Top stories

HR & ManagementNational minimum wage 2026: What workers (and employers) need to know

Danelle Plaatjies and Ludwig Frahm-Arp 13 hours

More news

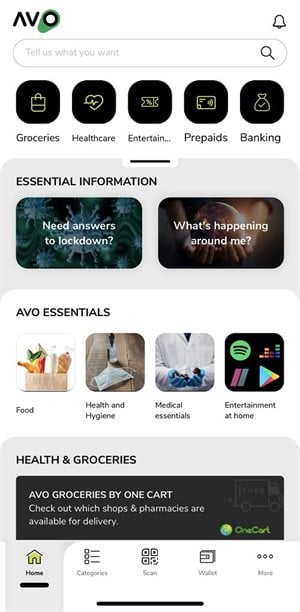

Launched during the lockdown, Nedbank says the app was developed in response to the limitations that people have been subjected to due to Covid-19 restrictions, and it provides customers with a virtual environment in which they can purchase products and service offerings supported by artificial intelligence, safe and secure payments, and bank-grade security.

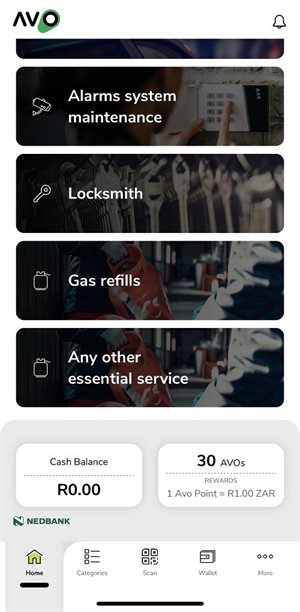

Products and services currently available via the Avo app includes: online grocery shopping, digital home entertainment services like Deezer and Showmax; airtime, data and electricity; and essential professional home repair and services like locksmiths and alarm system maintenance.

The term “super app” refers to a multitude of apps aggregated into one, allowing users to manage their daily lives through one app, breaking through the digital clutter on mobile.

"Today's banks have an opportunity and a responsibility, to do far more for their customers than merely provide financial services. Platform ecosystems are the perfect way for them to deliver these comprehensive value propositions that their customers deserve," says Ciko Thomas, managing executive: retail and business banking at Nedbank.

As Nedbank continues to test the market, the company has filed eight provisional patents relating to the Avo platform, which the company describes as "a great feat for platform innovation in Africa".

Because Avo was launched to 30,000 staff members in the midst of the lockdown, Nedbank repositioned the app’s offering to be Level-5-compliant. As such, the beta version of Avo has been delivering essential goods, providing home entertainment and connecting home service providers across provinces.

Nedbank has since released a beta version to its Nedbank Money App users. This will see the phased release of Avo to Nedbank clients, to allow for further enhancements before full public launch. The beta version allows Nedbank Money App customers to use a two-click process to sign up easily onto Avo.

To date, the app has accumulated over 5,000 customers and 170 registered home repair and service merchants.

"For us at Nedbank, that capacity to add massive value to every aspect of a person's life or business is what makes a platform ecosystem really worthwhile. This new digital engagement platform is a massive next step for us on this journey to be more than a bank, but rather through leveraging our digital leadership to be a creator, facilitator and enabler of real and lasting value," Thomas concludes.