Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

The importance of the mobile phone when shopping is not surprising considering that mobiles are part of the daily lives of South Africans. About 80% of the population only use mobiles to access the net and mobile now plays several distinct roles in todays' shopping experience. We use it to look for help on what to buy, it provides us with the information we need in-store, and sometimes it is even how we shop.

So it's not surprising that mobiles act as a research tool when people are thinking about what to buy. Studies by Millward Brown show that 88% of consumers use their phones to research products before they go shopping, compared to 48% on their PCs. In fact South Africans spend an average of an hour-and-a-half engaging in research before shopping, the bulk of this on their mobiles. This webrooming behaviour is a feature of South African shopping habits, outstripping US consumers with how long we spend researching before going shopping.

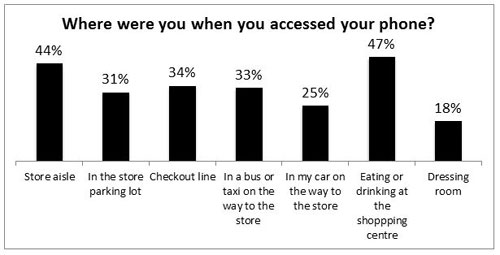

But we see that once a person actually gets to a store, mobile usage doesn't slow down. On a typical shopping trip, a South African consumer is likely use their phone almost five times - from in transit, to the store aisle itself. Consumers use their phones while shopping to look for more and more information on their potential choices, a function that may have been the role of a knowledgeable friend in the past. Now while shopping consumers can check pricing, reviews and deals in an instant. And South Africans do!

It is this behaviour that leads to a staggering 74% of people abandoning purchases they were about to make because of information they viewed on their mobile phone. This is driven primarily by price, with 57% of people finding the same product cheaper elsewhere, but negative reviews, and even product switching - based on finding "better" or cheaper products online and on social media, are also commonplace.

It is often at online stores themselves that consumers find the product they want at a cheaper price. Our research shows 13% of consumers have made a purchase at an online store on their mobile while in a shopping centre. This showrooming behaviour is driven by a need to check out the product before buying it cheaper online. The recent merger of Takealot and Kalahari is likely to make such behaviour even more commonplace as scale becomes more consolidated in the online retail space.

Of course not everyone shops on their mobile phones (29% of people claim to not want to) and several barriers still exist, primarily the risk of crime while shopping on the mobile web. Fears about identity theft, lack of delivery, scams and fake products are the cause of a full third of mobile shopping rejectors. Concerns also arise from the payment options available, with people preferring the "safety" of cash or not having access to credit and debit cards to make online purchases. The fact that many online retailers offer a COD option shows how entrenched this perception is and how much misinformation is present. The need for education if the online sector is to continue growing is best summed up by the very honest 5% of consumers who, when asked why they don't shop on their mobile phone, said, "I just don't know how."

The way that people shop is changing, a situation that carries with it both risk and opportunity for brand owners and retailers. For brand owners, failing to control your mobile presence and allowing other marketers to divert consumers is the biggest concern. For retailers, the threat of people using stores to try a product but actually buying it cheaper online is an increasing reality. However, the number of opportunities for both brand owners and retailers to serve the right information at the right time to an engaged consumer should far outweigh these risks. Never before in history has it been possible to catch a consumer in the act of purchasing or researching a product as easily as it is today. Using mobile phones, marketers have access to a constant knowledge source for consumers, a source that knows who the consumers are, what they are looking for, where they spend their time and even where they are shopping. The time to act is now!

The study done by Millward Brown is based on a national sample of 1,000 mobile internet users conducted via mobile survey. Data was collected in October 2014 across both smart and feature phones.

Jarrod Payne, Account Director Millward Brown South Africa & Desre Mann, Operations Director Millward Brown Africa & Middle East, will be discussing mobile research best practice at the upcoming MRMW conference in Cape Town. They will be outlining why mobile research is a must for Africa, showcasing case studies of mobile-based research from across the continent and further exploring the intersection of mobile phones and modern shopping.