Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

The unfortunate reality is that the industry is struggling. Foreign tourism has shown a 3% decline in the first 3 months of 2019, and the number of overseas tourists is down a staggering 6%. Unfortunately, this is off the back of low growth in 2018 (1,8%) and indications are that domestic tourism, which makes up the bulk of our visitor numbers in South Africa, was also flat last year. These dismal figures are (almost) unprecedented for democratic South Africa.

Over the 9-year period from 2010 to 2019, the number of foreign tourists visiting South Africa increased from 7,8 million to reach 10,5 million. Although an additional 2,6 million tourists seems like a lot, it is only a compound growth of 3,7% per annum. To reach the industry’s target of 21 million tourists by 2030, we will need compound growth of 6% per annum. Over the past 9 years we have only seen growth above 6% twice (in 2014 and 2016).

As an overview, South Africa’s total foreign arrivals were around 10.5 million in 2018, of which overseas visitors make up about 2.7 million and regional travellers (from the rest of Africa) make up the balance (7,8 million). So in reality, our 10,5 million foreign visitors are not all high spending tourists partaking in South Africa’s vast and often world-class experiences.

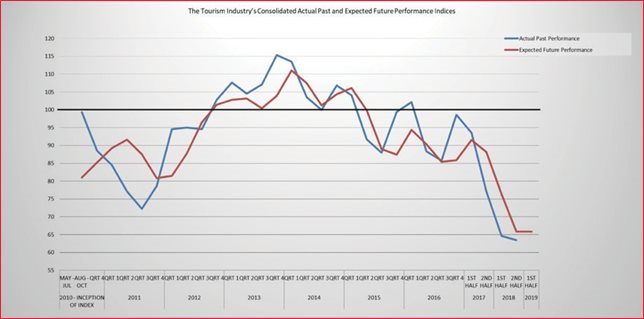

A report we compiled for the Tourism Business Council of South Africa – The Tourism Business Index – found that in the second half of 2018 business performance was at an all-time low (since we started measuring sector performance in 2010). The major contributors to significantly below normal business performance was found to be lack of demand from domestic and overseas leisure tourists.

Another significant contributor to poor sector performance is a lack of domestic business tourism-driven

by increased austerity measures for travel by government officials, and that business travel, in general, is being negatively affected by the moribund economy.

On the positive side, one part of the travel industry that does offer hope is domestic leisure. Like all of us, domestic leisure travellers are constrained by the struggling economy. However, this is an area where one can influence decisions. Leisure tourists might not have much money compared to inbound foreign tourists, but there are opportunities to innovate.

Tourism operators that fail to innovate, will close down. It is a matter of survival that they learn to think differently. “Business as usual” is no longer good enough. One has to be innovative in how you package and how you sell, in order to entice a holiday-maker to spend hard-earned money at your attraction/ establishment. Those who succeed will be those who offer an experience that distinguishes them from the competition.

This requires creativity – as a region, as a town, and as individual players.

An exciting and largely untapped component of the domestic travel market is what is termed the VFR market – visiting friends and relatives. These include people travelling for religious purposes, going to funerals, weddings and family functions.

Traditionally, this market would stay over with its families, but many are increasingly preferring to stay over at hospitality establishments during their visit – at a nearby B&B, Airbnb or a local hotel. This is a real opportunity for growth.

Let’s be realistic, many of our tourism products have not been updated from a legacy offering. There is great scope to start customizing our offerings to better suit the new demographics of our domestic tourism market. If we have locals exploring our country more, who knows what messages they could be spreading to foreigners and others interested in SA but unsure of what to do.

This revamp need not require huge changes, but it might encompass how guests are welcomed, house rules, the booking functionality, and the activities that are offered.

As family arrangements shift, our tourist offerings should cater to this by having a more fluid sensibility. Not every set of guests will be a family of four with two kids. There are friends on getaways, childless couples, young singles and large groups from a variety of population groups

There is more to a tourism offering than a pile of brochures, or a page of links and the advice that, “all of this is available”. That is a somewhat lazy approach, which places the responsibility for organising the holiday back on the tourist. As a tourism expert, the operator should advise its guests – or better yet, organise the holiday for their guests!

There is nothing so relaxing as a getaway where you have a single point of contact, and everything is taken care of, be it a game drive, a weekend break or a beach holiday.

More and more South Africans are able and open to exploring their country. However, we cannot take that market for granted if we want to see an increase in tourism numbers.