Related

Top stories

More news

Pieter Faber, executive: Tax at the South African Institute of Chartered Accountants (SAICA) tells us why we need to pay attention to the “mini budget”.

The Mini Budget is not just a year-to-date summary of the February National Budget, but serves distinct and separate purposes. By law, the MTBPS serves to:

The law also obligates Parliament to hold public hearings on the fiscal framework (i.e. estimates of revenue, expenses, money to be borrowed and current debt and debt service costs) and revenue proposals (i.e. how the money will be collected and divided amongst the three spheres of Government).

It is the Constitution that directly imposes obligations on government when it comes to things about money and that money is what is needed to hold government accountable for service delivery. The Constitutional Court in the Doctors for Life case has affirmed that South Africa is a mixture of a participatory and representative democracy, i.e. we don’t just leave lawmaking, nor the budget to the elected officials. The same court has also affirmed that this right is the right to be heard, not just to be listened to, hence why our elected representatives must demonstrate that they heard the people’s concerns.

For the people to participate, we need to understand what principles apply to the MTPBS.

Importantly, the Budget process does not only have procedures, but principles that Parliament is supposed to abide by. The first set of principles is contained in section 214 of the Constitution and talks about how money should be “spent”, namely:

a. the national interest;

b. any provision that must be made in respect of the national debt and other national obligations;

c. the needs and interests of the national government, determined by objective criteria;

d. the need to ensure that the provinces and municipalities are able to provide basic services and perform the functions allocated to them;

e. the fiscal capacity and efficiency of the provinces and municipalities;

j. the need for flexibility in responding to emergencies or other temporary needs, and other factors based on similar objective criteria.

Similarly, the Money Bills Amendment Procedure and Related Matters Act, 2009 provides that Parliament must:

a. ensure that there is an appropriate balance between revenue, expenditure, and borrowing;

b. ensure that debt levels and debt interest costs are reasonable;

c. ensure that the cost of recurrent spending is not deferred to future generations;

d. ensure that there is adequate provision for spending on infrastructure development, overall capital spending and maintenance;

e. consider the short-, medium- and long-term implications of the fiscal framework, division of revenue, and national budget on the long-term growth potential of the economy and the development of the country;

f. take into account cyclical factors that may impact the prevailing fiscal position; and

g. take into account all public revenue and expenditure, including extra-budgetary funds, and contingent liabilities.

So is Parliament and through the budget process, Treasury, meeting the principles of a budget and in particular, a budget that conforms to the principles of the Constitution and its enabling law?

In the February 2023 Budget, SAICA and other public commentators expressed concern that the Budget as tabled was in essence not meeting the criteria in the fiscal framework, namely that current expenditure was being under-estimated with known liabilities. This includes the wage bill and legal liabilities of the state for claims against the Police and Department of Health in particular. One commentator also had reservations about the manner in which the Treasury had changed budget “accounting” rules for the Eskom debt bailout, changing it from pre-interest spending (i.e. part of the budget deficit) to debt repayments (i.e. not part of the budget deficit) which also obscures the fact that government will have to borrow more money to fund its operations.

As the public, we should be holding Parliament, which holds power over the budget, more accountable on whether they are in fact applying the relevant principles. They, rather than National Treasury, should better respond to questions of:

Though budgetary law and process is a minefield of legislation, the principles and questions they elicit can be understood and posed by any lay person and they should be.

What seems apparent is that Parliament is failing to apply the principles set out in law when they approve the Budget and that the Budget is failing to meet the minimum criteria.

So, if the numbers are not making sense, which many Parliamentary officials would claim is not of their making, is Parliament at least properly applying its oversight functions?

In demonstrating that these oversight functions and principles are being applied, the law obliges Parliament to prepare the Budget Review and Recommendation Report (BRRR) before the MTBPS is finalised. A BRRR:

a. must provide an assessment of the department's service delivery performance given available resources;

b. must provide an assessment of the effectiveness and efficiency of the department use and forward allocation of available resources; and

c. may include recommendations on the forward use of resources.

By looking into one of these 2023 reports for the Department of Water and Sanitation, we have noted with concern that the department is failing by not heeding the “water-shedding” crisis concerns. It is noteworthy that as of today, 13 departmental reports are outstanding.

The Parliamentary report starts off with:

“The Department set out to achieve six (6) strategic oriented outcomes with their 19 respective outcomes indicators during the year under review. In this regard, the Department achieved an average of 92% of the overall strategic-oriented outcomes, which is a tremendous achievement compared to the previous year. The department has satisfactorily attained a majority of its strategic objectives.”

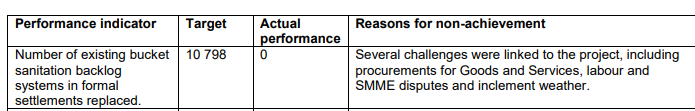

The department had 11 key performance targets, that by first impressions were not that high, yet only met 1. A key one they missed will hit a particular nerve with the people of South Africa:

Other key findings by the Auditor General include:

Findings from the Department of Planning include:

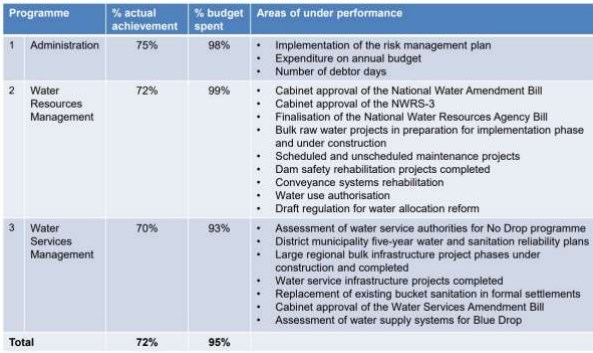

Then there is performance vs spending:

The report reveals Parliament made 11 observations, with 10 in essence requiring further reports to Parliament in future as the main recommendation. At this point, it begs the question whether Parliament provided a proper assessment of such underperforming departments' performance and whether it provided a proper assessment of the efficiency of the use of available resources so that the 2023 MTBPS and 2024 Budget can be informed.

It is at this point that we must conclude that a good budget approved by Parliament may still be a bridge too far; a Mini Budget that at least conforms to the basics of numerical requirements and compositional principles, may have to do for now.