Top stories

More news

Construction & Engineering

Egypt plans $1bn Red Sea marina, hotel development

Highlights for the Year

Highlights for the Quarter

Commenting on the key financial highlights of the year and fourth quarter, Sappi Chief Executive Officer Steve Binnie said:

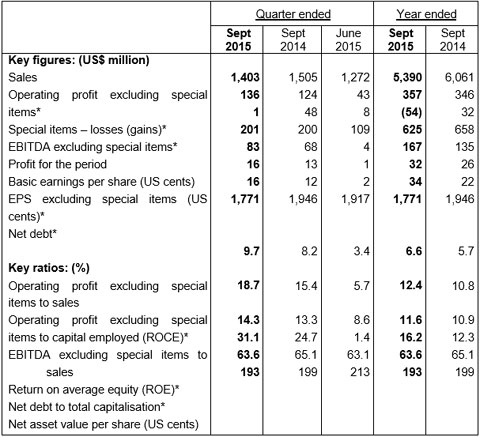

"I am very satisfied with the strong performance by the group during the financial year. Importantly, net profit for the year increased by 24% to US$167 million and earnings per share excluding special items for the year increased by 55% from US 22 cents to US 34 cents. Operating performances improved in all regions in their underlying currencies. In particular, the group benefitted from the strong export performance of the southern African business combined with a weaker South African rand. In rand terms group EBITDA excluding special items increased by approximately 8% from ZAR7 billion to ZAR7.5 billion and group net profit increased by 40% from ZAR1.4 billion to ZAR2 billion on group sales of ZAR64.5 billion for the year.

"The refinancing of higher cost debt, and the reduction in net debt by US$175 million resulted in significantly lower ongoing interest charges. The completion of major capital projects at Gratkorn, Kirkniemi and Somerset Mills will lower our cost base further in the coming years.

"For the quarter, all regions increased their profitability through stronger seasonal demand and improved markets for graphic paper and dissolving wood pulp. For the quarter, profit increased by 22% to US$83 million due to the higher operating profits and lower interest costs.

"The Specialised Cellulose business generated improved returns due to increased US dollar spot prices for dissolving wood pulp in China, driven by improved conditions for viscose staple fibre. The weaker rand also helped margins, lowering our cost base and improving selling prices."

The European business achieved an increase in graphic paper sales volumes of 5% and average sales prices of 4% over the equivalent quarter last year, with particular strength in the woodfree coated segment. This was mainly due to the euro/dollar exchange rate on export sales pricing and the graphic paper price increases implemented in the past quarter. The speciality paper business continued to improve its sales volumes and prices compared to both the prior quarter and the equivalent quarter last year.

The North American business showed a good recovery in a seasonally stronger quarter. This is despite the continued impact of the strong US dollar on the graphic paper markets in the US and continued weak demand from China for the release paper business. Coated paper sales volumes were flat year-on-year, with net sales prices slightly lower.

The southern Africa business had a strong quarter and year. Average prices and volumes were higher for both the equivalent quarter last year and the prior quarter. Demand for dissolving wood pulp remained strong and sales volumes were higher in both instances. Demand for virgin packaging grades was also strong.

We expect the first quarter to show an improvement in EBITDA excluding special items and a substantial increase in earnings per share excluding special items compared to the equivalent quarter last year as a result of improved operating performance and lower interest charges. However, a severe drought is currently being experienced in many parts of South Africa and may adversely impact our mill production and consequent profitability should normal summer rainfall not be forthcoming.

*Refer to the published results for details on special items, the definition of the terms and the reconciliation of EBITDA excluding special items to profit/loss for the period. The table above has not been audited or reviewed.

The year and quarter under review

Net cash generated for the quarter was US$159 million, compared with US$288 million in the equivalent quarter last year. The comparative period last year included proceeds from the sale of the Usutu forests of approximately ZAR1 billion (US$97 million). Capital expenditure in the quarter was US$85 million compared to US$105 million a year ago. Special items amounted to a gain of US$54 million, and comprised mainly of gains from the transfer of the Sappi Dutch pension fund to a general fund and plantation fair value pricing, offset by once-off losses resulting from mechanical breakdowns and plantation fires.

Net finance costs for the year were US$182 million, an increase from the US$177 million in the prior year as a result of one-time charges of US$61 million associated with the refinancing of the 2018 and 2019 bonds.

Earnings per share for the quarter excluding special items were 16 US cents, compared with 2 US cents for the prior quarter and 12 US cents for the equivalent quarter last year.

Net debt at financial year-end decreased to US$1,771 million as a result of the cash generated and gains on the translation of Euro-denominated debt.

At the end of September 2015, liquidity comprised cash on hand of US$456 million and US$537 million from the committed revolving credit facilities in South Africa and Europe.

Outlook

Dissolving wood pulp markets have improved considerably this year as a result of higher pricing and improved operating rates for viscose staple fibre in China. Higher hardwood paper pulp prices are also impacting dissolving wood pulp supply as some swing producers continue to manufacture paper pulp rather than dissolving wood pulp.

Graphic paper markets in Europe are slightly better than anticipated, albeit they are still expected to decline. Production at our mills is full and export pricing is benefitting from a weaker Euro. However, the business faces pressure from higher pulp prices. In North America, the strong US Dollar continues to impact graphic paper trade flows negatively.

Capex during 2016 is expected to be in line with 2015 and is focused largely on energy and debottlenecking projects in South Africa together with the annual maintenance at the mills.

Depending on market conditions, we are considering utilising some of our cash reserves to repay and refinance a portion of our debt in order to lower our future interest costs. We expect to reduce our net debt further over the course of the year and reduce our financial leverage towards our target of two times net debt to EBITDA.

Based on current market conditions, and assuming current exchange rates, we believe that EBITDA excluding special items in the 2016 financial year will be higher than 2015. We also expect strong growth in our earnings per share excluding special items as a result of expected lower interest costs, offset somewhat by increased cash taxes.