Within the South African Fast Food market, there is a growing love for 'local is lekker' which is resulting in robust market growth, driven by large servings of locally focused advertising and marketing, such as load shedding and the country's ever-popular braai culture. At the same time, township culture is having a supersized effect on the domestic market, not only in terms of flavours and offerings, but also demand and investment, with players leveraging this growing popularity to create a uniquely South African fast food experience.

Insight Survey’s latest SA Fast Food/QSR Industry Landscape Report 2023 carefully unfolds the global and local Fast Food/QSR markets, based on the most credible intelligence and research. It examines the latest market trends, innovation and technology, drivers, and challenges, to present an objective insight into the South African Fast Food industry environment and its future.

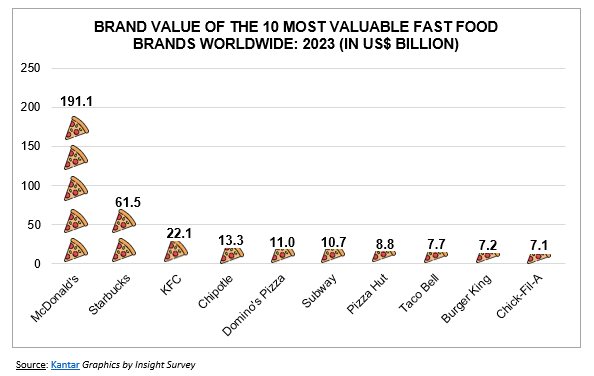

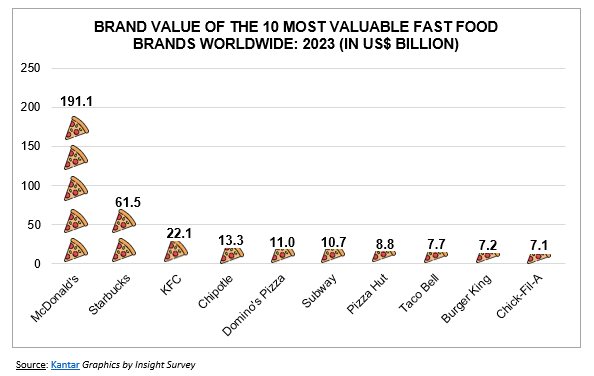

Globally, the Fast Food market is estimated to be valued at approximately US$884.8bn in 2023 and is forecast to grow at a high compound annual growth rate (CAGR) of 5.2%, to reach approximately US$1.1tn by 2028. As illustrated in the graph below, McDonald’s remains the most valuable fast food brand in 2023, by a large margin, achieving a brand value of US$191.5bn, despite having declined slightly from 2022. Significantly, Burger King and Chik-Fil-A were the only two brands that increased in value, with the rest declining slightly, during the period.

In 2022, the South African fast food industry continued to grow from strength to strength after the disastrous effects of the Covid-19 pandemic, demonstrated by a significant increase of 19.4% between 2021 and 2022, although this is slightly lower than the 27.5% increase from 2021 to 2022. This high growth is expected to continue, with an expected CAGR of 9.0%, between 2023 and 2027, driven by ongoing load shedding, drive-thru technology and innovation, rewards and cash-back offerings, and the growing popularity of local fast food flavours, offerings, and marketing.

Globally, based on Instagram tags, Italian cuisine reigns supreme, with pizza and pasta being two of the most popular foods in the world due its ‘comfort food’ status. This is followed by Indian cuisine, with its rich flavours, spices, warmth, and complexity, and Japanese cuisine, with sushi proving very popular. However, in South Africa, uniquely local tastes, flavours, and offerings, are rapidly gaining in popularity, with local influences featuring in the introduction of new, locally inspired menu items and services.

Specifically, township fast food offerings and flavour trends are making waves in the local market, boosted by the uniquely local flavours, as well as history and heritage, associated with these offerings, and the flavour fusions they provide. This includes the growing popularity of items such as bunny chows and kotas, which are also being offered by big players, such as KFC, which offered its Kentucky Sphatlho kota as a limited-edition menu item, and Kentucky Chow at its Kentucky Town pop-ups.

Other uniquely local township offerings increasing in popularity include spicy Cape Malay meals, as well as braaied meats, such as chicken dust, and desserts, such as monster and freak shakes. This growing influence of township culture is demonstrated by Uber Eats’ pilot project for township expansion in the local market, a ‘world first’ for the company, which includes significant investments in township restaurants and dark kitchens, as well as growing the numbers of Uber Eats couriers servicing these areas to meet demand, also potentially serving as a blueprint for global markets.

Moreover, according to the Uber Eats South Africa Cravings Report, a uniquely South African fast food item, pap, was indicated to be one of the top Uber Eats orders with meals in 2022. This report also indicated that local consumers are also exceptionally fussy in terms of the spiciness of their food, as well as the inclusion and exclusion of ingredients, such as onions, cheese, and sauces, and often make unique requests, such as asking for more caramel on their ice-cream.

This increasing preference for everything local is being driven by the utilisation of various localised advertising promotions and campaigns by prominent market players. As an example, Burger King partnered with Grey Advertising Africa on a new marketing campaign aimed at leveraging South African braai culture. This was achieved by promoting the company’s speed of service and incorporating the ‘it’s coming now-now’ phrase, as well as the company’s focus on perfecting flame grilling, similar to braais.

Additionally, KFC also used locally born comedian, Trevor Noah, on a new television commercial promoting its ‘Chicken for Breakfast’ campaign, and affordable breakfast options, that also included uniquely South African humour. Furthermore, in July 2022, Nando’s also launched a new television advert as part of its ‘Bright Side’ campaign, that makes light of load shedding, and offered consumers free sides according to stages of load shedding, a uniquely South African phenomenon.

The South African Fast Food/QSR Industry Landscape Report 2023 (178 pages) provides a dynamic synthesis of industry research, examining the local and global fast food from a uniquely holistic perspective, with detailed insights into the entire value chain – market size and forecasts, latest industry trends and innovation, industry drivers and challenges, fast food/QSR competitor analysis, latest marketing and advertising news, pricing and promotion analysis.

Some key questions the report will help you to answer:

- What are the current market dynamics of the global and South African Fast Food industry?

- What are the latest global and South African Fast Food industry trends, innovation and technology, drivers, and challenges?

- What are the market, food-type and off-line/on-line retail value trends in the South African Fast Food market (2017-2022) and forecasts (2023-2027)?

- Which are the key South African Fast Food market players and what is the latest marketing and advertising news for each of the competitors?

- What is the latest company news for key South African Fast Food players in terms of products, new launches, and marketing initiatives?

- What is the pricing and recent promotions of key Fast Food competitors by category: Burgers, Chicken, Pizza, Pies, and Others?

Please note that the 182-page report is available for purchase for R45,000.00 (excluding VAT). Alternatively, individual sections can be purchased for R20,000.00 (excluding VAT).

For more information, please email az.oc.yevrusthgisni@ofni, or call our Cape Town office on (021) 045-0202 or Johannesburg office on (010) 140- 5756.

For a full brochure, please click here: South African Fast Food/QSR Industry Report 2023

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 15 years of heritage, focusing on business-to-business (B2B) and industry research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B and industry research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.