SME survey sheds light on job creation

In what are groundbreaking findings, SMEs have expressed themselves ready to help create the jobs that South Africa so desperately needs to pull our masses out of poverty - but they are challenging the new Department of Small Business Development (DSBD) to create the conditions that will help them to do this.

By their very nature, small business owners tend to be optimistic. This is borne out by the results of an SME survey conducted by the South African Institute of Chartered Accountants (SAICA); while only 39.8% of SMEs saw an increase in profitability over the past year, 87.1% expect turnover to remain stable or grow over the next year, 88.6% expect to be employing the same number of people or more next year, and 83.5% expect their profitability to remain the same or to increase over this period. It is this positive attitude that needs to be harnessed if SMEs are to serve as a job-creation engine. These numbers are a far cry from the gloomy predictions of global financial bodies, our own Reserve Bank and many of our large corporates, and one wonders what it will take for the SME sector to come to the rescue of the economy. There is no shortage of positivity and willingness, and fortunately the survey goes on to answer this question.

"When asked to rate the specific obstacles to their growth," says Bridgitte Kriel, Project Director for Small and Medium Practices at SAICA, "the SMEs showed a large degree of consensus. Some 82% agreed that government-generated red tape was a brake on growth, 63% were concerned about restrictive labour laws, and 60% took issue with tax levels. Difficulty in raising finance to grow was a problem for 51%. The message they are sending is clear: a reduction in red tape, a change in tax laws to encourage small business growth - and, over and above the youth wage subsidy, to encourage employment in general - and an adjustment to the labour laws to give SMEs more flexibility in reducing staff complements when necessary, will encourage them to take on more staff, without putting their businesses' long-term sustainability in jeopardy. These are decisions which are all in the hands of policy makers, and which some countries to the north of us have implemented with considerable success."

She is quick to add, "Such changes - particularly those relating to labour law - will no doubt raise concerns within the unions, who have a mandate to protect their members' best interests - but who do not necessarily speak for the unemployed. If the DSBD is to be effective, business, government and Cosatu, as their tripartite partner, may need to hammer out a compromise to allow relaxation or simplification of labour law and the red tape in the SME sector."

With a sample size of just short of 900 SMEs, the survey seeks to shed light on ways that the profession, and indeed the DSBD can formulate constructive policy to help to achieve the objectives of the National Development Plan (NDP).

Analysis of the data reveals that while most of our SMEs are small, many are also well-established, successful concerns. Half the SMEs surveyed have been in business more than ten years, and a further quarter for more than five years. "The number of employees tends to increase sharply with turnover," says Kriel, "which suggests that the most effective and urgent solutions to unemployment may not lie only in stimulating the establishment of a rash of new SMEs, but rather in encouraging growth and employment in existing SMEs that have survived the first three to five years of start-up challenges."

South Africa is blessed to have in the funding sector organisations like Business Partners, one of the most successful small-business lending institutions in the world, and SEFA, the consolidation of several state-owned small-enterprise funding bodies as well as several large and small banks who have specialist SME focuses. It might be time for the banks, SEFA, Business Partners, the DSBD and the treasury to engage in a dialogue, and perhaps create a "financing package" specifically aimed at mature, successful SMEs to encourage their growth.

SAICA is already embarking on a follow-up survey, to marshal even more information with which to assist government on SME policy, and its own members on how they can engage the sector. The initial data, however, leaves one overriding impression: many of our SMEs are like highly trained racehorses, champing at the bit as they wait for the starting gates to open. If the DBSD can throw open those starting gates - by reducing SME obstacles in the areas of bureaucracy, tax, labour and funding - they are ready and willing to grow, and in doing so, create many new jobs.

Download the survey here

Late payments: the SME bugbear

A survey of South African SMEs reveals the risk late payments pose to many small businesses - and that government at all levels are seen as the slowest payers by far. As a result, 70% of SMEs surveyed do no business with government, with slow payment and ted tape being major sticking points.

The creation earlier this year of the Department of Small Business Development (DSBD) indicates that government has accepted the fact that SME development and growth is the most efficient means of creating employment at the pace required to reduce both our unemployment rate and the burden of social grants on the fiscus. This strategy is backed up by a comprehensive survey of almost 1 000 SMEs, conducted by the South African Institute of Chartered Accountants (SAICA) in August 2014, to canvass grass-roots opinions on the state of South Africa's SME sector and to formulate suggestions that might be helpful to the DSBD as it considers policy and strategy.

When analysing the data from the survey, one fact that is immediately apparent is that the number of people employed by an SME increases significantly with size and with the age of the business.

Taking this into consideration, it seems apparent that the DSBD would do well to encourage job-creation by focusing its aid and interventions on existing SMEs with a proven track record, encouraging them to grow both turnover and staff. Internationally SMEs struggle to access the cash to grow. It would seem that if government simply paid SMEs on time this could be a massive - and possibly the most important - step to stimulating growth in the sector.

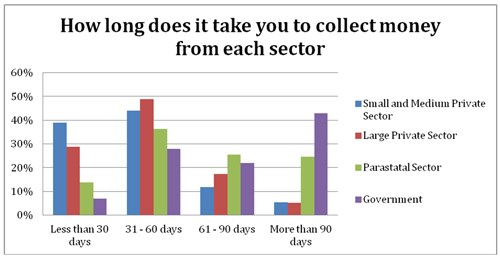

Cash flow makes or breaks a business

Smaller companies in particular are vulnerable to this cash flow risk; until a business has had the time and turnover to build substantial reserves, getting paid on time is crucial to its liquidity. It is not surprising then that 70% of SMEs shy away from doing any business at all with government. It's simply too dangerous for their cash flow. Asked to rate various sectors according to how quickly they settled invoices, SMEs rated other small businesses as the fastest payers, followed by large and medium business - but finishing a very late third were parastatals and government departments at all levels: municipal, provincial and national.

Government quite rightly wants to use the State Procurement System to stimulate transformation and SME growth, and has built incentives into its tender procedures for BEE-compliant SMEs. This is not a matter of principle or politics; SMEs need uninterrupted cash flow if they are to remain liquid and grow from small, to medium, to large businesses - with additional employment opportunities at every growth spurt. To enter into contracts with government departments, to expend resources in fulfilling those contracts, and then have to wait months for payment, could cripple or even sink many small businesses.

A quick win for the DSBD that would stimulate job creation via the SME sector would be to ensure that every government department and parastatal develops payment procedures that ensure SMEs are paid on time - preferably, on delivery. An SME that knows it can rely on prompt payments is in a much better position when contemplating borrowing for growth, or hiring more staff. This is an intervention for the DSBD that would reduce the growth risks for SMEs and could open up the Government procurement opportunity to those to whom it is intended. Other incentives SMEs cited for government and the DSBD's attention were tax reform to stimulate SME growth, tax reform to reward employment, and a relaxation of Labour laws as they pertain to SMEs.