BMW's partnership with Saab, announced last month, drew a large amount of positive press attention for Saab. As the larger partner, BMW has little to worry about in terms of the effect on its brand equity; however, the Saab brand is in a more precarious position.

Saab, a small Swedish luxury car brand was - as far as the media and many industry analysts were concerned - about to take its rightful place as a historical footnote at the end of 2009. At the eleventh hour, Saab's owners (General Motors since the year 2000) found a buyer just as they were winding the operation down.

Since then, the brand has gradually begun to right itself, with a fresh take on its niche brand strategy.

Saab's brand heritage

Saab's brand heritage boil down to two major factors: contrarian engineering and relatively low sales figures. Saab has never sold more than 140 000 units in any one year of its entire existence.2 The fact that it is only popular among a small niche of buyers seems to be itself attractive to the niche.5

Brand equity is an intangible asset; it only exists in the minds of the consumers. Saab's particular form of brand equity was reputed to result in a loyal, almost fanatical customer base - conquest sales were not the way the brand survived.

Whether or not that was entirely true is debatable, given the available data. However, what is clear is that Saab's repeat-purchase rates dropped during the GM years and especially during the credit crunch: 35.5%, 33.4% and 9% in 2004, 2006 and 2009 respectively (source: JD Powers).

Yet, even though repeat-purchase loyalty wavered, the emotional attachment continued - even going as far as a global protest action in 2009 in response to GM's initial decision to shut down the brand. Many brand advocates don't even own Saab's anymore - but wait on the sidelines for a revival.

What needs to be done?

What needs to be done to strengthen the Saab brand within its niche?

According to imminent brand theorist David Aaker3, there are four major processes that build a strong brand:

- Ensuring the organisational structure and processes support the brand

A major failing of GM's management was not ensuring that someone senior enough championed the brand. Under new ownership, circumstances couldn't be more different. The new CEO, Dutchman Victor Muller, has returned the 'small' feel to the brand - going as far as driving the cars in races and personally taking motoring journalists on test drives.

- Ensuring that the brand architecture is correct

In the past this was poorly managed - evidence of this being the media's constant confusion over whether Saabs were Saabs or just badge-engineered Opels. Saab risks a similar blurring in its relationship with BMW.

- Defining the brand positioning crisply

Saab's strengths were and still are poorly communicated. Therefore, consumers often don't include these strengths in their mental positioning of Saab.

- Brand building programmes

Saab needs to ensure it has the right target positioning. Saab needs to invest in marketing research to determine which brand positioning will produce the most brand equity within its target niche. Saab then needs to work to communicate this positioning by spending the required advertising and PR money.

How is the 'new' Saab performing so far?

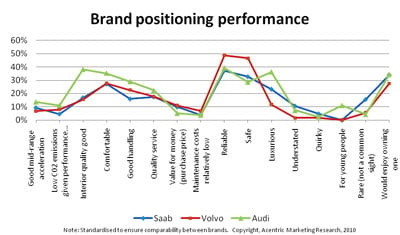

On the 1 November 2010, Acentric completed a small exploratory survey of 112 UK respondents (Saab's most lucrative European market outside of Sweden). The survey was demographically representative of the general public. The largest relative gaps are interior quality (relative to Audi) and safety leadership relative to Volvo (in spite of injury statistics to the contrary).

What can be done to build Saab's brand equity?

Building brand equity costs money. Balancing financial viability with engineering and brand-building investment will continue to be a challenge.

For this partnership to work, Saab needs to avoid making the same mistakes again. Off-the shelf components must be invisible or modified to take on Saabish qualities. Most essentially, Saab needs to ensure that perceived quality is balanced against price perceptions.

So far, if the new 95 is anything to go by, Saab still seems only vaguely aware of how critical quality perceptions are.

Action steps:

- Guard the brand architecture and prevent confusion with larger partners. For instance, Saab is currently advertising its new class leading CO2 emissions levels - Saab needs to ensure this is clearly communicated as its own engineering achievement, otherwise many will automatically attribute this to BMW.

- Ensure Saab has a well-defined target brand positioning on paper, track the actual brand positioning using surveys and then manage the brand towards the target. Managing quality and value-for-money perceptions are likely to be key.

- Only spend money on brand-building campaigns that actually communicate the brand's unique positioning - scrap the rest.

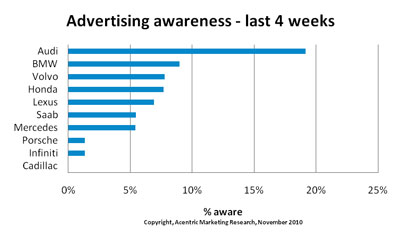

- Ensure the advertising is actually generating the required awareness. As can be seen below, Saab's recent campaigns have not generated much awareness relative to competitors.

- Enable Saab's existing brand advocates. Saab has an unusually loyal core of brand advocates who promote the brand through word of mouth and numerous blogs (numerous given Saab's small market share)7.

- Saab should use any opportunities that allow other strong brands to 'rub-off' on Saab's brand equity. An alternative that does not yet seem to be under consideration is involving Saab's automotive's original owner - Saab aerospace - in the design of one or two components.

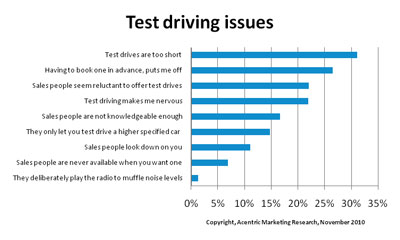

- Test drives. The survey results also revealed some key issues among those who test drive new cars. Saab should aim to counter these issues, as test-driving will be critical to improving perceptions in Saab's case. The three main issues are: 1) The short duration of test drives, 2) having to book in advance and 3) reluctance on the part of dealers to offer test drives.

References and notes- "Spyker Cars N.V.: SPYKER CARS N.V. (including SAAB AUTOMOBILE A.B.) REPORTS ITS SEMI-ANNUAL REPORT 2010". Web: www.reuters.com.

- "Saab Automobile's Global Sales Volume 1947-2007" (2008). Web: www.saabhistory.com.

- Aaker, DA and Joachimsthaler E (2000) "Brand Leadership", The Free Press: New York.

- Stevenson, R (2010), "Spyker aims to boost Saab production 18%", Business Day, 29 September.

- Anecdotal evidence from blog entries.

- Bold, B. (2004). "News Analysis: Is BMW risking brand suicide?", Marketing, April 21.

- An interesting example of this phenomenon is a blog run by a chartered accountant, Steven Wade, who seems to spend most of his spare time promoting the brand. Web: www.saabsunited.com.

- O. Aykac, D. Selcen, (2007). "Identification in Hyper-Loyalty Brand Communities" (2007). MAKING OF CULT BRANDS, Swapna Gopalan, ed., ICFAI Press: Andhra Pradesh, India, 2007. Available at SSRN: http://ssrn.com/abstract=1363795

- Hjalte, S. & Larsson, S. (2004) "Managing customer loyalty in the automotive industry: Two case studies", Masters thesis. Lulea University of Technology. Web: http://epubl.luth.se/1404-5508/2004/074/LTU-SHU-EX-04074-SE.pdf

- Kinnander, O. (2010)."Volvo, Saab Need More Than `Me-Too' Luxury to Beat BMW". Bloomber, 23 September. Web: www.bloomberg.com/news/2010-09-22/volvo-saab-need-more-than-me-too-german-luxury-to-beat-bmw.html