According to the Re/Max National Housing Report for Q3 2021, rather than subsiding to pre-Covid levels of activity, the residential property market is continuing to exceed expectations.

“Understandably, the third quarter of 2020 was a period of unprecedented activity as record-low interest rates and pent-up demand following the Deeds Office closure drove sales to an all-time high. But, what could not have been expected was that this period of hyperactivity would last as long as it has. It is now a full year later and we are still seeing record-breaking sales volumes,” remarks Adrian Goslett, regional director and CEO of Re/Max of Southern Africa.

According to Lightstone Property data, a total of 44,215 bond registrations were recorded at the Deeds Office over the period of July to September 2021. The Re/Max National Housing Reports then reveal that this figure is 9% up from last quarter and, quite remarkably, 20% up on Q3 2020’s figures.

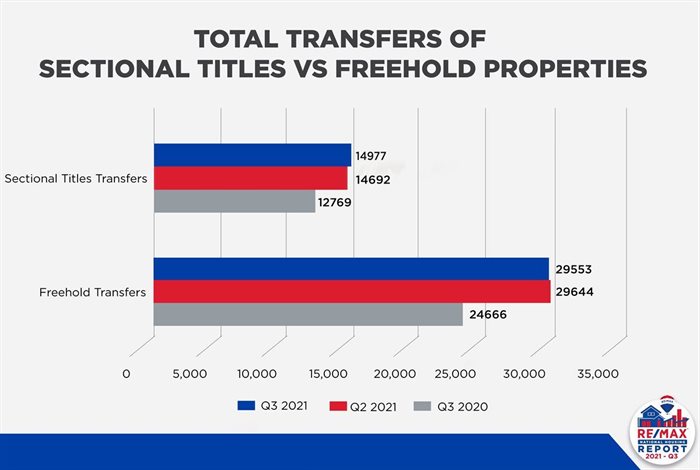

The number of transfers (both bonded and unbonded) recorded at the Deeds Office between July to September amounted to 60,025*. This amount is 2% up on last quarter and 25% up YoY.

Of the 60,025 transfers, a total of 29,553* freehold properties and 14,977* sectional title units were sold countrywide (these figures exclude estates, farms, and land only transfers). The number of freehold properties registered increased by 20% YoY and remained steady QoQ. Sectional titles increased by 17% YoY and 2% QoQ.

Strong house price appreciation

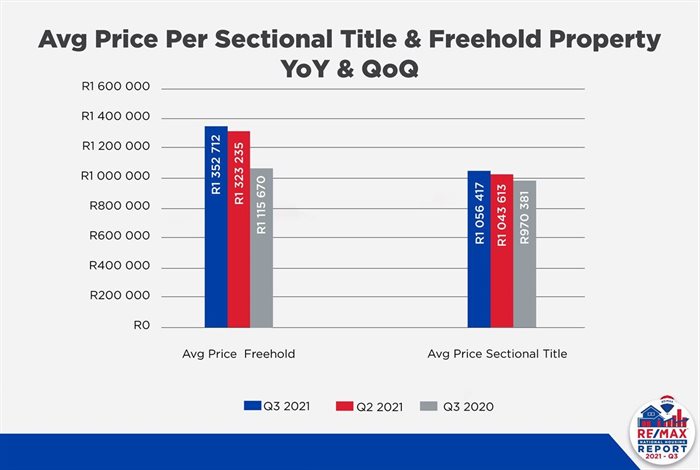

Along with an increase in the number of transactions, house prices also climbed steadily in the third quarter of this year. According to Lightstone Property data, the nationwide average price of sectional titles for Q3 2021 is R1,056,417* which, when reviewed against the figures from previous Re/Max National Housing Reports, is an increase of 9% YoY and 1% QoQ.

The nationwide average price of freehold homes is R1,352,712*, which is a 2% increase when compared to Q2 2021 and a 21% increase when compared to Q3 2020. According to Lightstone, year-to-date, the average price changes per annum for sectional titles is 6% and 12% for freehold properties. The average active Re/Max listing price for the period July – September 2021 amounted to R4,093,400.85. This is a 24% increase QoQ and an 18% increase YoY.

“House price appreciation is strongly linked to the rules of supply and demand. When buyer activity is high, sellers are more likely to achieve higher asking prices. This then causes greater house price appreciation until the demand levels out,” Goslett explains.

Lightstone Property data also reveals that the average bond amount granted during this period amounted to R1,287,000. The Re/Max National Housing reports reflect that this is an increase of 3% since last quarter and of 16% since Q3 2020.

Activity within price brackets

Sales priced between R800,000 and R1.5m continue to account for the largest portion at 26.7%* of all transfers occurring in Q3 2021. Transfers between R400,000-R800,000 follow close behind this at 23.1%* of the total transfers. Following this figure were transfers priced below R400,000 which now account for 22.9%* of all transfers in Q3. Sales between R1.5m to R3m accounted for 20.1%* and those priced above R3m accounted for 7.2%* of the total transfers this quarter, which is a healthy figure for this market segment.

Market performance per province

The top five searched suburbs on remax.co.za were as follows:

- Parklands, Western Cape, with 2,897 searches,

- Glenvista, Gauteng, with 2,616 searches,

- Bloubergstrand, Western Cape, with 2,560 searches,

- Fourways, Gauteng, with 2,536 searches,

- Faerie Glen, Gauteng, with 2,426 searches.

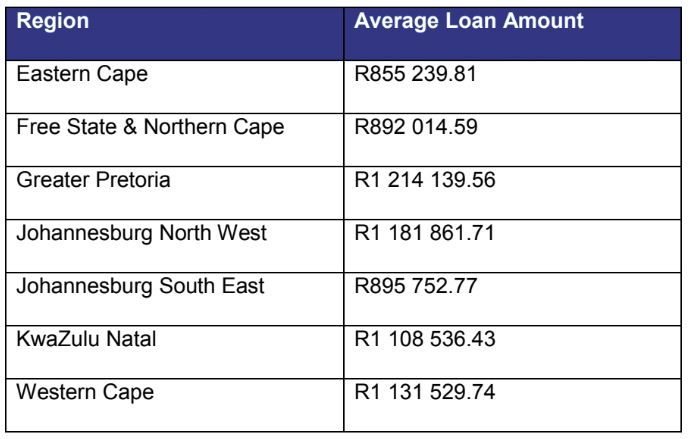

BetterBond reports the following average loan amounts per region for Q3 2021:

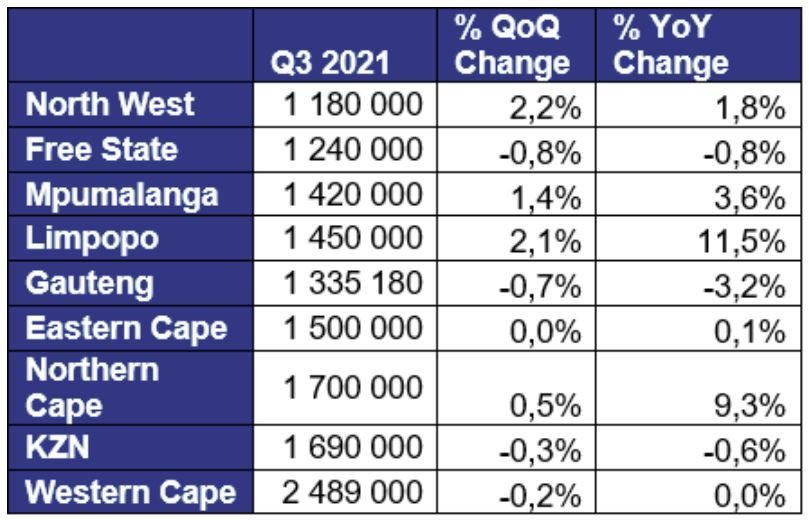

According to Private Property, the median asking price per province for the third quarter of 2021 were as follows:

“While I am grateful to see the local housing market thriving as it is, I also do not expect that the market will remain this active forever. It is likely that demand will dampen as soon as the cycle of interest rate hikes starts. Until then, I would encourage buyers to make the most of the low interest rates and sellers should seize the opportunity to sell now while buyer demand is still high,” Goslett concludes.

*Figures according to Lightstone Property.