No investors have felt the economic regime shift of the past three years more keenly than those in global fixed income markets.

Source: 123RF.

Returns have been sobering; US Treasuries has posted its worst loss since the fledgling United States ratified its constitution in 1787.

However, such performance has also created opportunity.

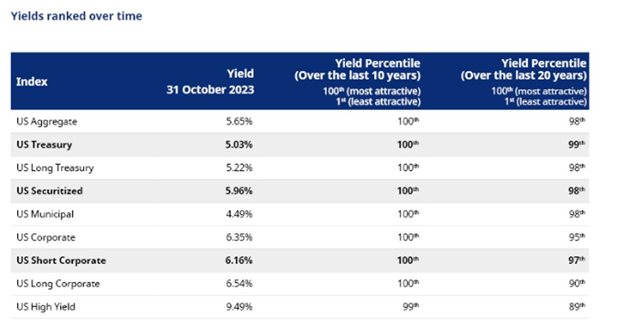

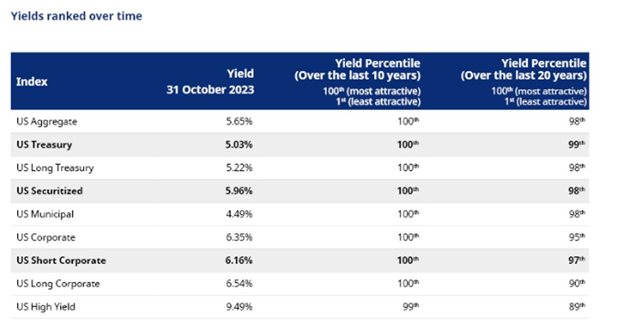

Despite inflation being more elevated than the previous decade, yields - both real and nominal - on higher quality bonds now stand at their highest levels in 15 years. This not only makes them look cheap in absolute terms, but also relative to other asset classes, particularly equities.

Additionally, with growth and inflation slowing, and most developed central banks at or near the end of their hiking cycle, historically this has been when investing in bonds has been the most rewarding.

The unprecedented bond market falls seen over the last three years can be attributed to three key factors. First, the low starting point in yields provided minimal income to offset capital losses. Secondly, major central banks’ most aggressive calendar year hiking cycle on record. Finally, the fallout from the pandemic resulted in the highest inflation in 40 years.

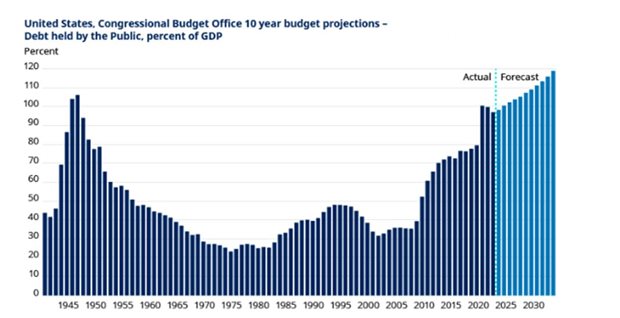

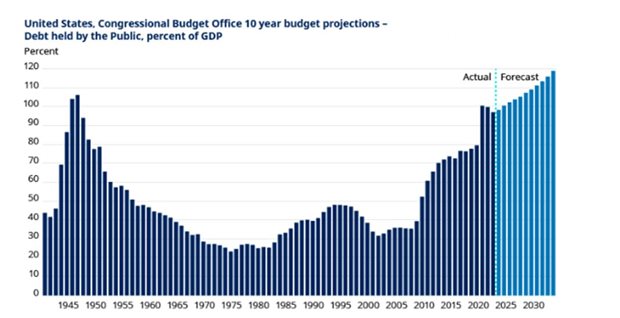

Challenges undoubtedly remain amid what we’ve labelled the "3D Reset”, with global trends related to the Ds of demographics, deglobalisation and decarbonisation reshaping the investment landscape. Fiscal dynamics in the US and other developed markets remain problematic, while high inflation is set to linger, and geopolitical tensions add another layer of uncertainty.

But the disappointing returns of the last three years are now in the history books and as we start a new chapter, we must shift our focus towards the opportunities that lie ahead.

In terms of valuations, both in an absolute sense and relative to other asset classes, bonds screen as cheaply as they have in the last decade and in the top quartile in terms of their attractiveness over the last 20 years.

That doesn’t mean a rally is necessarily imminent, but the higher yields do offer a significant cushion in terms of income to offset any further price declines.

Global 3D reset

Julien Houdain, head of global unconstrained fixed income at Schroders comments that the market has fully embraced the higher-for-longer narrative as inflation challenges persist.

But with interest rates now peaking, what’s going to drive markets in 2024?

"We think the three Ds of decarbonisation, deglobalisation and demographics are likely to lead to three more Ds with major consequences for fixed income investing: deficits, debt and defaults.

"Although this doesn’t sound particularly positive for the bond markets, we see some compelling investment opportunities ahead."

Divergence amid global trends

"Unlike Ronald Reagan, as bond investors we do worry about the size of government budget deficits, which are large for this stage of the economic cycle. And the market is beginning to take notice.

"Nowhere does this have greater significance than in the US, where the deficit is beyond that seen at any time in the pre-pandemic era.

"Worryingly there seems to be few signs of curtailment any time soon. While pandemic support measures have now all but ended, longer-term ‘green’ subsidies, including those offered by the Inflation Reduction Act, (which is helping to fund the decarbonisation effort) have now taken up the fiscal baton.

"Meanwhile, reshoring in the form of the CHIPS Act, motivated by a protection of national interests (part of a broader deglobalisation trend), and the requirement to support an aging demographic are adding fuel to the fiscal fire. The problem being that financing this level of debt is getting significantly more expensive."

Source: Supplied. US debt mounting at a time of higher financing costs.

"All this points to structurally higher bond yields, but also to a greater level of market divergence as regional fiscal trends differ. This presents interesting cross-market opportunities. Let’s take the eurozone, for example. Unlike the US, the fiscal narrative here is one of consolidation which warrants a preference for European bond exposure over the US."

Yield curve steepening strategies

"Fiscal management is intrinsically linked to our second ‘D’ - debt dynamics. Transitioning to a new era where financing costs are higher, is likely to perpetuate a vicious cycle, adding to the stock of debt in the years to come.

"After years of price-insensitive buyers (i.e. central banks) dominating demand for debt, they are retreating because of quantitative tightening. This means greater reliance upon price-sensitive buyers of debt, who expect greater compensation for holding a bond over a longer period (higher “term premia”).

"This should lead to a steepening of yield curves, meaning a growing difference between long-term and short-term bond yields. Indeed, we see value in strategies that benefit from yield curve steepening across a number of markets.

"More broadly, the higher coupons generated not only provide a cushion against capital losses, but also offer a genuine alternative to other income-generating asset classes (including equities) for the first time in many years."

The Big ‘D’: default

"Default is the ultimate risk to bond investors. For cyclical assets, the macro environment is likely to have the most relevance. We currently assign a high probability to an economic ‘soft landing’, but it’s difficult to ignore the warning signs around a potential ‘hard landing’ as tighter financial conditions bite.

"With central banks all but finished raising interest rates, the start of a rate-cutting cycle in 2024, would be a real support for bonds. Corporate default rates will likely rise, although with balance sheets relatively robust, we are not expecting them to spike significantly.

"Nevertheless, the transition to higher funding costs may be much faster in some economies compared to others. The pass-through from higher interest rates is felt much more quickly in Europe, where bank lending is far more prevalent than capital market funding, which is favoured in the US.

"As a result, we expect there to be greater market dispersion, not just on a regional basis, but at an issuer level too, as investors will want to be compensated for allocating to more levered corporates. This creates opportunities to generate outperformance from careful bond selection.

"Although the higher income offered by certain cyclical assets do provide a cushion against losses, given the risks around a potentially sharper slowdown, we prefer to play it relatively safe. A preference for investment grade (IG) over high yield, with an allocation to covered bonds, government related and securitised debt remaining a favoured high quality, lower beta way of adding yield to a portfolio."

Rate hikes impact

Lisa Hornby, head of US multi-sector fixed income at Schroders, says, "The US economy has shown remarkable resilience over the last 18 months despite a number of headwinds. In the face of the most aggressive rate hiking cycle witnessed in a generation, markets have grappled with a regional banking crisis, soaring energy costs, a persistently strong dollar, and geopolitical uncertainty.

"This economic strength can be attributed to two primary factors. Firstly, the drawdown of consumer excess savings accumulated during the Covid-19 crisis, which has rapidly diminished from its peak of $2tn. And secondly, the implementation in 2022 of federal investment programmes, namely the CHIPS and Science Act (approximately $280bn) and the somewhat ironically named Inflation Reduction Act ($781bn).

"The economic tailwinds provided by these factors over the past 18 months are unlikely to be replicated in the coming quarters. What’s more, the full effect of the “long and variable lags” associated with monetary policy, as acknowledged by the Fed, has yet to be fully felt.

"With more than 500 basis points in rate hikes since the beginning of 2022, bond yields have more than tripled. In a highly indebted economy, it would be rather optimistic to assume that there will be no unintended consequences.

"We have begun to see some of the consequences of higher interest rates. Financing costs for businesses have continued to move higher in response to the increasing Fed funds rate. We are also starting to see signs of stress from the previously bulletproof consumer.

"With pandemic savings close to exhausted and the savings rate now back below 4%, the bottom decile since 1960, consumers are increasingly relying on debt. Credit-card balances have recently reached an all-time high above $1tn and delinquencies, while low, are rising. The labour markets remain strong but are showing signs of decelerating.

"There are signs that investor concerns will shift away from higher rates and towards deteriorating fundamentals and credit risk in 2024.

"In terms of allocating across the fixed income universe, we recommend a more selective and opportunistic approach, considering the current yield levels in different sectors."

Source: Supplied. After record-low returns, bonds offer compelling value.

"Our investment focus currently remains on high quality sectors such as Treasuries and agency mortgage-backed securities (MBS) as well as short and intermediate-dated corporates.

"We believe that there will be better occasions to add risk in the coming quarters as higher rates affect the economy and slower growth begins to weigh more heavily on corporate earnings. Once markets dislocate, there will be a significant opportunity to rotate out of liquid sectors and into higher risk assets."

Emerging market debt: end of the exodus?

Abdallah Guezour, head of emerging market debt and commodities at Schroders, says "The exodus of investors from emerging market debt in 2022 continued in 2023. Record outflows and depressed net new issuance have made the asset class severely under-represented in global investors’ portfolios.

"Despite this challenging flow backdrop, EM bonds and currencies have started to perform reasonably well. Tightening global financial liquidity, US-induced fixed income volatility, broad US dollar strength, China’s disappointing growth trajectory and recent geopolitical dislocations have all been absorbed well by various EM fixed-income sectors recently.

"Spreads in dollar-denominated IG debt barely moved, while both EM dollar high yield and local-currency debt generated positive total returns in 2023. We expect this recovery in performance to gain traction in 2024. This is because several dollar and local currency-denominated debt markets remain firmly supported by not only their attractive levels of yields, but also disciplined monetary policy frameworks which have brought inflation under control, improved balance of payments and led to lower reliance on short-term foreign capital.

"These macroeconomic adjustments are likely to lead to EM economies outperforming their developed counterparts in terms of growth.

"Following a pro-active hiking cycle that has taken the average real policy rate as high as 7%, several EM central banks are now regaining the right to ease. We expect these rate cuts to be moderate in most EM countries given the risks associated with diverging too much from the US Fed, which still appears committed to a tight monetary stance.

Source: EM inflation has come under control.

"Such cautious monetary easing by key EM central banks, is likely to reinforce credibility, sustain the recent stabilisation of currencies that are equally supported by improving trade balances, and lead to a return of capital to local government bond markets.

"Ten-year local government bond yields of Brazil (11.5%), Mexico (9.7%), Colombia (11%), South Africa (12%) and Indonesia (6.8%) are particularly well-positioned to generate high returns in 2024.

"EM dollar debt also offers appealing pockets of value, especially in sovereign high yield. Spreads remain at historically high levels, but a cautious and selective approach is warranted towards this sub-sector.

"Some high yield sovereign issuers, such as Nigeria, are experiencing strong reform momentum, a benign maturity profile and current account surpluses while offering dollar bond yields in excess of 11%.

"Although the levels of spreads in EM dollar IG debt indices appear less appealing as they are extremely tight relative to history, it is important to consider that highly rated AA and A Gulf countries now represent about 20% of the EM IG universe.

"The already potentially attractive returns in EM fixed income will be boosted further should the US dollar complete its over-extended bull cycle. The dollar is extremely overvalued and unsustainable US twin deficits are now starting to act as a major headwind for the greenback.

"We think the post-pandemic long-term bull cycle in commodities is still in place and is also a potential tailwind for several EM bonds and currencies.

"After a period of strong gains, the commodities complex saw a correction from the highs seen in 2022, as investors turned more cautious on the outlook for global demand.

"Looking ahead, we are entering the age of the 3D Reset with increasing risks of further waves of inflation and deepening geopolitical conflicts. Resilient commodity demand and constrained supply should also drive prices higher in the long run, especially in commodities leveraged to the energy transition investment boom.

"Such a backdrop supports an active allocation to the commodities complex as a strategic hedge for investors’ portfolios."