Many people get to a point where they're quietly thinking about whether or not they should or could move into a retirement village. And one of the most important things to wrap your head around is if you do make the move, what sort of property contract you should enter into.

There are three possibilities offered in retirement villages – life rights, freehold and sectional title.

According to Jason Appel, financial planner at Chartered Wealth Solutions, most retirement complexes no longer offer outright ownership. “Internationally, it’s mostly life rights, but we’re still getting used to it here,” says Appel.

Life rights options are more budget friendly than ownership, he says. “I did an exercise for my parents comparing ownership versus life rights and I was taken by surprise. You can generally get a life rights unit at a lower cost than outright ownership. You do pay levies, but these cover all external maintenance, security, perhaps a meal a day, and the fact that there’s a maintenance team on the property to respond quickly to any problems.”

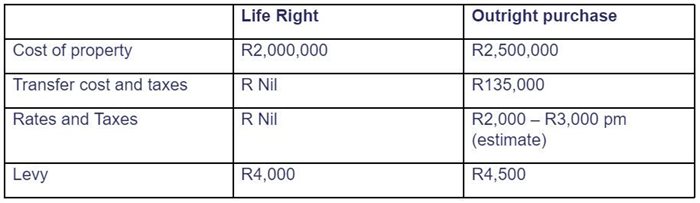

Appel looked at:

Life rights costs R500,000 less in this example; there are no transfer costs and there are no ongoing rates and taxes every month. With outright purchase, if you add the rates and taxes to the levies, you will be paying R6,500 to R7,500pm as opposed to R4,000pm.

The saving of R500,000 on capital outlay should of course be invested, said Appel. If it was placed “in a diversified investment strategy (targeting a return of 10% per annum), it could create an additional R2,000 of income per month while still experiencing growth”. If this extra income is not needed on a monthly basis, it will just compound in the investment portfolio.

The saving on monthly levies/rates and taxes, would of course also result in needing less monthly income out of your current investments. “A reduction in expense of R3,000pm would add five to six years onto the longevity of the client’s assets. The best way to improve the longevity of a retired person’s plan is to reduce their expenses and a little goes a long way!”

If you go for life rights, you forgo the capital appreciation in the property’s value. “This growth is hard to estimate,” says Appel, “as residential property valuations vary quite drastically. I would suggest that people consult their financial planners before making the decision.”

Benefits of life rights

One of the main benefits of life rights is that if you live to a really old age, and you run out of money, the village will not throw you out, adds Appel. What happens is that the cost of your continued care is deducted from the capital amount you paid upfront. For example, if you paid R1.5m for a flat, and the village cares for you for an extra few years after your money runs out, after selling the unit, your estate will get the R1.5m minus the care costs. (There may well be other deductions too, such as a sales commission and/or an amount to refurbish the unit for the next purchaser.)

Jason Appel, financial planner at Chartered Wealth Solutions

People sometimes avoid life rights because the feeling is that their heirs will lose out on that initial investment. Appel, however, says he would rather know his parents were being well cared for and that there was no risk of him having to put in extra money down the line. “It really helps me knowing that’s taken care of,” he says.

Invest sooner rather than later

From a purely numbers point of view, it’s better to invest in a retirement village earlier rather than later. “A person buying in at 50 or 72 gets the same value over time, so the younger person will ultimately get a better deal,” says Appel. However, most people are not ready to even talk about it in their 50s.

An added consideration, though, is that most places have a waiting list. You’ll pay a small amount to be placed on it, but if you get the call before you’re ready, you can decline and you’ll be pushed down a spot on the list. But some places have a maximum age restriction as well, or some will say you’re restricted to a smaller unit if you’re at advanced age.

So it is better to move in before your age becomes a problem, but only you will know at what point you are ready. And then again, the older you are, the more difficult change is, says Appel.

The three contracts explained

Freehold: “You own the land and building, it’s your responsibility, you pay rates and taxes and there is a registered title deed in your name,” explains Rob Jones, managing director of Shire Retirement Properties.

“You can leave it to your heirs and any gains in value would be for you. There may be some exit levy to pay to the complex, but it differs from place to place.”

Sectional title: “You own a portion of the building, say an apartment or townhouse. You will have a title deed and you can leave it to your estate. You are responsible for internal maintenance, while the body corporate takes responsibility for outside maintenance as a general rule. You pay for that in your levies, of course. There may be some exit levy to pay to the complex, but it differs from place to place.”

Life rights: “Essentially, it’s a lease for the rest of your life,” says Jones. “You’re paying upfront for the occupation of the building for you and your spouse for the remainder of your lives.”

Details differ from village to village, but usually it means that if you pass away and your unit is sold, your estate will get back the amount you paid, but not any portion of the increase in value (gain).

“In some estates, a share of the profit will be paid to your estate, in others you will get back a bit less than you originally paid,” says Jones. The levies cover all external maintenance, rates and taxes and common service costs such as security and common garden maintenance. Additional services are often included such as meals, cleaning and laundry.

Life rights can be a bit cheaper as a capital investment, says Jones, because the developer knows he can make profit over and over again, as he resells the unit over the years. “In essence, the life rights village owner wants to look after the building because he wants to resell it.”

Differences in levies

Comparing levies across the different models doesn’t make sense, he says. It makes more sense to look at the total cost between the different packages. “All purchasers into estates should compare their full monthly budget of where they live now with whatever their full costs will be in a retirement estate. I have had letters from life right holders who were surprised to find out that they had saved money by moving into the estate.”

As far as medical benefits go, “make sure you have care available to you in your home for as long as you need it. These days, in most cases, we can care for people in their homes right through to the end of life. That’s what most people want.”

Paul Williams and Kirsty Gibson 20 Sep 2022 Understanding the agreements

He did issue a word of warning, though, and that is that all purchase agreements, but life right contracts in particular, are often very thick documents, sometimes with constitutions, lists of rules and so on.

“Unfortunately you’ve got to understand what’s there, so get help if you need it… Ask 1,000 questions. Some things to look at are: what am I going to get back when I terminate the agreement or leave the estate? What are my exit levies if I sell? How are my levies determined and increased annually? And how are they stabilised over the years? That’s because I want to be able to estimate my costs for the future,” he advises.