In August, after more than 130 days of lockdown, Covid-19 infections in South Africa surpassed the half-a-million mark, leaving the economy devastated. The economic impact of the lockdown will linger even once the health threat associated with the virus has passed.

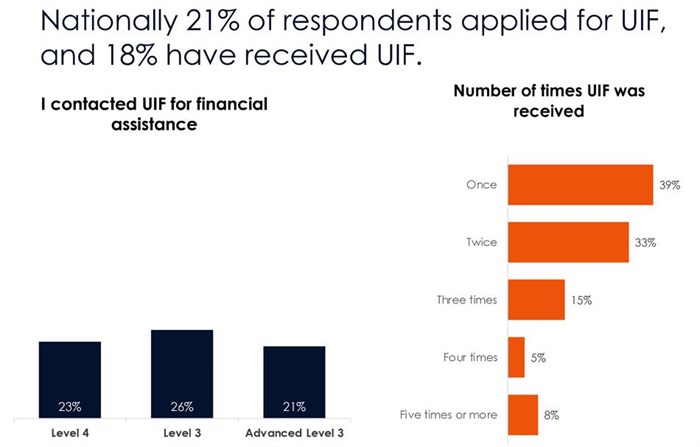

Growing levels of unemployment mean that an increasing number of households throughout the country are under financial pressure. According to the Ask Afrika Covid-19 Tracker, 21% of respondents nationally applied for UIF. Of this figure, only 18% have received UIF with the Western Cape having the highest proportion of respondents who received UIF.

Ask Afrika’s Covid-19 Tracker is a pro bono study which aims to understand the socio-economic impact that the coronavirus, lockdown and gradual reopening of the economy has on South Africans. The quantitative research is conducted via computer aided telephone and online interviews amongst a proportionally representative study of the South African demographic profile. The research explores different themes and topics each week in order to better understand relevant issues and provide an immediate statistic.

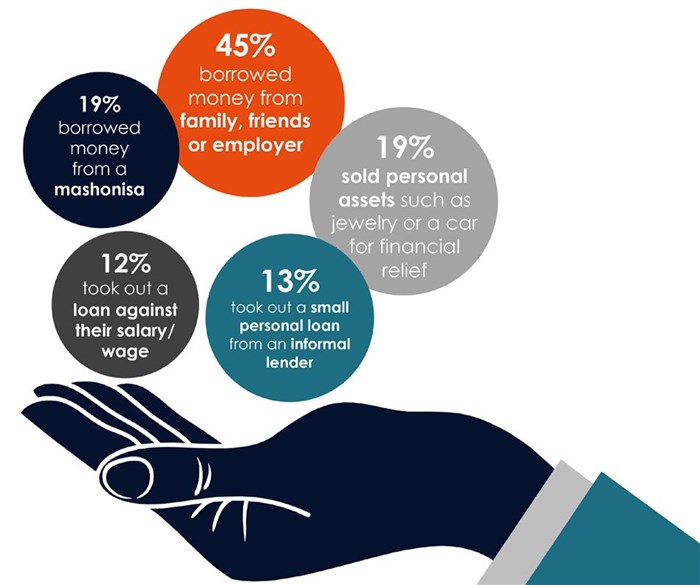

Not only do 40% of consumers feel their economic situations are now worse than prior to the lockdown but the Ask Afrika Covid-19 Tracker study reveals that 37% of South Africans have been forced to resort to new means of financial assistance. A quarter (25%) have reduced their shopping trips and basket sizes when shopping. Car insurance – considered a non-essential – has been cancelled by 25% of consumers while 19% have applied for payment holidays offered by credit providers. A total of 43% of consumers will consider letting their gardener or domestic help go due to financial pressure.

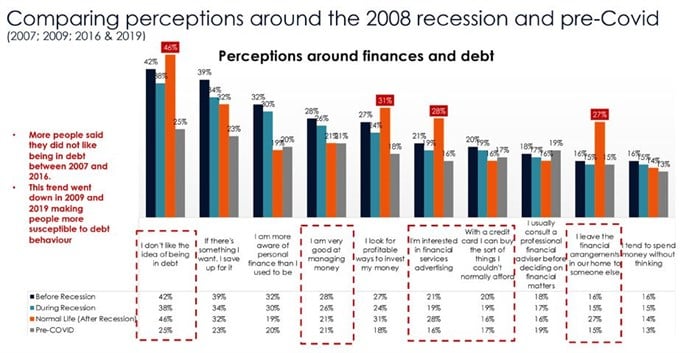

Ask Afrika has been tracking consumer behaviour in South Africa for the past two decades through the Target Group Index (TGI) survey which measures psychographics, service, products, media and brands. This trended analysis helps to understand consumer behaviour over extended periods. In a similar vein, Ask Afrika has investigated how economic factors impacted consumer behaviour both during and post the 2008/9 global financial crisis and whether there are likely to be any correlations between that crisis and the current Covid-19 economic crisis.

Prior to the 2008/9 crisis and consequent recession, 42% of South African consumers were averse to the idea of being in debt and were therefore less susceptible to debt. However, with the onset of the recession, this figure dropped to 38%, indicating that consumers view debt as more acceptable when money is tight. However, while a third of consumers said they were more aware of their personal finances, this figure decreased to 11% once the recession was over and life had stabilised. More consumers tended to leave their financial arrangements to somebody else after the recession, implying a more ‘laissez faire’ paradigm when it comes to finances.

Consumers are more likely to look for profitable ways to invest money after a recession. TGI figures post the 2008/9 financial crisis showed a 7% increase in the number of people looking for profitable ways to invest money, with more consumers interested in financial services advertising.

There are numerous factors that impact consumer behaviour over time including the way they shop, what they shop for and the key influences over their shopping behaviour. An interesting discovery is that price and value for money are less important drivers of shopping decisions during a recovery from a recession. Once the South African economy had recovered in 2016, only 16% of consumers based their shopping decisions on price while only 10% of shopping decisions were on based on value for money.

There is no disputing the fact that Covid-19 has decimated consumer’s spending power. Similar to the previous recession, consumers are currently viewing borrowing and debt as a way to survive. The Ask Afrika Covid-19 Tracker reveals that 45% of the respondents have borrowed money from family and friends while another 19% have borrowed money from mashonisas (loan sharks or money lender) in recent months.

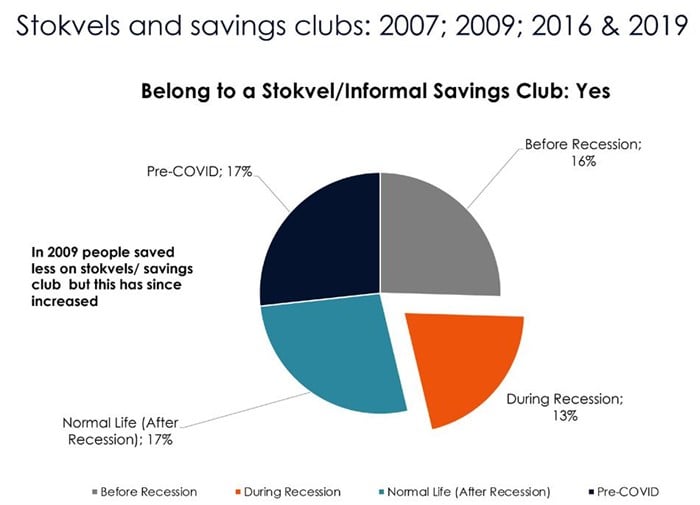

The dire state of the economy continues to influence consumer behavioural changes. Price hikes on essential items have become a concern to the extent that they are now receiving government attention. The Ask Afrika Covid-19 Tracker reveals that two-thirds of respondents (63%) have started using their savings as a form of financial relief during lockdown. TGI data showed a decline of 3% in stokvel membership during the 2008/9 recession, increasing after the recession to 17% membership in communities of more than 8,000 people.

According to the most recent Ask Afrika Kasi Star Brand survey – an industry benchmark that measures South Africa’s favourite township brands - 10% or 739,000 Kasi consumers belong to a stokvel, with 22% belonging to one or two stokvels simultaneously. Stokvel savings are primarily used for expenses such as groceries (32%), as a general savings club (19%), education expenses (11%), festive season expenses (11%) and investment (9%).

Cash-strapped consumers have in the past been called ‘penny pinchers’ while the ‘lipstick effect’ has been used to describe the theory that consumers will continue to buy small luxury items even during an economic downturn or recession. The extent to which this theory will hold true in a post Covid-19 world remains to be seen. What is not in doubt, however, is that there will be a fundamental change to consumption dynamics. Most industries currently are struggling to survive. A new class of shopper is starting to emerge – one with little or no money to spend – but upon which the economy will continue to rely as it struggles to recover. A critical part of this recovery will include support for local brands and businesses as they fight to survive this current crisis.

For more information or to find to find out how your company can participate in the research to establish how the current situation is impacting their particular brands, contact Mariëtte Croukamp – 082 853 8919 – az.oc.akirfaksa@pmakuorc.etteiram. Media enquiries can be directed to Jackie Kraft – 061 809 7758 – az.oc.akirfaksa@tfark.eikcaJ.

About Ask Afrika

Ask Afrika is a decisioneering company. We support our clients’ decisions through facts. Typically, our clients’ require information around social research and philanthropy, experience measures and consulting, and brand dynamics.

Social research decisions are required around HIV/Aids and more recently, Covid-19. Educational and early childhood development, fair-trade shopping, media and financial research are some of the areas we love to work in. NGOs, public- and private-sector clients choose to work with us to get the pulse of the nation.

Besides being decisioneers in brand and customer experience research, Ask Afrika is well known for creating some of the most useful, go-to industry benchmarks, including the Ask Afrika Orange Index®, the Ask Afrika Icon Brands®, the Ask Afrika Kasi Star Brands and the Target Group Index (TGI). Ask Afrika’s knowledge of brands is extensive. The Target Group Index (TGI) survey, which measures psychographics, service, products, media and brands, has been used by the majority of the top 50 advertisers and media owners in South Africa for nearly two decades.

Our clients operate across various industries, including retail, telecoms, finance, and the public sector. We offer tailor-made and ready-to-use offerings for all our clients regardless of the size of project.

In addition to being brave, agile, vibrant and experimental, we apply deep thinking to every research project. Our aim is to be great at everything we do and to make a meaningful impact.

Partner with Ask Afrika in order to confidently make game-changing business decisions that grow your business.