Euromonitor International research has identified South Africa as the leading apparel and footwear industry in sub-Saharan Africa (SSA). The country’s apparel and footwear industry was worth over $11bn and recorded the highest growth rate of 6% in 2023.

South Africa’s strong sales are linked to its developing retail infrastructure, primarily anchored in modern retail channels.

Nigeria recorded strong results with a growth rate of 5% last year. The country’s retail landscape relies on informal markets, accounting for over 80% of sales. Nigeria’s forecasts indicate a promising trajectory, with apparel and footwear sales in the region projected to see a Compound Annual Growth Rate (CAGR) of 6% by 2028.

Rubab Abdoolla, consultant at Euromonitor International, said: “Despite being a small market by global standards, SSA occupies a growing percentage of the global apparel and footwear market. According to Euromonitor research, SSA contributed USD24 billion to the global textile and apparel exports in 2023.

“Retail value sales growth in key markets like South Africa and Nigeria was over 5% last year. This robust growth signifies burgeoning regional demand, driven by a diverse array of clothing options, evolving fashion trends and the profound cultural significance of fashion across markets.”

Price sensitivity continues to influence shopping patterns

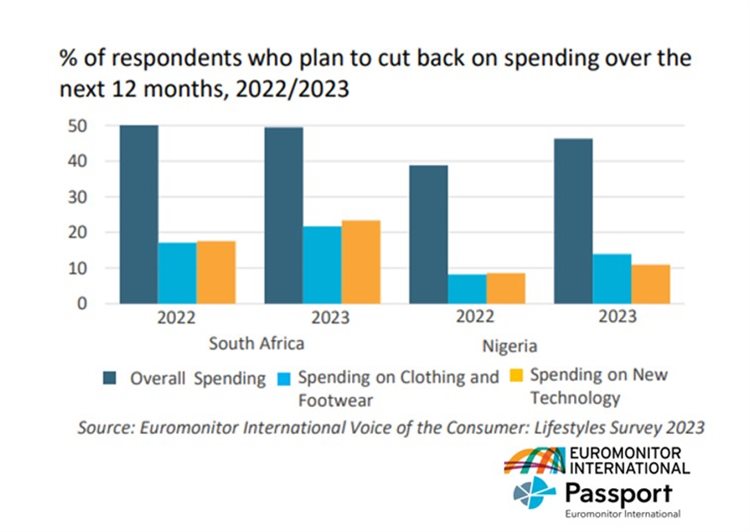

According to Euromonitor International’s Voice of the Consumer: Lifestyles Survey, more than 20% of South African respondents said they will reduce spending on clothing and footwear. With high inflation in many markets and, economic woes like high unemployment and declining disposable incomes, consumers are prioritising essential spending.

Equally, the pandemic has made consumers realise the importance of self-care and treating themselves to the small pleasures in life.

Abdoolla said: “While overall spending on clothing and footwear is expected to decline, it is not being completely phased out from consumers’ budgets. Rather, there is a shift towards downgrading to more affordable options like value brands or good quality second-hand garments.

“Many retailers have chosen to absorb rising raw material costs to maintain consumer appeal, resulting in lower profit margins. Retailers are aligning with global trends by offering trendy apparel and footwear at competitive prices to match their target markets’ budgets.

“Affluent and digitally connected consumers are broadening their shopping horizons by purchasing clothing from overseas. In South Africa, Shein’s rise in popularity can be attributed to its competitive prices and attractive offers, such as free shipping.”

Footwear market maintains dominant lead in South Africa and Nigeria

In 2023, sales of footwear accounted for over 30% of total market in South Africa and Nigeria. Footwear (35%) leads these markets in value share, followed by womenswear (24%) and menswear (20%). The category continues to be influenced by consumer preferences and economic and competitive factors.

South African consumers are driven to purchase branded shoes on credit or through buy-now-pay-later schemes because of brand loyalty and status.

There is a significant development in the footwear market in the region, with the rise of local sneaker brands. Nigeria’s harsh economic climate, characterised by high inflation and currency depreciation, has led consumers to opt for cheaper alternatives, such as second-hand footwear or products from the cottage industry.

Kauthar Jakoet, research analyst at Euromonitor International, said: “Entrepreneurs are taking advantage of the growing streetwear and sneaker culture to establish their brands in countries like Kenya, Nigeria, Senegal and South Africa. Adapting to these changing dynamics could be pivotal for both local and international footwear brands operating in the region.

“Local brands - Bathu from South Africa and SoleRebels from Ethiopia - are prime examples of this. As part of their differentiation strategy, both brands draw on cultural heritage. Authenticity has allowed these brands to carve out a niche in a market traditionally dominated by global brands.”

Digitalisation and consumer lifestyles boost online sales

Digitalisation and changing consumer lifestyles are driving demand in the region. Research from Euromonitor shows 5% of South Africa’s apparel and footwear sales took place online last year compared to 2% in 2019.

The retail landscape in Africa has diversified, offering consumers a broader range of choices. International players are expanding their presence, sometimes bypassing South Africa to tap into more promising markets on the continent, such as Ermenegildo Zegna opening its first physical store in Nigeria.

Abdoolla said: “Digitalisation has given rise to African e-tailers, enabling luxury designers to reach global audiences. Even the second-hand clothing market is evolving towards premium options, with thrift stores in upscale areas catering to a more affluent clientele.

“Despite formal industry growth, informal trade remains dominant. Cheap imports flood open markets, offering competitive prices for lower- and middle-income consumers. Tailors continue to fill gaps left by established players, especially in crafting made-to-measure traditional outfits. Ready-to-wear items often fail to accommodate the unique body shapes of African women, reinforcing the strong market presence of tailors specialising in bespoke clothing.”

For more information, see Euromonitor report Africa’s Fashion: A Tale of Diversity.