Related

Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

Insight Survey’s latest South African Fast Food Industry Landscape Report 2017 provides a dynamic synthesis of industry research, examining the local and global fast food industry from a uniquely holistic perspective, with detailed insights into the entire South African value chain.

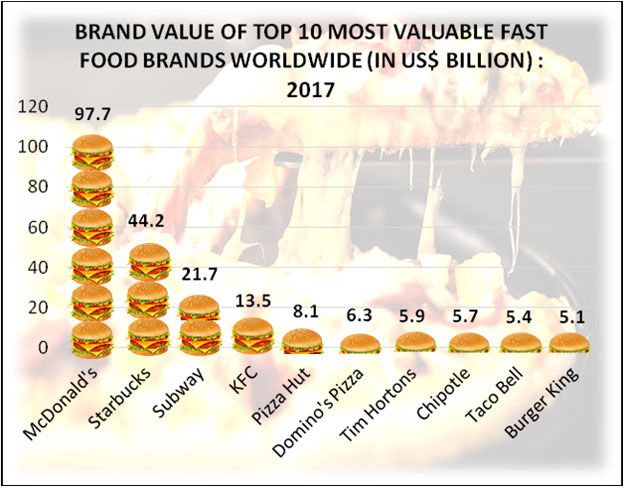

Valued at over US$539.6 billion in 2016, the global fast food industry is estimated to grow at a compound annual growth rate (CAGR) of 4.2% between 2017-2022 to increase to approximately US$ 690.8 billion in 2022. In terms of brands, McDonald’s was the most valued fast food brand globally with an estimated brand value of approximately US$97.7 billion in 2017 (as illustrated in the graph below), followed by Starbucks (US$44.2 billion) and Subway (US$21.7 billion).

Although the US is currently the largest consumer of fast food globally, this market is expected to witness growth at a slower pace between 2017-2025 in comparison to emerging markets like Asia-Pacific. In terms of consumption frequency, for example, 69% of people in China consumed fast food more than once per week in 2016 compared to an estimated 20% of South Africans.

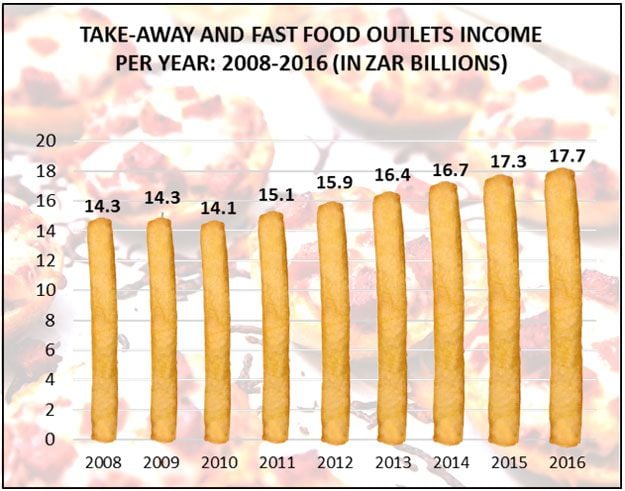

In South Africa, takeaway and fast food outlets have seen steady growth since 2010 with the last four years bringing in more income than the average for the period, however, growth is slowing. The growth between 2015 and 2016 was just 2.3% compared to the 7% achieved between 2010 and 2011, as seen from the graph below.

Of concern for the industry, is that since the beginning of 2017, takeaway and fast food outlets have not recorded positive growth. The market remains highly competitive with local and international brands fiercely competing for consumers' share of wallet (and stomach!) amid declining disposable incomes. Furthermore, the rising popularity of in-store food services either in the form of in-store cafés (at supermarkets and retailers) or convenience foods is slowly placing further pressure on this highly competitive market. Local fast food companies have responded by partnering with local retailers to offer in-store food services, for example Made Café which is a partnership between Edgars and Famous Brands.

The industry is being forced to evolve around the ever-changing needs of the consumer. Considering continuing economic constraints, consumer needs of value-for-money and affordability will be key determinants directing the market environment. Offering cheaper menu items allows fast food outlets to cater to a broader range of demographics, and is sound advice for all fast food industry players to consider throughout 2017. Other key trends and drivers that will help stimulate growth include the health food trend, mobile ordering and delivery services (like UberEats, Mr D and NOW-NOW), and creating more engaging customer experiences.

The Fast Food Industry Landscape Report 2017 (135 pages) provides a dynamic synthesis of industry research, examining the local and global fast food industry from a uniquely holistic perspective, with detailed insights into the entire value chain – from manufacturing to retailing, competitor positioning, latest marketing and advertising news for each competitor, pricing and promotions analysis, consumption and purchasing trends.

Some key questions the report will help you to answer:

Please note that the 135-page PowerPoint report is available for purchase for R25,000 (excluding VAT). Alternatively, individual sections can be purchased for R9,000 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (0)21 045-0202 or (010) 140-5756.

For a full brochure please go to: SA Fast Food Landscape Report 2017.

About Insight Survey:

Insight Survey is a South African B2B market research company with almost 10 years of heritage, focusing on business-to business (B2B) market research to ensure smarter, more profitable business decisions are made with reduced investment risk.

We offer B2B market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.