Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

The accessibility study models the allocation of people (demand) to the location of the large shopping centres (supply) across the existing road network in Gauteng and using a car or taxi as the mode of transport.

If the estimated 10.5 million people living in Gauteng (2009 estimates) are equally allocated to the large regional shopping centres included in the study, one would expect the size of the population within each shopping centre's catchment area to be around 617 000 people.

A review of the graph in Figure 1 shows that Maponya Mall stands out from the rest. It also shows that only five of the large shopping centres reach the benchmark population size of 617 000 people and these include Festival, Eastgate, East Rand, Wonderpark and Southgate. All five of these shopping centres reach their catchment population within 13-16 min.

The shopping centres of Menlyn Park and Sandton City reach just under 600 000 people within a travel time of 17-20 min. All the remaining large shopping centres struggle to reach a population of 200 000 people within a travel time of 5 min and above. This large variation in the number of the people within the catchment area of large shopping centres and travel times indicates that optimizing the location of large shopping centres in relation to where the demand is does not seem to have been a major criterion. Consequently, what one sees is that large shopping centres are over concentrated in the wealthier suburbs of Gauteng leaving the township areas without access to large shopping centres.

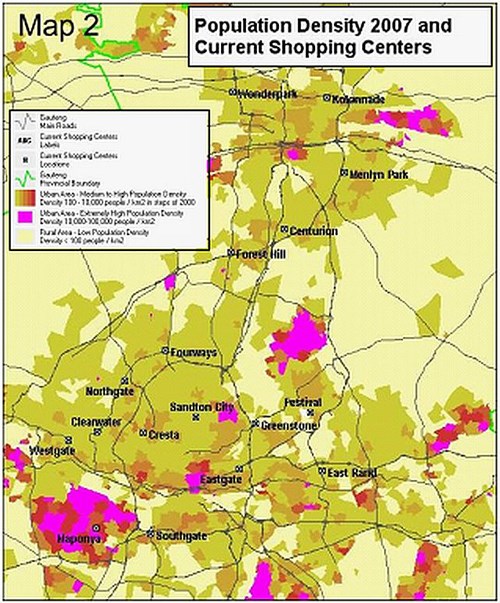

This is contrary to an article in the Business Day in 2008 on the big shopping centres where it states that Gauteng is "over shopped." Map 2 below shows the disparity between where the large shopping centres are located and where the largest concentrations of people are living.

A review of all other sized shopping centres in Gauteng shows that they are located in the wealthier suburbs and not necessarily where the largest demand or concentrations of people are located. A further analysis of where shopping centres are located in relation to where the concentrations of the working population are located is being considered. Furthermore, this disparity is exacerbated in Johannesburg where large shopping centres are located much closer to one another than those in Pretoria are.

On average, each large shopping centre is 8 minutes travel time away from its nearest competitor while their uncontested catchment areas have a radius of only 4 minutes travel time. Table 1 below shows the distance in travel time by car along the road network from each large shopping centre to its nearest competitor and what the radius of its uncontested catchment areas is in kilometres based on an average travel speed of 60 kph.

The average travel time from anywhere in Gauteng to the nearest large shopping centre is almost 14 minutes by car or taxi. The worst case travel time is almost 2 hours while 99% of the population are in reach of the nearest large shopping centre within 41 minutes, 95% of the population is within 33 minutes and 90% of the population is within 27.5 minutes. Fifty percent of the population living in Gauteng is within 11.9 minutes of a large shopping centre. What this provides is some guidance on what large shopping centres should possibly aim in terms of a travel time when looking at their optimum location from a travel time and market share perspective.

What can be concluded is that the wealthier suburbs of Gauteng are probably "over shopped" but not so for the whole of Gauteng. However, there is a real opportunity to locate large shopping centres in the township areas.

The mix of retailers, offices, entertainment and government services will be key to the success of these shopping centres. Many new developers are showing the way in making shopping centres successful in urban townships and rural communities throughout the country.

From the accessibility study and considering the present locations of large regional shopping centres, we believe that there are at least ten sites where new large regional shopping centres like Maponya Mall can be located.

AfricaScope has developed current estimates of the South African population at a local level. It has proprietary datasets on consumer spending patterns and income in further defining target markets. The company has also mapped the location of shopping centres and many retail chains in the country.

Using accessibility modelling methods, the team is able to identify the optimum location of new shopping centres of different sizes considering the size of the target market, where existing shopping centres are located, travel times using various modes of transport and the market share of shopping centres to make them financially viable.