According to Ooba's first-quarter statistics for 2022 (Q1 22), the current residential property market and lending environment are still favourable for first-time entrants.

“The rising interest rate cycle has some people believing that now is not the right time to enter the property market. Whilst the anticipated increases to the prime lending rate during the remainder of 2022 will see home loan repayments rise from the current levels, the modest pace at which interest rates are expected to rise suggests that homebuyers should still continue to benefit from a relatively low interest rate environment,” says Rhys Dyer, Ooba CEO.

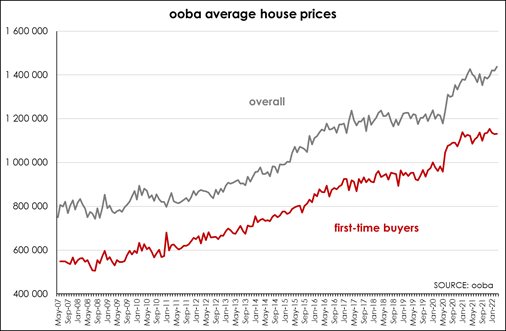

The latest statistics from Ooba show a nominal 2.9% year-on-year property price growth for Q1 22, with the average purchase price up marginally from R1,386,785 in Q1 21 to R1,426,483 in Q1 22. Dyer says that this translates into good news for those looking at entering the property market.

“Despite a higher inflationary environment impacting the cost of goods like food and fuel, the average purchase price for first-time homebuyers is effectively the same as it was a year ago, at R1,131,905 up from R1,127,776, given the nominal increase of 0.4% from Q1 21 to Q2 22. There are therefore still good opportunities for first-time homebuyers to enter the market now.”

Western Cape sets record high

Gauteng South and East remains the most affordable region for first-time homebuyers, with an average purchase price of R973,499 in Q1 22 – the only region in South Africa with an average first-time buyer purchase price below R1m. In contrast, first-time buyers paid an average R1,592,777 in the Western Cape in Q1 22 – the highest average price in country during Q1 22 and a record high for the region.

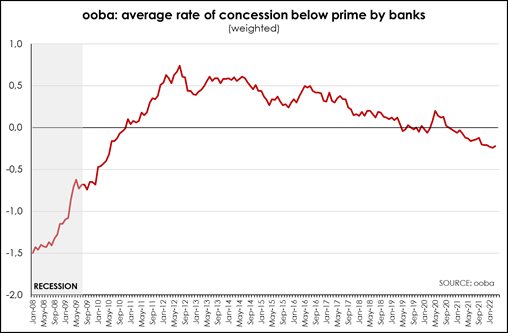

He adds that competition amongst South African banks for home loans is expected to remain strong throughout 2022. “The banks have reacted strategically to buyers’ confidence in the property market by making home loan finance more accessible and affordable. The current record low deposit requirements, attractive interest rate discounts, and cost-inclusive loans create an ideal environment for aspirant home buyers,” adds Dyer.

Increasing demand for no-deposit loans

“Banks are responding well to the increasing demand for no-deposit loans with an approval rate of 82% in Q1 22 in this segment, up on Q1 21’s approval rate of just under 81%. Ooba’s latest statistics show that 64% of applications processed during Q1 22 were from homebuyers who required financing for the full purchase price, a 5% increase on Q1 21’s intake of 100% loan applications.

Lower deposit requirements have seen the average deposit as a percentage of the purchase price drop from 10.2% in Q1 21 to 6.7% in Q2 22. Similarly, the average deposit for first-time homebuyers is down from 8.2% in Q1 21 to 6.7% in Q1 22 (see chart below).

Ooba’s statistics show a 6.9% growth in the average bond size from R1,244,884 in Q1 21 to R1,331,368 in Q2 22. “The 6.9% growth in our average bond size vastly exceeds the 2.9% growth in the average purchase price. This illustrates the increased number of loans that are being granting at high loan to values,” says Dyer. Bonds with a value of greater than R1,500,000 accounted for 60% of Ooba’s total approved and instructed home loans in Q1 22, an upward shift of 3% on Q1 21’s 57%.

The competitiveness of the home loan environment can be seen in the high ratio of applications declined by one lender but approved by another. Of the home loan applications declined by one bank, 45.3% were approved by another bank in Q1 22.

“Ooba achieved an average interest rate discount of prime less 0.23% for our homebuyers in Q1 22, 18 basis points lower than Q1 21’s average rate of prime less 0.05% (see chart above). Banks continue to compete on rate to attract new home loan business,” says Dyer.