Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

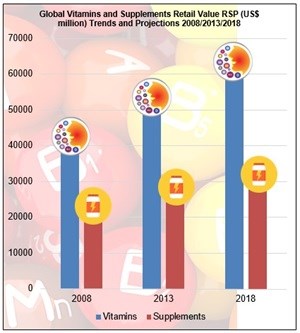

With an expected compound annual growth rate (CAGR) of 6.8%, the global market is predicted to surge towards a staggering valuation of around US$ 60bn by 2020. Whilst South Africa is often somewhat of a global maverick in certain FMCG sectors, in this instance its domestic vitamins and supplements sector provides a veracious microcosm of the global market landscape.

Insight Survey’s latest SA Vitamins and Supplements Landscape Report 2016 addresses this symmetry by fleshing out the various ‘glocal’ constituent market drivers; in so doing providing a comprehensively nuanced understanding of the domestic industry environment and market dynamics.

The vitamins and supplements market in South Africa is worth R2.9bn and is growing annually at a rate of 7.7% (in sync with global CAGR of 6.8%).

Such exponential growth hinges on three seemingly ubiquitous factors which currently pervade global markets (see accompanying infographic).

The first factor is that of the ‘global health trend’. Brands are capitalising on this shift towards aesthetic wellness, and positioning themselves as architects of this ‘corporeal ideal’. In essence what we are witnessing is the emotive interplay between neuro-savvy marketers and the global consumer’s ‘need’ to attain a certain media-induced bodily ideal.

According to a 2015 survey across all domestic LSM’s, 51% of South African consumers considered themselves overweight, with 82% saying they plan to make changes to their diet in 2016.

A whopping 17% of this sample claimed they currently use some form of Dietary Supplement on a daily basis – a stark indication of the 8% rise in Retail Value over the past 3 years.

This consumer trend is echoed on a global level with a 7.5% increase over the same period.

The second factor, closely linked to the ‘global health trend’ is that of the marked rise of Sports Nutrition as a mainstream supplement. No longer a niche market, Sports Nutrition in South Africa is set to witness a CAGR of 8% at constant 2015 prices over the next 5 years – closely mirroring the global forecast of 8.5% growth over the same period.

And lastly, the third factor fuelling such exponential sector growth is the growing ageing population, both locally and globally.

In South Africa, the percentage of the population aged 65+ has risen from 4.8% in 1996 to 6.3% in 2015 (in line with a global average of 7%).

This trend has manifested in an increase in Preventative Healthcare sales (e.g. Vitamin C, Calcium, Probiotics) as elderly consumers become increasingly health-conscious.

Given such global-local symmetry across these 3 factors (coupled with the dove-tailing of peripheral factors such as consumer segmentation strategies, product innovation and channel proliferation), it is evident that South Africa has (within the context of this FMCG segment) shed its ‘maverick epithet’ and is a bona fide microcosm of the global Vitamin and Supplement market landscape.

The South African Vitamins and Supplements Landscape Report (91 pages) provides a dynamic synthesis of industry research, examining the local and global vitamins and supplements industry from a uniquely holistic perspective, with detailed insights into the entire value chain – from manufacturing to retail and consumption.

Some key questions the report will help you to answer:

Please note that the 91-page PowerPoint report is available for purchase for R25,000 (excluding VAT). Alternatively, individual sections can be purchased for R7,500 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (0)21 045-0202.

For a full brochure please go to: South African Vitamins and Supplements Landscape Report 2016

Insight Survey is a South African B2B market research company with almost 10 years of heritage, focusing on business-to business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.