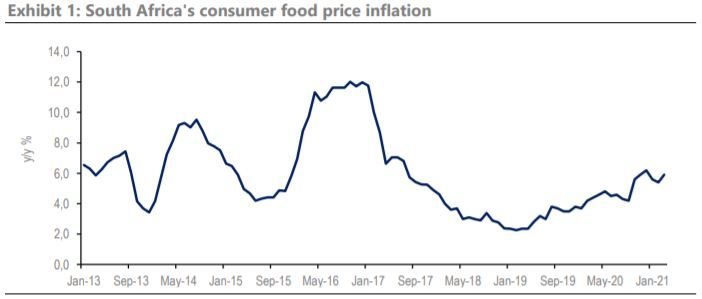

While South Africa's consumer food price inflation was generally elevated in the first quarter of the year, we expect softening from the second quarter. This will primarily be underpinned by grain-related products, whose prices could soften and filter through, with a lag, on the "bread and cereals" products prices. The anticipated decline in prices is on the back of the large forecast harvest of 16,7 million tonnes.

This product category also has a higher weighting of 21% in the food basket, and changes in its price inflation will be noticeable. In terms of meat, we expect a sideways price movement for the coming months. The cattle slaughtering could slightly improve in 2021, and the base effects on poultry meat, which increased in 2020 partly as a result of an import tariff hike, could also bode well for food price inflation.

South Africa is a net importer of vegetable oils, and the prices tend to be influenced by the exchange rate. The relatively firmer ZAR/USD currently bodes well for oils and fats price inflation for the coming months. In sum, we maintain our baseline view for South Africa's consumer food price inflation to average around 5,0% y/y in 2021. The only upside risk that we continue to monitor and assess inflation's impact is the rising fuel prices.

South Africa's agricultural commodities and processed food are primarily transported by road, and the increased transport costs could impact the final product prices. For example, South Africa is transporting roughly 81% of maize, 76% of wheat, and 69% of soybeans. On average, 75% of national grains and oilseeds are transported by road. This is an area worth monitoring over the coming months.

Source: Agbiz