Top stories

More news

“Not only does this cut make it more affordable for buyers to enter the market, but it also makes it easier for existing homeowners to keep up with their monthly repayments. This is beneficial to everyone as it will hopefully reduce the amount of homes that will have to be repossessed and sold at public auction, which safeguards against further downward pressure on asking prices,” explains Goslett.

To get an idea on how much a homeowner stands to save on their existing home loan, Goslett recommends that homeowners use BetterBond’s Additional Payment Calculator. Based on this calculator, if homeowners kept their bond repayments on a R1m home loan at the same amount as they were when interest rates were at 9.75%, they will save R304,000 on interest and shorten the loan by 6.25 years at the current 7%.

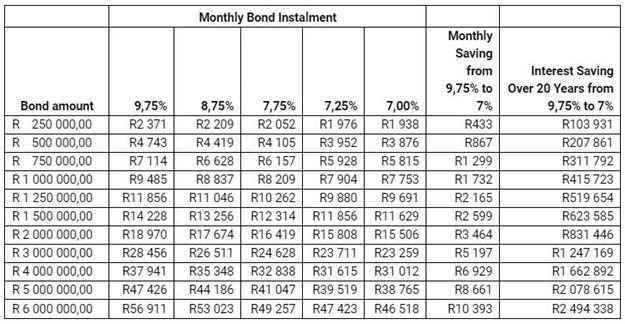

The table below provides a few more examples of what homeowners stand to save following the interest rate cuts:

“For those who can afford to do so, there really has never been a better time to enter the market than right now. I would just advise buyers to leave room in their budget for if and when the interest rates return to pre-lockdown levels. For existing homeowners, if it is within their budget, I would recommend keeping the repayment as it was before the cut. This is one of the best ways to save money and, if you have an access bond, it is also a great way to have access to emergency funds if you later come to need them,” Goslett concludes.