Despite 2018 being the so-called 'crypto winter' characterised by a dip in the Bitcoin price, cryptocurrency company Luno is gearing up for a positive year ahead as it predicts increased Bitcoin adoption and the technology scaling faster than imagined. These are the sentiments of both Marcus Swanepoel, the company's CEO and cofounder and Marius Reitz, Luno's South African country manager.

Clearer regulation for businesses

Marius Reitz, SA country manager, Luno

More regulators around the world are providing clarity for cryptocurrency companies to operate either within existing frameworks, or with new licenses. This will help increase trust, weed out most if not all of the bad apples, and form the foundation for large scale institutional money to move into the crypto ecosystem.

The SA Reserve Bank (SARB) last week announced its plans to regulate crypto. Luno is actively working with a number of central banks and financial regulators, including SARB, to drive regulation in cryptocurrency.

Realistic risk expectations

Visibility around illicit activity is an important issue. With cryptocurrency, the bar has been set high by regulators, banks and the media - in many cases at a zero-risk tolerance level. “We see 2019 as a critical point where this sentiment will shift from one of ‘risk elimination’ to ‘risk mitigation’, which will have a big knock-on effect for the industry’s growth prospects,” says Reitz.

Decentralised cryptocurrencies

Over the last year or two, initial coin offerings (ICOs) and ‘blockchain projects’ have been in the spotlight. Luno expects that another major trend for 2019 will be the mass abandoning of these ‘blockchain’ and ICO projects, with attention and money shifting back to decentralised cryptocurrencies.

Investor and fintech interest

While Luno doesn’t expect to see mass institutional adoption in 2019, it expects to welcome some early movers into the space. “Early adopters are institutions like Fidelity and BAKKT (which also attracted investment from our own lead Series A investor, Naspers) that will get the momentum started,” says Reitz. “We also predict that smaller fintech and other tech companies will enter the space via partnerships with existing cryptocurrency companies like Luno. As one of the early market leaders in the B2B cryptocurrency space, we have launched our Luno for Business team to help connect all of these businesses and their customers to cryptocurrency.”

Education

This year will also see better education around the cryptocurrency market. This will be helped by the media, cryptocurrency companies and existing financial institutions that are not ready to launch cryptocurrency projects yet, but are dipping their toes in the water to test interest from their customers.

“One of the cryptocurrency industry’s gravest mistakes was to assume Joe Public would understand all the ‘decentralised-this-and-mining-that’. When the price was skyrocketing, people didn’t care much about what it all meant, but in 2019 real education will become a key driver of growth, as it should have been from the start,” says Reitz.

Luno has invested heavily into its Luno learning portal which provides information about the facts, opportunities and risks in the cryptocurrency market.

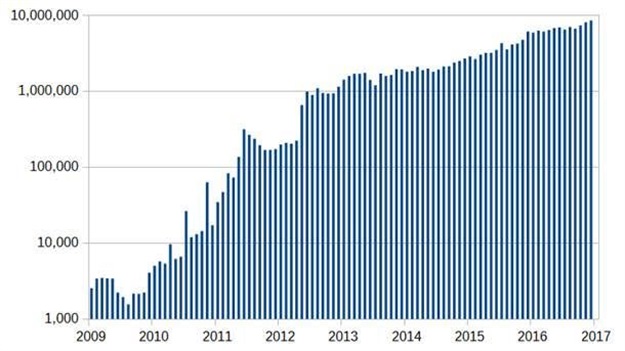

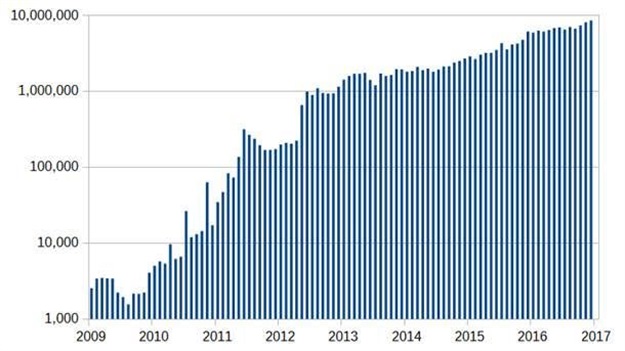

Number of Bitcoin transactions per month from 2009 to 2017.

Scaling up

This year will see cryptocurrencies like Bitcoin, scale better in terms of speed, cost and security. “We believe the scaling trend will continue and slowly help start unlocking more value to the overall network and industry,” he says.

There is no silver bullet

Luno expects more implementation of crypto use cases in niche products and services where they demonstrate that cryptocurrency does what the existing financial system cannot, such as immutability and traceability. Emerging markets in particular are expected to grow.

Early stages of building a new financial system

Challenges to cryptocurrency growth and adoption this year will remain. While regulatory views are positive overall, some countries will take longer to align their views and this will have a negative impact on those markets. Banks, which are essentially the de facto regulators of the industry right now, will continue to work only with select cryptocurrency companies, which dampens competition and growth.

“Innovation happens slower than early adopters hope, but faster than sceptics believe. Either way, it’s important to take a long term view of the market and we believe that this means a major transition in the way the world thinks about and uses money in the next 5 to 10 years. The reality is that the existing financial system was built over hundreds of years and we’re not going to build a new financial infrastructure overnight,” says Reitz.

“Cryptocurrency will be the same or better than the existing financial system – a good store of value, allowing for faster and cheaper transactions, bringing down the cost of remittances and be global, while being open and completely secure,” he says, adding that the volume of Bitcoin transactions show that the new system is moving in the right direction.

Even in a flat or declining market, thousands of people became first-time cryptocurrency buyers every single day.

“Luno has long term view on the fundamentals that are driving cryptocurrency adoption and why it’s moving so fast. We believe this is part of the natural evolution of money. For this reason, the price is not important in achieving our long term vision of upgrading the world to a better financial system. However, price increases attracts newcomers faster, one of the reasons we expect to see Bitcoin scale quickly,” concludes Reitz.