Top stories

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

Many businesses say they are in a difficult position due to the extreme competition. However many believe that the worst phase in the industry has passed and that the industry is looking forward to a recovery post the 2008 global economic recession.

In its review of the textiles and footwear industry, international credit insurer Coface says despite about $1500-million being spent on modernising and upgrading the industry since 1994 to improve efficiencies and competitiveness, the sector still faces many challenges.

Access to finance makes it difficult for smaller businesses to grow and expand their operations. Textile mills are particularly vulnerable to the Chinese incursion. Already adversely affected by the robust trade in second-hand clothing from wealthier countries, cloth-makers now face significantly more competition from their Chinese and Indian counterparts.

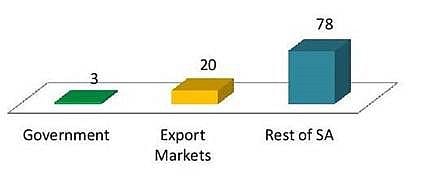

Currently the US, EU and Japan are the largest consumers of textiles and apparel. The majority of clothing and textiles in these countries are imported. The Japan Textile Importers Association estimates that 87% of clothes on sale in Japan are imported, while the American Apparel and Footwear Association estimates that 89% of US clothes are imported. However in the South African market 78% of textiles manufactured are kept within the country and only 20% are exported.

"The industry has always faced challenges especially of a competitive nature, especially with China and India being the monopoly in the global market. Many jobs have been lost over the years, but the industry has recently managed to stabilise and continues to contribute largely to the country's GDP and job creation," the report says.

Government intervention and assistance with grants has enabled the industry to grow marginally over the last ten years. However issues such as striking workers, technological advancements and global competition have hampered growth. With South Africa known for its fast turnaround time and good service delivery in this industry, many developed nations have opted to invest locally. The weakening rand may also assist.

However, the company says South Africa will never be able to compete against the industry powerhouses of China and India. In terms of Africa, it says South Africa is one of the largest manufacturers on the continent. But the outlook looks bleak, with minimum wages increasing and continued global competition rising. Businesses are set to continue cutting back on costs because operational costs are rising faster than inflation.

The industry directly employs 230 000 and another 200 000 in dependent industries such as transport and packaging. The Industrial Development Corporation has calculated that for every worker in the textile industry 2.5 jobs are generated in related industries.

From 2005 to 2012, the sector contracted drastically, with total production output down by 19.5%. However in this period footwear manufacturing grew by 6.2%. Textiles, clothing, leather and footwear make up 4.9% of the total manufacturing output.

Exports account for R1.4-billion for apparel and R2.5-billion for textiles, mostly to the US and European markets. In 2001, South Africa saw the biggest boom in exports with a 61% increase. Exports to overseas countries are doing well, driven primarily by the benefits offered under the Africa Growth and Opportunity Act (AGOA) which provides for duty-free imports of apparel produced in South Africa. However over the last 10 years, exports have decreased because of India and China's monopoly.

A recent World Trade Organisation (WTO) study concluded that China and India will dominate global textile and clothing production, valued at more than $340-billion, with China capturing a 50% market share.

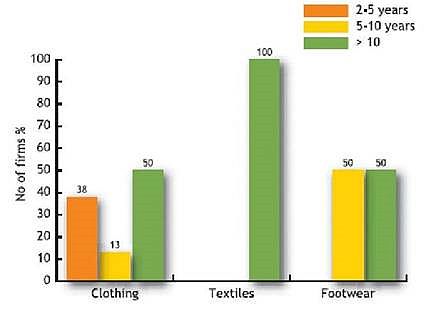

From the above graph we can see that the majority of the machinery used in South African textiles, clothing and footwear manufacturing is over 10 years old, which indicates how South Africa has not kept up to date with technological advancements.

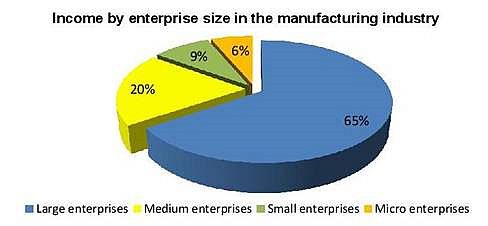

The majority of the income in the sector comes from large and medium-sized enterprises, accounting for a total of 85% of income. Small and micro enterprises account for only 15% of the total income in the industry. With most people employed in medium and large enterprises, it poses challenges for people looking to open new businesses because the market is dominated by the larger enterprises.

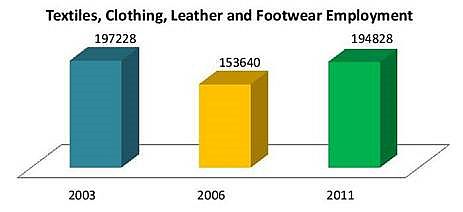

As shown, the employment figures are volatile in the industry. Currently they are almost at the levels of 2003 but after 2003, the figures dropped drastically. It is feared that the same cycle may repeat itself in the coming years.

Overall, the company is not optimistic and sees the potential for continued challenges for companies in the textile industry fuelled by increased competition, growing wage demands and traditional markets not growing.