Seasonal swamping

This is a logical and simple method - best explained, perhaps, by way of an example. Unfortunately, it can only be useful in a few marketing situations.

For example: The average consumer is likely to catch a cold when the first winter rains and temperature drops occur. It's therefore a reasonably intelligent thing to do to concentrate the advertising of your common-cold remedy on a mass-reach basis to coincide with forecast inclement weather.

Thus, the long-range weather forecast may predict cold and wet weather on 1 July so we swamp the media with our advertising message on, say, 3 July.

By 'swamp' I mean that every available advertising space is taken - on an affordable basis, of course - and the consumer is literally bombarded with promises of relief. Maximum reach and frequency are achieved extremely quickly.

It's much the same with Eskom's loadshedding. It's a fairly sleepy retailer who hasn't stocked up on candles, torch batteries and other types of lighting.

Of course, this method is perhaps best described as a marketing strategy rather than a budget calculation.

It also means that if the forecasts are correct and our swamping strategy is successful, the advertising costs can be calculated in advance with a fairly high degree of accuracy.

And, given a known advertising expenditure and an estimated level of sales, the marketing department can make fairly accurate forecasts of what the year-end profits will be. They can also use this method as preliminary to, or in the first stages of, the objective and task method (which I covered last week).

Marginal analysis

This is where the budget is continually increased for as long as the incremental expenditure is exceeded by the marginal revenue it produces.

This is Return-On-Investment (ROI) in the purest sense. This method will eventually highlight, for example, the fact that sales resulting from advertising will decline in relative value as advertising expenditure reaches (and passes) saturation levels.

It also tracks (by its very nature) not only the costs of the advertising but also the additional costs of servicing the additional sales (i.e. increased overheads).

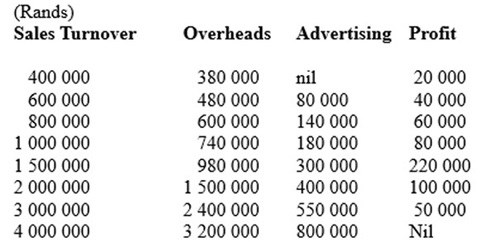

A hypothetical example will illustrate the point:

It's fairly obvious, in this example, where the optimum level is and where diminished returns will begin to be evident (i.e. at a budget of circa R300,000 and a profit of R220,000). But remember, this is a great theory and, like all theories, they can go horribly wrong - even in the most intelligent hands and within the most stable economic conditions.

Concluding note

As we continue to develop more scientific models we become more desperate to find justifications for our actions. It seems that these days, just about anyone can write an algorithm that will calculate a budget once you've entered all the variables. Personally, I believe these to be as suspect as the 'guess' method.

Calculating the budget, as I hope I've shown, is not as easy as it sounds because there are so many things getting in the way - like hurricanes, floods, recession, strikes, inflation, riots, war and other tiresome things.

And that's not to mention the 'imperfect market influence'.

And for those of you who have forgotten what your economics lecturer taught you; a market is said to be Perfect when all the potential sellers and buyers are promptly aware of the prices at which transactions take place and all the offers made by other sellers and buyers - and when any buyer can purchase from any seller (and vice versa). Under such conditions, the price of a commodity will tend to be the same.

A market is imperfect when some buyers or sellers, or both, are not aware of the offers being made by others. Under such conditions, the price of a commodity is likely to differ (quite considerably sometimes).

So there you have the basic fundamentals of budgeting, and I'll leave the final word to Robert Townsend who, when he was head of Avis, asked his agency "how do we get $5,000,000 of advertising for $1,000,000?" and, perhaps, that says it all - that advertising must work harder.

(His agency, Doyle, Dane Bernbach, did exactly that by the way when they ran the "We Try Harder Because We're Number Two" campaign.)

az.oc.srewerb@sirhc

Read my blog (brewersdroop.co.za) or see what other amazing things we do at brewers.co.za

*Note that Bizcommunity staff and management do not necessarily share the views of its contributors - the opinions and statements expressed herein are solely those of the author.*